The US housing market is in trouble: despite new home sales doing better than expected, not only did last month’s existing home sales crash— but pending home sales are faring even worse.

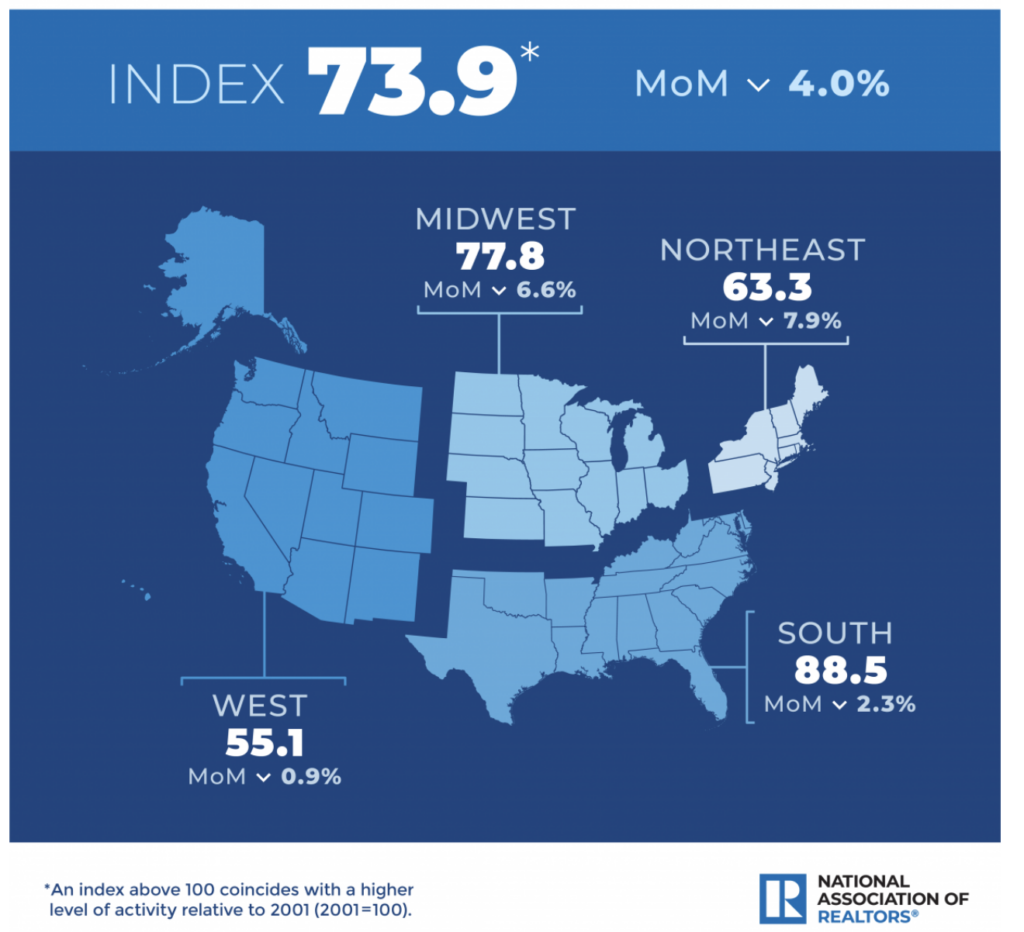

The latest report from the National Association of Realtors (NAR) shows pending home sales fell for the sixth straight month across all regions, dropping 4% between October and November to a reading of 73.9. Compared to November 2021, pending transactions slumped a staggering 37.8%— the largest decline on record, bringing contract activity on par with 2001 levels.

“Pending home sales recorded the second-lowest monthly reading in 20 years as interest rates, which climbed at one of the fastest paces on record this year, drastically cut into the number of contract signings to buy a home,” commented NAR chief economist Lawrence Yun. “Falling home sales and construction have hurt broader economic activity.”

Given that homes are put under contract several months before they are actually sold, pending home sales are the de facto gauge of future real estate activity. With that in mind, the big picture is not looking too optimistic for the US housing market.

Information for this briefing was found via the NAR. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.