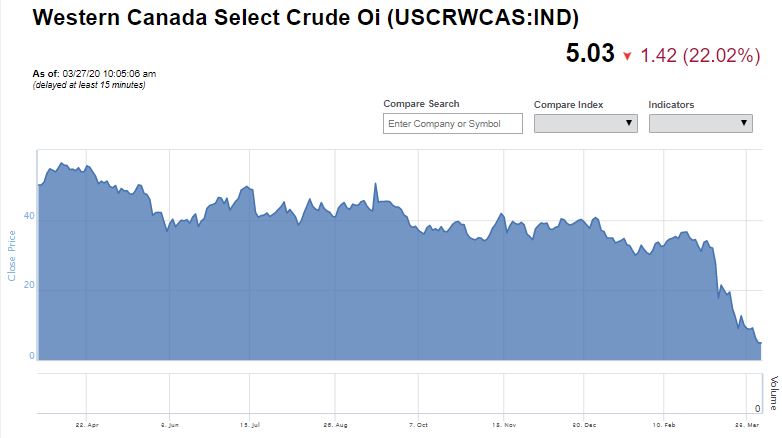

The price of the Canadian oil benchmark, Western Canadian Select, has been obliterated this week, sinking as low as US$5.03 in this mornings trading. This morning’s fall of $1.42 per barrel follows yesterday’s massive tumble of $2.45 per barrel to close the day at $6.45.

The fall marks a second day of record lows for the benchmark, with yesterday’s close at $6.45 having been a new low for the commodity. The sharp decline in oil has resulted in the price of shipping product now being higher than that of what can be collected for it on the market as BNN Bloomberg pointed out last night. CBC attempted to make light of the hard fall, humorously highlighting that a Barrel of Monkeys, a child’s game, is now more expensive than that of a barrel of WCS.

The news however is terrible for the Alberta economy, given that oil accounted for approximately 16.81% of the province’s GDP in 2018. For Canada, that figure is closer to 7% just for the extraction of oil and gas, and doesn’t include related services for the activity.

However, the problem is more extreme in Alberta than Canada as a whole, where the provinces 2020 budget released at the end of February indicates that sharp deficits are going to occur. While the province bases its budget on the price of West Texas Intermediate (WTI) oil, the budget that was tabled was based on a price per barrel of $58, with every dollar below that figure anticipated to cost the province $200 million in lost revenues. As of current trading, WTI is currently at $21.44 a barrel.

Western Canadian Select has fallen more than 50% this week based on current trading, closing last Friday’s session at $10.11 per barrel and now down to $5.03 as per the most recently available data.

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.