As the Federal Reserve continues to pump trillions of dollars into the US economy, concerns over inflation continue to mount. As a result, Goldman Sachs warns that the US dollar may soon lose its leading role in the global markets, all while the price of gold continues to skyrocket.

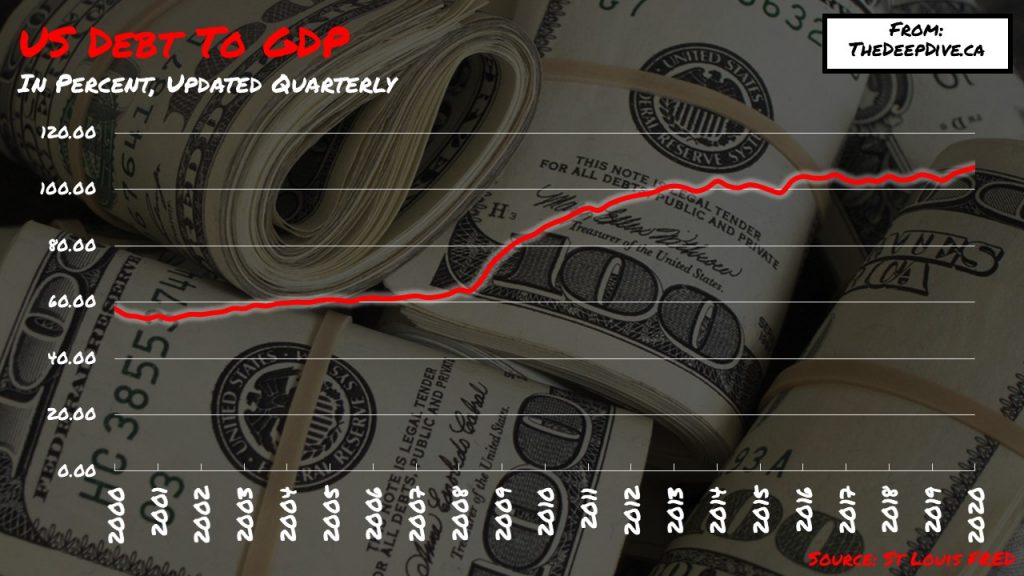

According to Goldman Sachs strategists, the Federal Reserve’s extensive balance sheets and continued money creation to prop up the collapsing economy has caused alarm over impending inflation. The current debt level in the US has surpassed 80% of the country’s GDP, which in turn may cause the government and the Federal Reserve to let inflation advance as a move to curtail the expanding debt burden.

Subsequently, with a rise in inflation, the US dollar’s role as the reserve currency may begin to subside. In addition, the continued political uncertainty as well as growing fears over the continued coronavirus infection spike may further fuel the dollar’s demise. In the meantime, the price of gold has been skyrocketing to near records, and is up 7% over the last month; conversely, the US Dollar Index has fallen by 3.7% during the same time.

Correspondingly, Goldman has updated its 12-month gold forecast, predicting the price of an ounce of gold to increase to $2,300, which is up form the previous forecast of $2,000 per ounce. In addition, the bank anticipates the US real interest rate to continue falling, which in turn will further fuel the price of gold.

Information for this briefing was found via Goldman Sachs. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.