Usha Resources (TSXV: USHA) has entered into a letter of intent to sell one of its flagship properties. The agreement, as per this mornings release, was reportedly entered into two months ago on March 15, 2024.

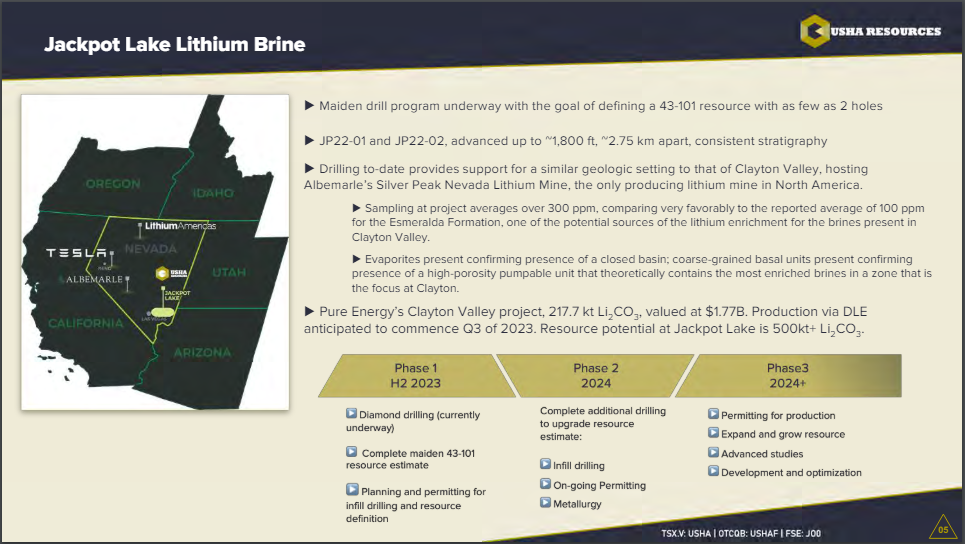

The LOI is for the sale of a 90% interest in the firms Jackpot Lake Lithium Brine Project, which is located northeast of Las Vegas, Nevada. The project consists of 442 optioned and staked mineral claims that cover a total of 8,714 hectares. The target on that property, a lithium brine deposit, is said to cover approximately 2,800 acres, and is 450 metres thick, while remaining open in all directions.

The letter of intent, entered into with Stardust Power, contemplates the sale of 90% of the project in exchange for total consideration of up to US$26.0 million that is to be paid out over five years. Usha says that consideration is to consists of US$1.5 million in cash, US$0.75 in stock, US$15.75 million in cash or stock at Stardust’s discretion, and total work commitments of US$8.0 million.

A 2.0% NSR is also to be in place on the property, half of which can be repurchased for a cash payment of US$7.5 million. Upon completion of the full earn-in, a joint venture would be entered into among Usha and Stardust, until a formal decision to mine has been made.

The LOI is said to be non-binding, with Usha committing to an exclusivity period that terminates at the end of September 2024. The transaction is subjected to regulatory approval, commercial and legal due diligence, and the ability of Stardust Power to list on the Nasdaq via a preciously announced combination with Global Partner Acquisition Corp II (NASDAQ: GPAC).

Stardust meanwhile is in the process of developing a lithium refinery in Oklahoma, which it expects will be capable of producing 50,000 tonnes of lithium carbonate per year. This transaction with Usha appears to be part of an effort to source feedstock for that facility.

Usha Resources last traded at $0.10 on the TSX Venture.

Information for this briefing was found via Edgar, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.