Geopolitical tensions between the United States and China has the former reconsidering its trade relations with the latter, most especially with the security of its mining resources supply chain. The American government is instead reportedly looking at its northern neighbor to lessen its dependence from Beijing.

The US military has covertly solicited bids from Canadian mining ventures seeking American public support as part of a significant national security endeavor, supposedly as part of Washington DC’s priority to find other critical minerals resources besides Beijing.

The move to electric vehicles is said to be a significant driver of this high demand on minerals which China currently dominates–it controls two-thirds of the world’s lithium processing capacity, for instance.

But the tenuous US-China relations is strained further by House Speaker Nancy Pelosi’s visit to Taiwan, causing commotion along the Taiwan Strait.

READ: The Taiwan Paradox: The Nancy Pelosi Visit No One Asked For

It also didn’t help that the administration of US President Joe Biden has been increasingly hawkish on Chinese firms, adding companies to the Pentagon’s blacklist. The blacklist includes chipmaker Semiconductor Manufacturing International Corporation and NYSE-listed oil producer CNOOC.

For its part, Beijing has already demonstrated its willingness to cut rivals off from mineral exports, as it did a few years ago during a fishing dispute with Japan.

Defense Production Act

The move to consider Canadian mining projects chiefly stems from Biden’s act to invoke the 1950 Defense Production Act in March to fund essential mineral projects required by technology such as electric automobiles. This was prompted by a White House assessment released last year warning that reliance on certain foreign-made items poses a national security danger to the United States, citing semiconductors, batteries, medications, and 53 different types of minerals.

The funding unlocked by the law is eligible not only for domestic companies; Canadian projects also qualify because Canada has been a part of the US military industrial base for decades and is entitled to the same funds as American mining operations.

“It’s really quite simple. It’s a matter of law,” said Matthew Zolnowski, a portfolio manager for the Defense Production Act program. “So an investment in Alberta or Quebec or Nova Scotia would be no different than if it was in Nebraska or anywhere else in the United States.”

Zolnowski added that the US is aggressively reaching out to businesses to explain the procedure, as many have no interaction with the US government and may be unaware of how it works.

The Canadian government has also been active, having already presented a list of 70 projects that may be funded by the US.

The thriving minerals industry in Canada is also an attractive partner for the US as Ottawa recently limited foreign state-owned corporations’ involvement in Canada’s crucial minerals industry, citing a worldwide scramble for resources and rising tensions with China.

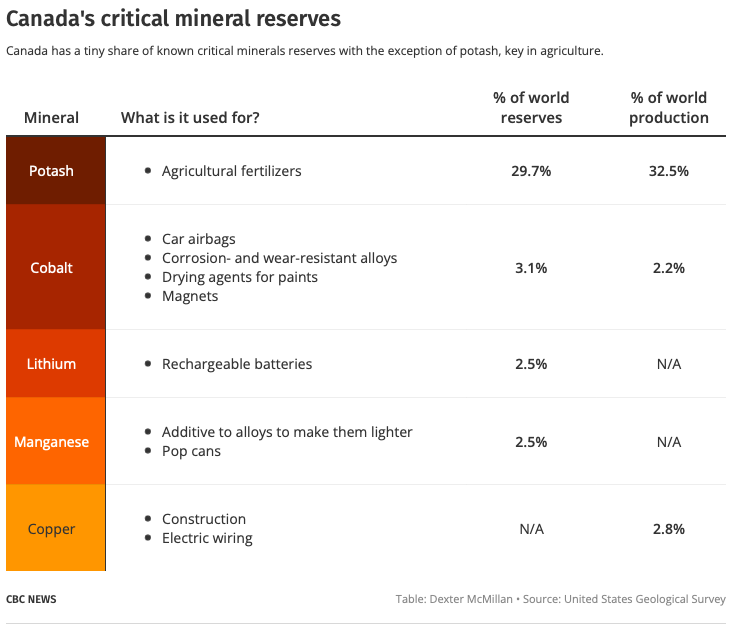

Both countries, however, see this as a generational project that is still in its early phases, with Canada remaining a bit player in the production of these minerals, which include lithium, cobalt, and manganese.

Earlier in October, twenty-one American projects were announced to share the earmarked US$2.8 billion budget to support battery manufacturing firms, according to the Department of Energy’s Manufacturing and Energy Supply Chains division.

Information for this briefing was found via the CBC and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.