America’s labour market continued to show resilience despite a slowdown in economic growth, further fuelling expectations that the Fed will deliver another 75 basis-point rate hike later this month.

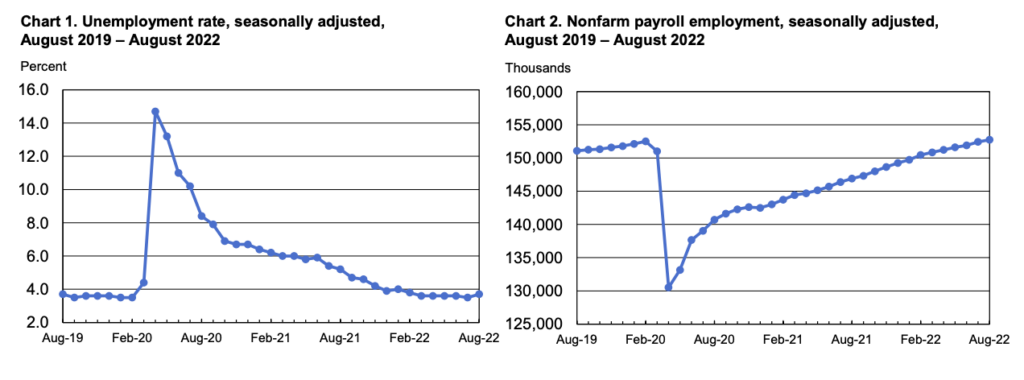

US nonfarm payrolls were up 315,000 in August, marking the 20th consecutive month of gains, but receded from the downwardly revised 526,000 reported in July. The latest figures surpassed expectations calling for an increase of 300,000, bringing total employment 240,000 higher than the pre-pandemic levels of February 2020.

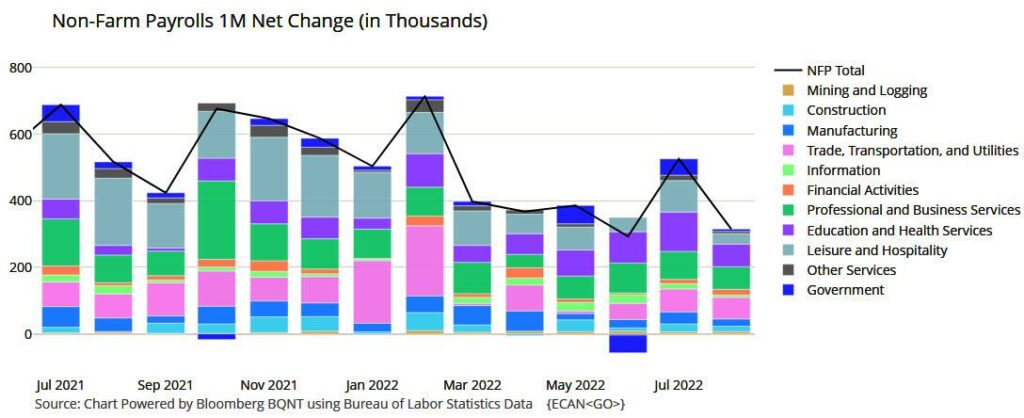

But, the unemployment rate— which the BLS reported at 3.7%— fell short of economists expectations of 3.5%, and above July’s rate of 3.5%. The increase was largely due to the number of unemployed Americans increasing by 344,000, while the number of employed rose 442,000, resulting in a labour force gain of 800,000. The majority of the job gains were concentrated across the professional and business services sector, as well as health care and retail trade.

Meanwhile, hourly earnings slowed down further last month, rising by only 0.3% against expectations calling for an increase of 0.4%. Annually, average hourly earnings were up 5.2%, also less than the 5.3% forecast by economists. In short, the headline payrolls figure came in strong, but a weaker-than-expected unemployment rate and a slower tapering in wage growth will still provide a basis for a Fed rate hike of 75 basis points come the September 21 meeting, as all eyes await the upcoming CPI reading.

Information for this briefing was found via the BLS and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.