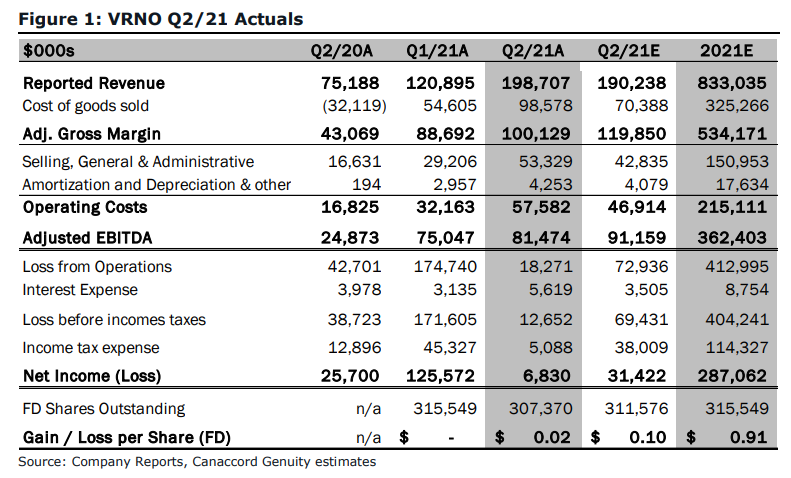

On August 10, Verano Holdings (CSE: VRNO) reported their second quarter financial results. The company reported revenues of $199 million, an increase of 39% sequentially, beating analyst estimates (which are in Canadian dollars.) The company reported gross profits of $100 million, or 50%, while adjusted EBITDA came in at $81.47 million.

One analyst increased their 12-month price target, bringing the consensus average up to $38.89 from $38.46. The street high comes from BTIG with a C$47 price target, and the lowest target comes in at C$19.70. Verano has 7 analysts covering the stock, with 2 analysts having a strong buy rating and the other 5 have buy ratings.

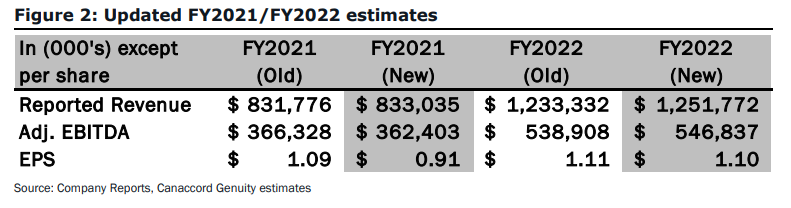

In Canaccord’s update note they reiterate their buy rating and C$35 price target saying that the M&A pieces are quickly coming together but margins are getting hurt due to the new product mix.

Verano’s revenue came in higher than Canaccord’s $190.23 million estimate but margins came in about 20% lower than Canaccord expected. The $199 revenue estimate came in at the high end of management guidance for the quarter. Gross margins came in at 50.4%, which was lower than estimated primarily due to fair value accounting around inventory acquired and a less Florida heavy revenue mix.

Canaccord says that Illinois and Florida remain the largest revenue contributors at 78% of retail sales and 22% of wholesale sales, while same-store sales also grew 13% sequentially. Canaccord also says that Verano’s $150 million in cash is sufficient as the company is now generating $16 million in free cash flow.

Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.