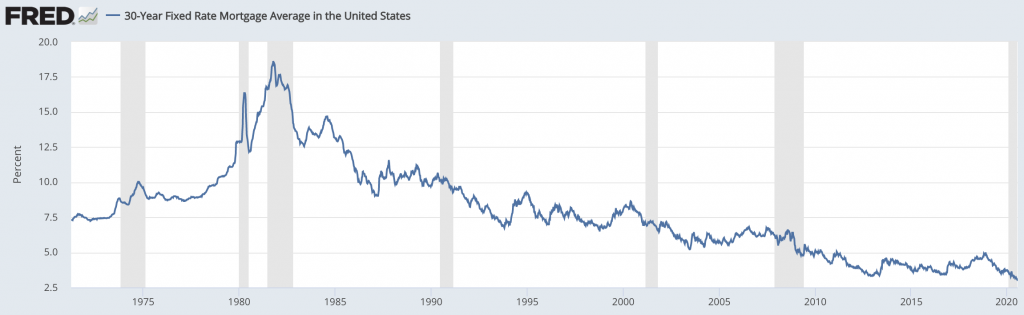

As the US Federal Reserve continues to pump liquidity into the economy while maintaining near-zero interest rates, the average rate on a 30-year fixed mortgage has dropped to 2.98%, further spurring the demand for housing.

Mortgage rates have fallen to the lowest in nearly 50 years according to Freddie Mac records, after a steady decline since the onset of the pandemic. The continued drop is predominantly attributed to the Fed’s near-zero benchmark rate, as well as the central bank’s mortgage bond purchases. Although the historically low rates have contributed to the stability of home prices during the coronavirus-induced recession, an increased demand for housing is most likely going to ensue.

The reduction in borrowing costs has created a frenzy of eager Americans looking to purchase their first home, or refinance their existing loan. However, given the current state of soaring unemployment rates and doubts over a rapid economic recovery, the housing market has been subject to increased risks. Credit standards have tightened, which in turn disqualifies some potential homebuyers, and the continued upkeep in housing prices has shunned out those looking for a home in a particular price range.

With no diminishing of coronavirus outbreaks in sight, the housing market may not be as robust in the coming future. With another wave anticipated in the fall, and the receding hope of Congress renewing the additional $600 in unemployment benefits, a double-dip recession is continually looking as being more likely.

Information for this briefing was found via CNBC, St. Louis Federal Reserve, and Freddie Mac. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.