The Department of Financial Regulation of the US state of Vermont is encouraging investors of Celsius Network to proceed with caution, claiming that the crypto exchange’s “assets and investments are probably inadequate to cover its outstanding obligations.”

“The Department believes Celsius is deeply insolvent and lacks the assets and liquidity to honor its obligations to account holders and other creditors,” the state’s regulatory body said on its website.

The comments follow the state’s move to join the multistate investigation of Celsius pertaining to the latter’s actions of trading “unregistered securities.”

“The Department believes Celsius has been engaged in an unregistered securities offering by offering cryptocurrency interest accounts to retail investors,” the department added.

The state regulatory body also pointed out that Celsius lacks a money transmitter license, saying that the crypto exchange “was operating largely without regulatory oversight.” This, the department believes, allowed for lax operations that left the customers unprotected from risks.

“Celsius deployed customer assets in a variety of risky and illiquid investments, trading, and lending activities. Celsius compounded these risks by using customer assets as collateral for additional borrowing to pursue leveraged investment strategies,” the state’s regulatory body also said.

It also added that it is aware of talks about Celsius priming to file for bankruptcy.

“If you are a Celsius customer, a bankruptcy filing could affect your investor rights and the value of your Celsius interest account balances. You should consult your own counsel,” the department added.

Stablecoin debt no more

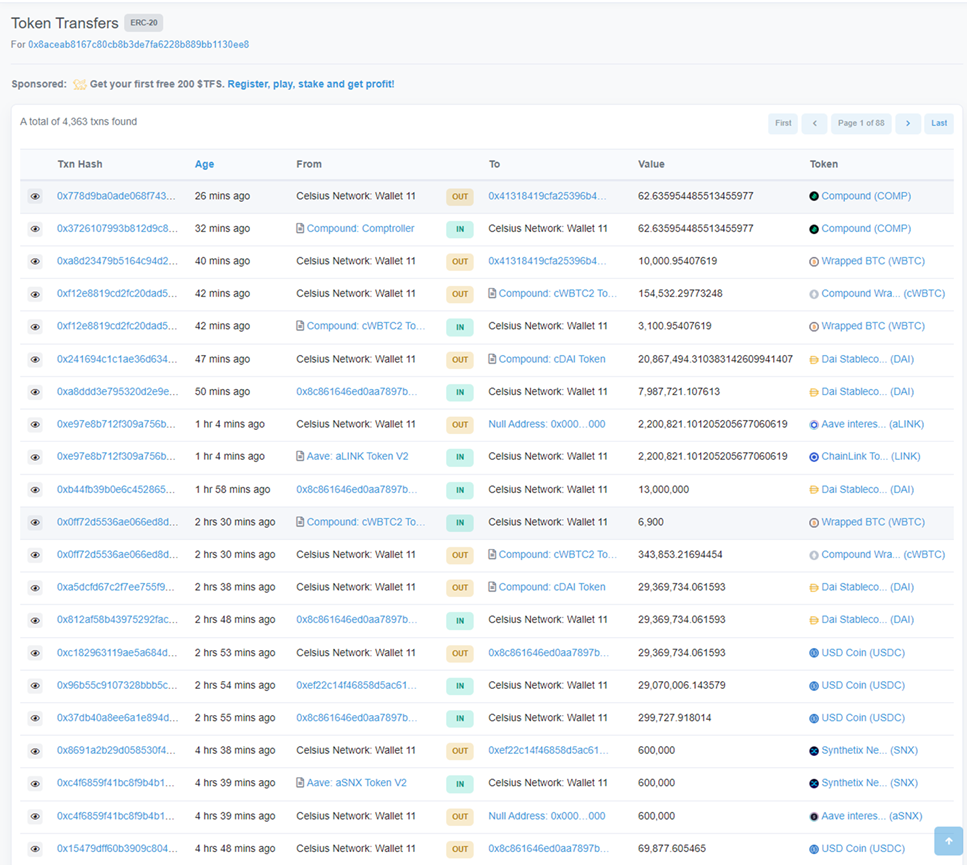

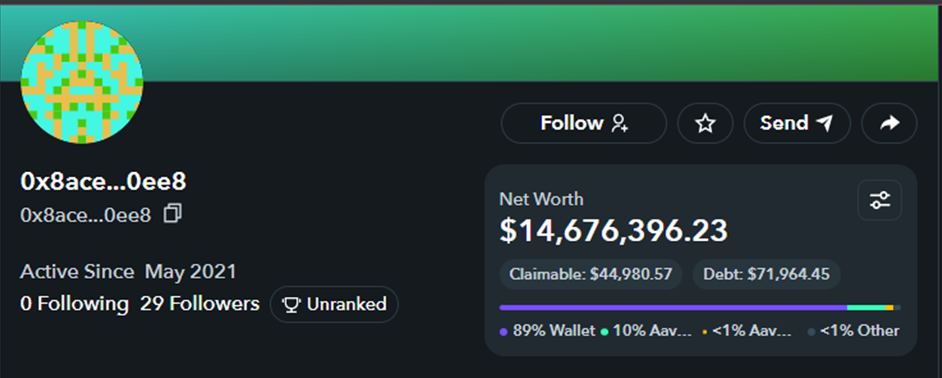

The comments from Vermont’s regulatory body have been juxtaposed with Celsius’s recent move to close out its USD Coin debt to Aave, according to on-chain data. The value of the repayment is around US$71.9 million.

The debt settlement also unlocked around US$417 million stETH, tied as collateral to the said loan. This also cleans out all of the lender’s stablecoin debt, having settled a further US$78 million in USDC also to Aave on Monday.

The crypto exchange also paid around US$50.3 million in DAI to Compound and freed up around US$195 million in wBTC tied to the loan as collateral.

Following these payments, the firm’s remaining loan is worth close to US$72,000 in REN also to Aave, far from its outstanding obligations of around US$820 million last month.

Since July started, Celsius has repaid US$223 million to Maker, US$235 million to Aave, and US$258 million to Compound.

#Celsius previously had most of their on-chain (DeFi) debt across these 3 positions (Maker wBTC Vault, Compound, and Aave).

— Josh (@CryptoWorldJosh) July 13, 2022

Their Maker & Compound debt has been reduced to $0, and they still owe ~$70k worth of REN in their Aave position. 👇 pic.twitter.com/ipZGer2CuM

However, the firm is still about to face a legal battle as its former investment manager, KeyFi founder Jason Stone, is taking Celsius to court under fraud allegations.

The latest digital debt payments follow a month after Celsius paused all withdrawals, transfers, and swaps–which led to a liquidity crisis.

Information for this briefing was found via Reuters, Forkast, and Etherscan. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.