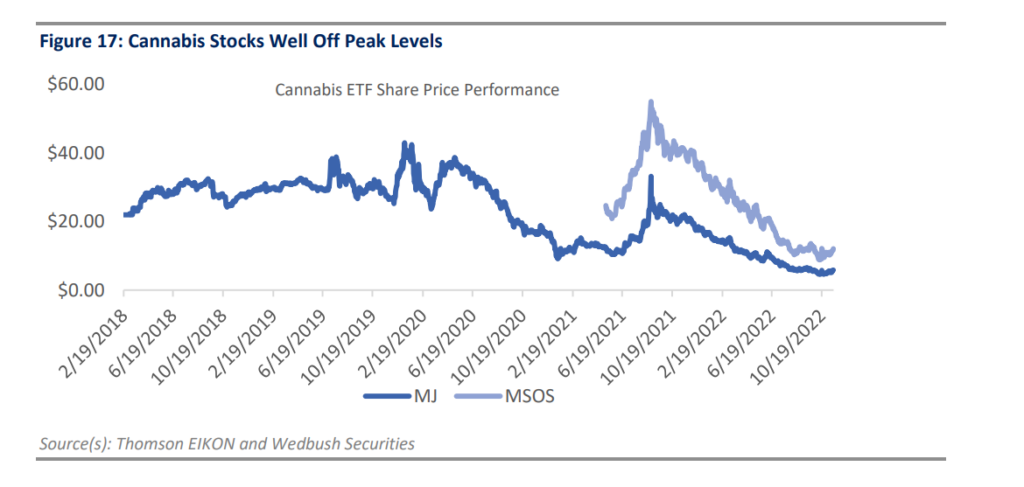

At the start of December, Wedbush initiated coverage on a select group of US multi-state operators, saying after a long 18 months they believe that brighter days “lie ahead for the U.S. cannabis industry.” They believe that the companies will generate incremental revenue from newly legalized states coupled with normalization from the black market.

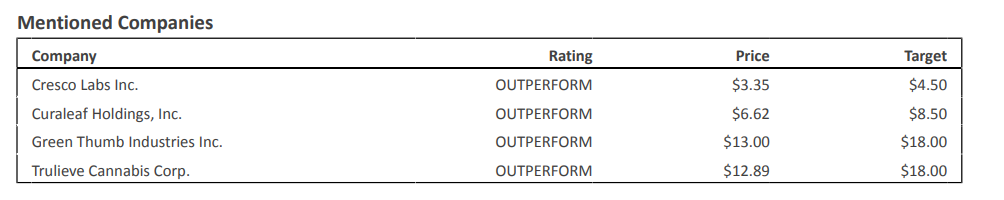

The company initiated coverage on what they call the four market-leading U.S. MSOs. This list is Cresco Labs, Curaleaf, Green Thumb, and Trulieve. They initiated coverage on Cresco Labs (CSE: CL) with a US$4.50 price target, Curaleaf Holdings (CSE: CURA) with a US$8.50 price target, Green Thumb Industries (CSE: GTII) with a US$18 price target, and Trulieve Cannabis (CSE: TRUL) with a US$18 price target.

All companies come with an overweight rating. Wedbush justifies the ratings by saying that the competitive advantages for each company are as well as “depressed stock valuations across the board.” They also name Green Thumb their top pick due to its “strong revenue growth, margins, profitability, and cash flow generation.”

They say that some of these companies’ headwinds include price deflation, a weak capital environment, increases in consumer mobility, and record-high inflation.

Wedbush expects the sector to see $9 billion in value creation over the next three years, with total revenues growing from roughly $25 billion today to $34 billion in 2025 or an 11% compound annual growth rate. They expect that of the $9 billion in new revenues, new states that are rolling out adult use sales or states that are expected to come online will drive 60% of that revenue.

One of the key investment themes the investment bank talks about is that CAPEX levels are coming down sector-wide as companies end their investment cycle. Which they believe will help with the current supply gut that many states are facing in states such as Pennsylvania, Illinois, and Massachusetts. Additionally, they expect companies to reap the benefits of the buildout money in 2023, with revenues and profitability improving throughout the year.

Information for this briefing was found via The Block. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.