First Quantum Minerals (TSX: FM) sits in a tight position with the Government of Panama as the two parties can’t seem to agree on how to move forward with the mining firm’s Cobre Panamá mine. Talks are currently suspended and the government is ordering the company to suspend operations and put the mine under “care and maintenance.”

Given that there are mining and junior firms drilling in the Central American country, it is noteworthy to understand the situation First Quantum is facing.

Law no. 9

This all started in 2018, when the Panamanian Supreme Court ruled that Law No. 9 of 1997 was unconstitutional. The law approved the contract between the state and mining company Sociedad Minera Petaquilla S.A. (predecessor of First Quantum’s subsidiary Minera Panamá which manages the Cobre Panamá mine).

The legal battle–lasting nine years–was put forth by the Centro de Incidencia Ambiental (CIAM), an environmental advocate organization. The main objective of the lawsuit was to prevent major damage on the ecosystems in Donoso, Colon.

“We celebrate the rule against the contract of open-pit mining and we encourage that the state guarantees a clean environment and free of contamination to its citizens,” CIAM said in a statement.

This Supreme Court decision also means that the extension granted to the successor Minera Panamá is deemed null and void, which means that all contracts and concessions secured by Minera Panamá under the protection of Law 9 must be canceled.

The contract with Minera Panamá was extended until 2037 by the government of then-President Juan Carlos Varela in 2017, before the Supreme Court decision. However, the renewed contract will still be binding because according to Panamanian legislation on unconstitutionality, if a regulation is ruled unconstitutional, it cannot be retroactively applied.

“We understand that the upholding of the unconstitutionality ruling against Law 9 of 1997 does not have retroactive effects, pursuant to article 2573 of the Code of Judicial Proceedings of Panama, therefore the approval of the mining concession contract which occurred in 1997 with the enactment of Law 9, remains unaltered, providing operation continuity as per status quo,” First Quantum said in a statement.

$375 million

The Canadian miner started working with the Panamian government, now under current President Laurentino Cortizo, to negotiate a new contract in September 2021. In January 2022, Cortizo announced plans to toughen the terms of its mining license, with a new contract requiring it to pay “at least” $375 million to Panama yearly – ten times what it is presently paying.

“Panama has the inalienable right to receive fair income from the extraction of its mineral resources, because the copper is Panamanian,” Cortizo said.

The new proposal also plans to change the existing revenue royalty, which will be replaced by a gross profit royalty.

To put this in perspective, $375 million is around 5.2% of the company’s revenue in 2021.

The miner first accepted the proposal’s premise after securing the appropriate safeguards to ensure the continuity of its operations.

After nearly a year of negotiations, both sides claimed independently that they had failed to achieve an agreement before the government-imposed December 14 deadline, implying that the new mine contract will not be signed.

“We have been given a deadline to sign the new contract by December 14, to accept the new terms,” First Quantum’s manager in Panama, Keith Green, told AFP. “We intend to reach an agreement, but negotiations are a bit deadlocked.”

The Panamian government, however, announced that Minera Panamá has submitted changes to the agreement a day after the deadline, adding that “this administration does not accept such changes.”

El 17 de enero de 2022, la empresa Minera Panamá comunicó al Gobierno Nacional que aceptaban la propuesta y los términos planteados.

— Presidencia de Panamá (@presidenciapma) December 15, 2022

Hoy 15 de diciembre de 2022, la empresa ha presentado cambios a lo acordado.

Comunicamos al país que esta administración no acepta dichos cambios. pic.twitter.com/J5MhNTJ7vG

For First Quantum, the agreement wasn’t reached because “necessary legal protections on termination, stability and transition arrangements could not be agreed upon.”

The government of Panama then “halted discussions and announced plans to order [Minera Panamá] to suspend operations” after the deadline, according to the miner.

“We are disappointed by the Government’s actions. The Government seeks a refreshed concession contract that does right by the country, its people and its economy, and we believe our proposal achieves just that,” said the company in its statement, adding that “Cobre Panamá and its employees would contribute more than US$500 million each year in revenues to the government at current copper prices.”

More than a week later, talks resumed between the parties and operations continued “as normal” as the company claimed. This despite the National Directorate of Mineral Resources of the Ministry of Commerce and Industries ordering Minera Panamá a few days before to submit a plan within 10 working days of such notification to suspend commercial operations at Cobre Panamá and put the mine under “care and maintenance.”

