Stellantis NV (NYSE: STLA) announced Monday a $155 million investment in an Argentina copper project to secure forecast copper demand beginning in 2027.

The automaker is acquiring a 14.2% share in McEwen Copper, a subsidiary of Canadian mining company McEwen Mining (NYSE: MUX), that wholly owns the copper projects Los Azules in Argentina and Elder Creek in Nevada, USA.

The multimillion investment, which roughly converts to 30 billion in Argentine peso, makes Stellantis the second largest shareholder in the copper miner, after McEwen Mining. The acquisition puts McEwen Copper’s valuation at $550 million.

McEwen Mining shares jumped 14.5% on the day following the news while Stellantis budged a quarter of a percent the same day.

Following the transaction, Stellantis gets to nominate one director to the McEwen Copper board and gets the rights to scientific, technical and strategic planning information.

Los Azules is an advanced-stage porphyry copper exploration project in Argentina’s San Juan mining area. The project is located in the Andes Mountains, roughly 80 kilometers west of Calingasta and 6 kilometers east of Argentina’s border with Chile, at 3,500 meters height.

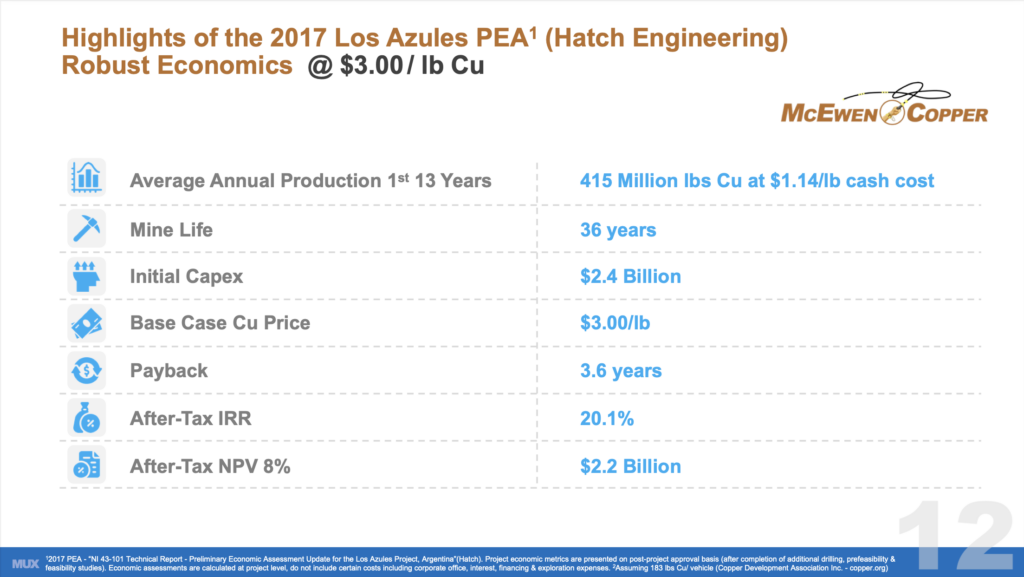

According to the project’s Preliminary Economic Assessment (PEA), completed in 2017, the project is expected to be the world’s 25th largest copper producer and a lowest cost quartile producer over the first ten years of operation.

The following drilling season will run from October 2022 to June 2023. McEwen Copper has assembled a team to complete the updated PEA for Los Azules in the first quarter of 2023, followed by an initial public offering in the second quarter of 2023 and a feasibility study in 2024.

The automaker race for mining

Back in June 2022, Stellantis was one of the early automakers shifting to manufacturing electric vehicles that started investing in mining companies drilling resources necessary to make EV battery. Weeks after establishing its hydrogen fuel cell division, the Netherlands-based automaker announced its €50 million equity investment into lithium producer Vulcan.

Tesla (Nasdaq: TSLA) has reportedly been working on multiple transactions with lithium companies. Earlier this year, the automaker revised its deal with Piedmont Lithium (Nasdaq: PLL) to deliver 125,000 metric tons of SC6 to Tesla beginning in H2 2023 and continuing through the end of 2025.

Most recently, Sigma Lithium (TSXV: SGMA) appears to be the latest target in the lithium space, with rumours put out by Bloomberg that Tesla is weighing a takeover of the company.

Meanwhile, General Motors (NYSE: GM) just became officially the largest shareholder of Lithium Americas (TSX: LAC) this month after the firms jointly announced that the first tranche of a $650 million investment relayed earlier has been closed.

The state of copper

Copper futures dipped below $4 per pound in late February, the lowest level since early January, as concerns about weakening demand collided with tight supply. Production halts in major South and Central American regions exacerbated concerns about low stockpiles in the United States and Europe, fueling speculation that copper markets may be entering a deficit.

Apart from mining delays in Peru owing to political upheaval, ore processing operations in Panama have lately been delayed due to concerns with government tax and royalty payments from Canada’s First Quantum Minerals.

On top of this, the world’s largest mining companies and metal traders are warning that a massive shortfall of copper could occur as early as 2025, which could hold back global growth, stoke inflation and impact global climate goals.

According to a recent report by S&P Global, copper demand is expected to double to 50 million tonnes annually by 2035 as the world moves towards a green economy encompassing electric vehicles and renewable energy, whereby millions of feet of copper wiring will be needed to strengthen power grids around the world, as well as build wind and solar farms. The increased demand comes in addition to copper’s traditional uses that include wiring, plumbing, communications, and power electronics.

“It’s very fascinating to watch copper because global copper stockpiles are falling,” Craig Hemke, founder of the TF Metals Report, said in a The Daily Dive interview. “What if copper breaks out? What if copper goes above $4.80 [per pound] and move towards $6? So, that’s why everybody should keep an eye on copper.”

But for Stellantis, it’s all about achieving net carbon zero by 2038, a condition included in the Copper Cathodes and Concentrates Purchase Rights Agreement (CCCPRA) inked with McEwen Copper.

“We are taking important steps in Argentina and Brazil, with the aim of decarbonizing mobility and ensuring strategic supplies of clean energy and raw materials necessary for the success of the company’s global plans,” Stellantis CEO Carlos Tavares said.

McEwen Copper CEO Rob McEwen echoes the sentiment, saying they share the vision with Stellantis “to build a mine for the future based on regenerative principles that can achieve net-zero carbon emissions by 2038.”

The CCCPRA also grants Stellantis and its affiliates the right to purchase a percentage of the copper cathodes, copper concentrates, or both produced by the Los Azules project, which in each event is to be equal to their equity ownership percentage in McEwen Copper at the time of exercise.

The two firms noted that Los Azules intends to produce 100,000 tons of cathode copper at 99.9% purity per year beginning in 2027, with sufficient resources to sustain the operation for at least 33 years.

So whether it’s a vertical integration move, or the automaker is banking on the throughput from the Los Azules copper project to “supply some of the projected copper demand starting in 2027” as it intended, the acquisition faces a volatile pricing environment amid a threatened supply.

Stellantis last traded at $17.61 on the NYSE.

Information for this briefing was found via the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.