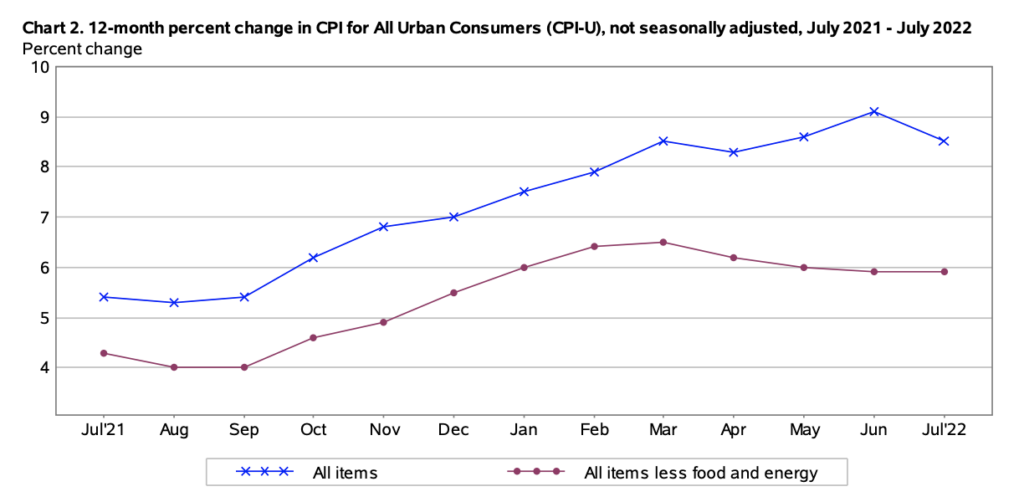

The time has come for the 16 month-long streak of rising consumer prices to finally end for the US.

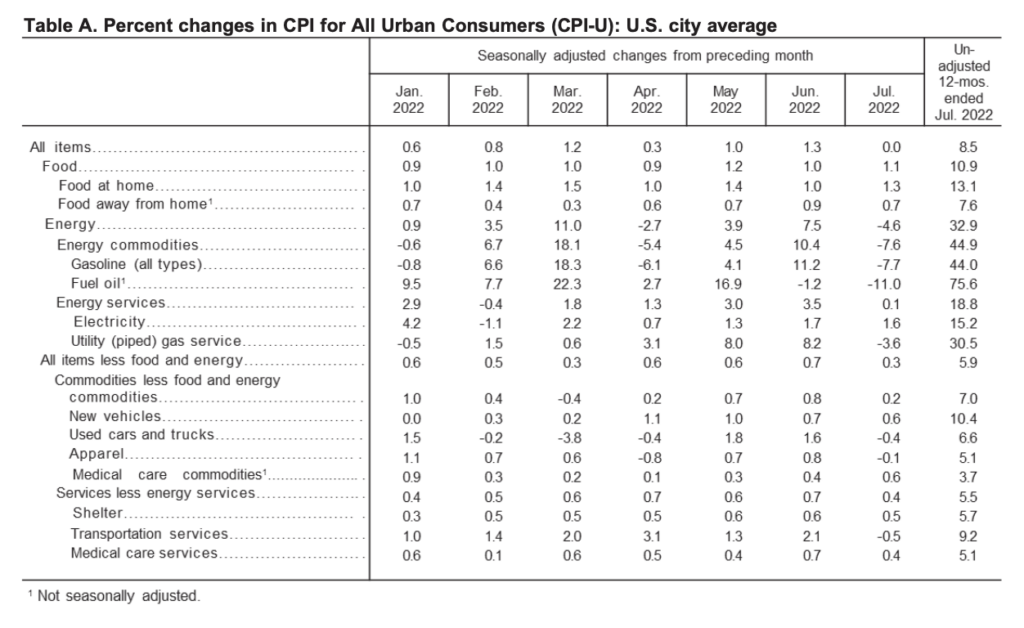

Well, kind of. Despite analysts calling for a reading of 8.7% following a June’s jaw-dropping 9.1% print, fresh data from the Bureau of Labour Statistics shows that headline consumer prices stagnated to an annualized 8.5%, as a decline in gasoline prices offset ongoing increases in food and shelter costs. Meanwhile, core CPI, which does not include volatile components such as food and energy, rose 0.3% last month, albeit a smaller gain than the previous three months to a 5.9% year-over-year increase.

Looking at the components, energy prices fell 4.6% since June, but still remained over 32% higher compared to July 2021. Motorists finally got a small break at the pump, as gasoline prices dropped 7.7% month-over-month following June’s increase of 11.2%. But, offsetting that decline was the ongoing rise in food prices, which registered their seventh straight month of increases above 0.9 percentage points. Likewise, Americans continued to pay more to keep a roof over their head, as shelter costs jumped by another 0.5% between June and July to an annual increase of 5.7%, which accounted for approximately 40% of the overall increase in core CPI.

But, on a more important note, Americans’ real wages continued their slide last month, marking the 16th consecutive month of declines. Even though inflation showed signs of moderating, a separate report showed that consumers’ incomes still aren’t keeping up. Real average hourly earnings slumped 3% in July compared to a year earlier, prompting an increasing number of Americans to forego non-essential spending.

The S&P 500 was on the rise following the CPI, while Treasury yields declined across the curve and the greenback slumped. According to Bloomberg, markets are now pricing in a 50 basis-point increase come the Fed’s meeting next month, instead of the 75 basis-point hike previously forecast.

Information for this briefing was found via the BLS and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.