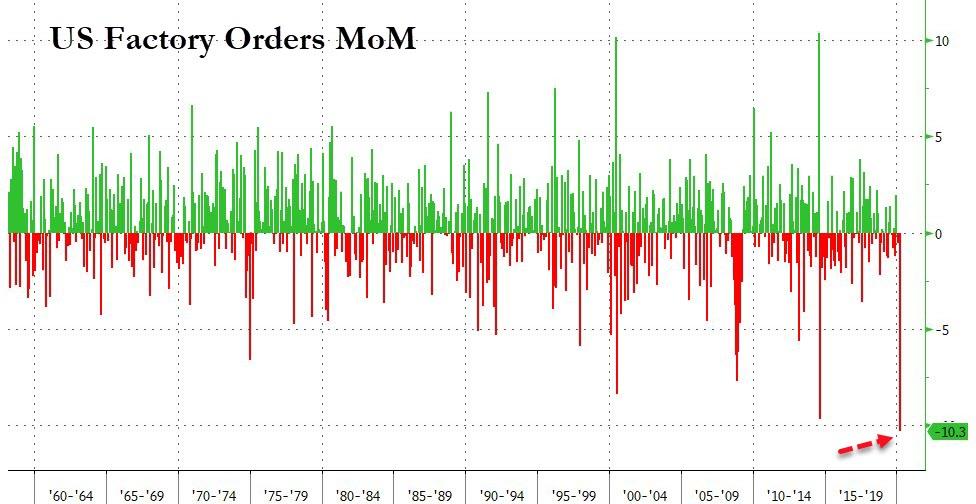

The coronavirus has caused significant disruptions across the US, shattering vital supply chains and reducing essential exports. As a result, new manufacturing orders for US-made goods have dropped by a record amount in March.

Previously, Reuters polled various economists, who predicted factory orders would drop by 9.7% for the month of March; however, the worst case scenario was even worse than predicted. A recently released report by the Commerce Department revealed that factory orders fell by 10.3% in March – which is thus far the largest decrease since data compilation began in 1992. Although a precedent for the manufacturing order decline can be attributed to President Donald Trump’s trade war with China, the coronavirus pandemic ended up being the final nail in the coffin which sealed the fate of America’s longest economic expansion in history.

The Commerce Department’s data further revealed that transportation orders fell by 41.3% in March, a decline which can be largely attributed to the demand for civilian aircraft and parts decreasing by 296.2%. Boeing has been a significant contributing factor to this grim statistic, given the aircraft manufacturer’s phlegmatic history with its 737 MAX. New orders for boats and ships also dropped by 65.3%, while new vehicles and vehicle parts declined by 6.7%.

However, much of the manufacturing declines have been offset by government orders for defense aircraft and parts, which rose by 63.7%. Even amid the domestic chaos the coronavirus has caused, the US is still determined to focus taxpayer dollars on its never-ending military interventions.

Information for this briefing was found via New York Times, Zero Hedge, and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.