Cobre Panamá: Job cuts and hefty royalties

Inarguably, the Cobre Panamá mine is First Quantum’s prized possession. It is considered one of the biggest mines in Central America, producing 300,000 tons of copper concentrate per year.

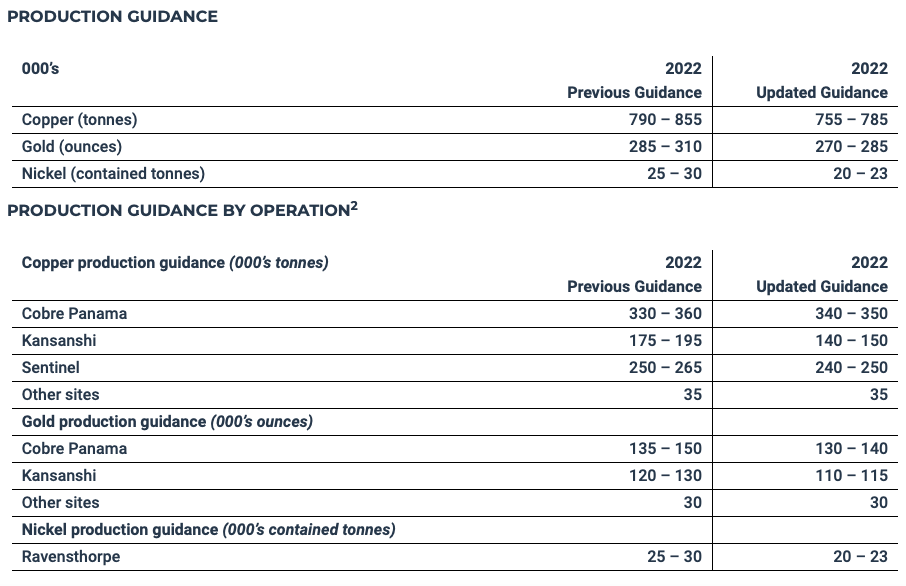

In the firm’s 2022 full-year guidance, 45% of expected copper production and 48% of expected gold production was marked to be produced at Cobre Panamá.

The potential loss of the concession would also mean Panama losing a sizable amount of its GDP. Minera Panamá’s business, the biggest private investment in the Central American country, accounts for 3.5% of its gross domestic product.

“Over the past 25 years, First Quantum and its predecessor have invested at least US$10 billion to build one of the world’s largest, safest and most advanced copper mines. It is the largest private investment in the history of Panamá and a significant contributor to the Panamanian economy and important social programs,” said CEO Tristan Pascall.

On Monday, Doris Zapata, Panama’s Minister of Labor, indicated that talks with Minera Panama have been postponed in order for the corporation to comply with the necessary care and maintenance plan. Prior to that, Milciades Concepción, the country’s Minister of Environment, revealed that Minera Panama requested a relaxation of the environmental safeguards that had already been agreed upon, including getting more acreage to run the mine.

Concepción said that the government “has not yielded to these requests.”

Michael Camacho, director of the Union of Mining Workers of Panama, also sounded the employees’ concerns on who will assume the payment of their salaries if the care and maintenance plan of the operation of the processing plant is completed.

About 5,941 workers in the Cobre Panamá project started 2023 with the warning of a possible dismissal. The company informed its workers that it will have to execute a cut in expenses if it does not reach an agreement with the government to continue the operation of the mine.

“If we have to reduce operations to care and maintenance mode, the company will need to take steps to reduce expenditure across the business. We could be forced to suspend a significant amount of our valued workforce, which is something we do not want to do,” states the letter signed by First Quantum general manager Alan Delaney.

Seemingly playing its final card, First Quantum relayed to the public on Tuesday that it is prepared “to agree with, and in part exceed, the objectives that the Government outlined in January 2022 related to revenues, environmental protections and labour standards.”

“This includes a minimum of US$375 million per year in Government income, comprised of corporate taxes and a profit-based mineral royalty of 12 to 16 percent, with downside protections aligned with the Government’s position,” the company said, highlighting that the royalty rates “would be amongst the highest, if not the highest, paid by copper miners in the Americas.”

First Quantum announced that it would hold a conference call on Tuesday to discuss the situation on the Cobre Panamá mine.

First Quantum last traded at $31.12 on the TSX.

Information for this briefing was found via France 24, Televisora Nacional, Prensa Latina, Mining Watch, BNAmericas, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.