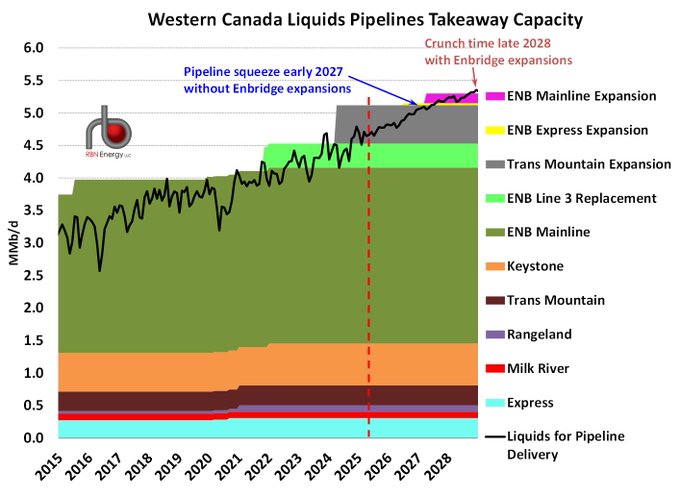

Western Canada’s crude output has more than doubled over the past decade—rising from roughly 2.5 MMb/d in 2015 to an estimated 4.6 MMb/d as of April 2025—driven predominantly by Alberta oil sands expansions. RBN Energy warns that “almost nothing is going to stop Western Canada’s crude oil production growth,” with annualized liquids volumes (crude plus diluent) expected to climb to 5.5 MMb/d in 2024 and 6.1 MMb/d by 2028.

Analysts smoothing out seasonal swings project that takeaway demand will consistently breach existing capacity in the spring of 2027.

Great post from @RBNEnergy on a critical topic.

— Rory Johnston (@Rory_Johnston) June 9, 2025

Currently, W Cdn egress capacity set to run short again by early-2027 absent expansions—the only real plans for which are Enbridge's, shown below.

But 1) we've been burned on that before, & 2) even then only buys us another ~year https://t.co/hdxcZiEk4h pic.twitter.com/PpHiwEt9sk

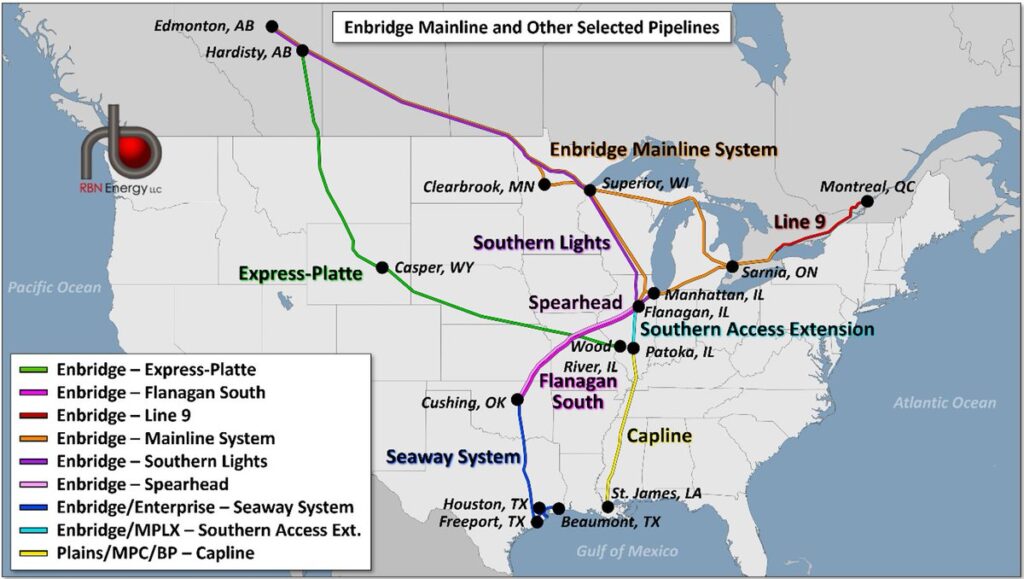

Canada last faced a Mainline bottleneck in late 2023 and early 2024, when stacked pipeline capacities approached parity with delivered volumes, triggering steep “apportionment” discounts on Western Canadian Select. The May 2024 in-service date of the Trans Mountain Expansion—adding 590 Mb/d to the West Coast export slate—temporarily widened the gap to about 500 Mb/d, easing near-term pressures but doing little to alter the upward trajectory of production.

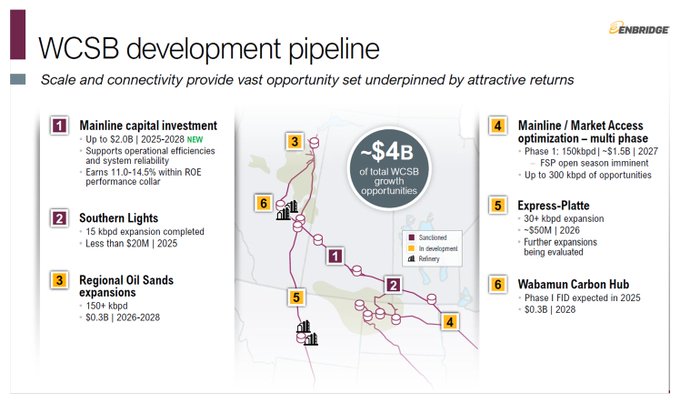

Enbridge has unveiled $3.5 billion of capital expenditures through 2028 to shore up its Mainline and Express-Platte systems. Between 2025 and 2028, up to $2.0 billion will enhance Mainline efficiency and reliability—engineering upgrades, additional pump stations and drag-reducing agents—aiming for a 150 Mb/d boost by spring 2027 and scope for a further 150 Mb/d beyond that.

A separate $1.5 billion allocation targets market-access optimization, potentially lifting capacity by another 150 Mb/d by 2027, while a low-cost $50 million project will add 30 Mb/d to Express-Platte by 2026.

Beyond Mainline and Express, Enbridge completed a modest 15 Mb/d Southern Lights diluent loop expansion earlier this year for under $20 million, taking that system to 195 Mb/d. Regional oil-sands companies are likewise investing heavily, with more than 1 MMb/d of new production sanctioned through the late 2020s, setting the stage for sustained takeaway demand.

No rail alternatives or refinery off-take within Alberta and Saskatchewan are sufficient to offset the need for fresh pipe capacity.

Stacked nameplate capacities excluding TMX currently total roughly 5.1 MMb/d. By spring 2027, liquids volumes—smoothed for seasonal lows—are forecast to brush against or exceed that mark, resurrecting the specter of apportionment.

Even with the planned 180 Mb/d total from Express-Platte and Mainline expansions, RBN Energy’s outlook suggests those additions merely defer the crunch to late 2028, “buying another ~year” before the next capacity cliff.

Securing permits, completing open seasons, and ordering specialized pumps and drag-reducing agents can each take 18–24 months. Given that Enbridge has only signaled an “open season imminent,” shippers face a narrow window to commit toll-and-term volumes if they wish to lock in the spring 2027 in-service date.

Information for this story was found via RBN Energy and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.