Earlier this month Raymond James released a note reiterating their $27 price target and Strong Buy on Village Farms (TSX: VFF) after they spent a day at their Delta, BC greenhouse. They write, “If we weren’t already bullish on this story, we certainly would be now,” and give 3 reasons as to why Village Farms is “an asymmetrically undervalued company, and hence a terrific investment opportunity.”

Village Farms currently has 7 analysts covering the stock with an average 12-month price target of C$23.80. Out of the 7 analysts, 1 has a strong buy rating and the other 6 have buy ratings. Raymond James has the street high at C$33.79(US$27) while the lowest comes in at C$17.

Raymond James outlines its three point thesis as follows.

- Village Farms is the most capital efficient and lowest-cost producer in the Canadian landscape. They write, “While many of VFF’s peers have been shuttering cultivation facilities left and right, VFF has just doubled its cultivation capacity to 2.2 mln sq ft to meet growing market demand for its products, adding 1.1 mln sq ft at its Delta 2 facility to the existing 1.1 mln sq ft at its Delta 3 facility, at a cost of just ~CAD$55 mln. For context, most of VFF’s peers have spent $200 mln in CAPEX on each of their greenhouses.” Raymond James estimates that the companies all-in cost per gram sits at around C$0.70 while its peer average is still above C$2/gram.

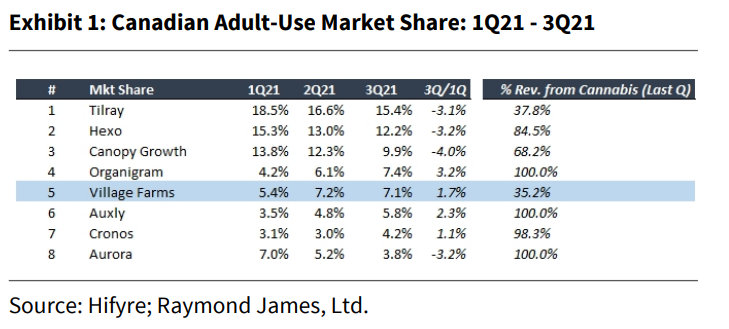

- Village Farms has been able to grow its market share, organically as well, of the adult-use market. Village, as estimated by Raymond James, now controls 7.1% of the adult-use branded-product market, up 1.7% in two quarters. This comes behind Tilray’s 15.4%, HEXO’s 12.2%, Canopy’s 9.9%, and Aurora’s 3.8% market share. These companies, excluding HEXO, have market capitalizations of over >$1b while they have lost more than 3% of their market share since the first quarter. Raymond James believes that Village should be valued “in the multi-billion market cap club,” as it currently trades at an $860 million market capitalization.

- Village Farms has “the best option on the U.S. market among its peers.” This comment refers to Village’s almost 6 million square foot greenhouse in Texas. The other big 3 companies have obtained a multi-billion dollar market capitalization mainly driven by their US and international opportunity Raymond James says. They believe that once eventual legalization comes around, for Village’s peers to turn these options into accretive deals, “the price of acquiring the non-owned share of MSOs will be quite steep, and/or the conversion of hemp/craft beer to the cultivation of cannabis will require significant investment.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.