Verano Holdings (CSE: VRNO) is due to debut on the CSE on February 17th. The company will trade on the Canadian Securities Exchange under the ticker symbol “VRNO.” The company is doing an RTO with Majesta Minerals.

Last week, Beacon Securities initiated coverage on the name with a C$32 price target, a 150% upside, and a buy rating. Russell Stanley writes, “We value Verano using a 14x EV/2022E EBITDA multiple, which is a 30% discount to the 20x average for US operators.”

Stanley starts off the initiation with a few highlights. His first highlight points to Verano’s core markets: Illinois, Florida, New Jersey, Maryland, Arizona, and Pennsylvania, which are some of the fastest growing and most illusive licensed states. Altmed has the fourth-largest flower market share and third-largest oil-based product sales in Florida. Verano is a top three wholesaler in Maryland. They have one of only twelve licensees in New Jersey, which is expected to go adult-use by the second half of 2021. Altmed also is vertically integrated in Arizona. Stanely writes, “This group of core markets represent an aggregate population of almost 70M people.”

The next highlight Stanley talks about is the potential M&A. He writes, “From a licensing perspective, Verano is already ‘maxed out’ in its core markets, except for Arizona and Pennsylvania.” He believes that Verano’s next large M&A will be in those two respective states as Arizona is still a highly fragmented market. Meanwhile, they have no cultivation or manufacturing operations in Pennsylvania.

The last highlight is about the operational efficiency Verano exhibits versus the peer group. Proforma third-quarter revenue and EBITDA was $242 million and $117 million, respectively, with only Trulieve having higher EBITDA margins. Stanley writes, “We attribute Verano’s margin outperformance to a combination of its focus/strength in higher-margin wholesale operations (vs. retail revenue), and a leaner overall cost structure.”

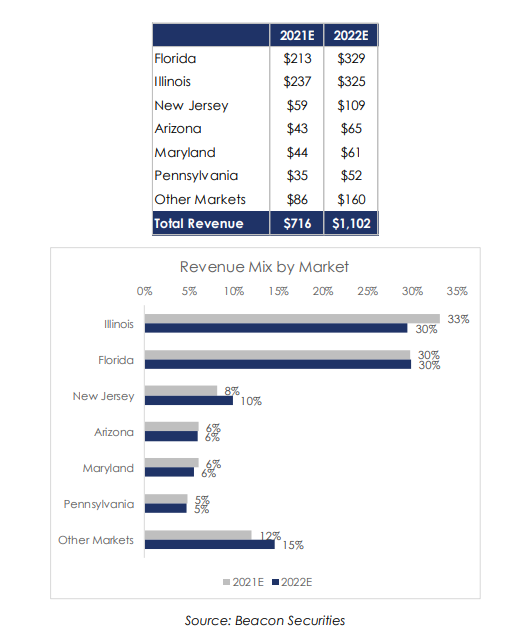

The revenue growth is driven by Verano’s core markets, with Stanley believing that Illinois and Florida are the largest revenue drivers. He adds that their fiscal 2021 estimates are based on a partial quarter contribution from Florida and Arizona. Stanley writes, “We expect significant EBITDA expansion over our forecast period, that is driven largely by revenue growth, with relatively modest margin expansion assumed.”

Below you can see Beacon’s 2021 and 2022 estimates for Verano.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.