It appears that Voyager Digital (TSX: VOYG) may be in trouble with respect to its exposure to Three Arrows Capital, whom is also known as 3AC. The firm this morning quietly announced that it may issue a notice of default to the firm.

Voyager reportedly has exposure to the crypto hedge fund via 15,250 bitcoin and $350 million USDC that was loaned to the firm. At $20,000 bitcoin, it equates to a $305 million position in bitcoin. Collectively, total exposure to the failing hedge fund is estimated at $655 million – a significant potential loss to be swallowed by Voyager.

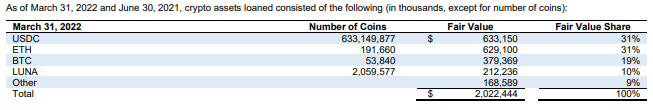

As of March 31, as per company filings, Voyager had loaned out 53,840 bitcoin, and 633.1 million USDC. This implies that 3AC represents 28.3% of the bitcoin currently loaned out by Voyager, and 55.3% of the USDC currently loaned.

The company is reportedly considering issuing a notice of default to the firm, after a payment of $25 million USDC was requested to be made by June 24. A repayment of the entire bitcoin and USDC position was requested to be made by June 27. The company has stated its intention to pursue recovery of the loan, but its unlikely they will be able to obtain much given the current state of the hedge fund.

Separately, the company has closed on previously announced credit facilities for bitcoin and USDC with Alameda Ventures. The loans, which consist of a 15,000 BTC revolver and US$200 million in USDC and cash, are to be used to combat current market volatility.

Voyager reportedly has $152 million in cash and crypto assets on hand, in addition to $20 million in cash that is restricted for the purchase of USDC.

Voyager Digital last traded at $1.60 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.