Continuing on his Bretton Woods III theory and the shift to a new world order tied to commodities, Credit Suisse contributor Zoltan Pozsar believes that “it’s now time to bring the state in as an extra layer in the hierarchy of money.”

“We usually think of money and its hierarchy in terms of instruments, prices, and intermediaries (gold, reserves, and deposits; secured, unsecured, and FX swaps; central banks, banks, and dealers, respectively), not in terms of money and state,” said Pozsar.

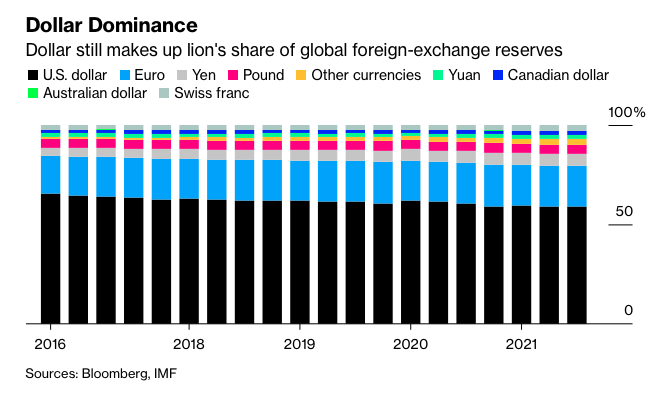

Citing the rise of Chinese currency renminbi, commodities’ influence on nominal prices, and the return of gold as reserve assets, the author is seeing a decline of the current global currency, the Eurodollar. The relative decline is believed to “naturally give rise to a set of ‘big shorts’.”

In short (no pun intended), the statecraft that affects the decline of the global currency Eurodollar should be factored into the equation as we shift to a new world monetary order–else, the short of the currency will be out of hand.

Source: Wallet Investor

The Currency Shift

For Pozsar, the risk in today’s financial climate is the revaluation of monetary staples, not devaluation.

“Revaluations and the abandonment of pegs that results in revaluations happen not from a position of weakness, but a position of strength and are matters of statecraft,” he said.

Seeing the rise of Chinese renminbi, Pozsar said it would be rational for the Asian nation to revalue its currency away from the dollar, while economic giants Saudi Arabia and Hong Kong may abandon their peg to the dollar or reevaluate their respective currencies based on a commodities basket instead.

The weaponization of the dollar evidenced by the series of fiscal policies implemented by the dollar-dominated nations against Russia did not help in securing the currency’s top preference as a peg for foreign reserves.

“‘Our commodity, your problem’ is about the rest of the world’s decision to re-think what the right value of their own currency is and what they’re pegged to,” he added.

As the shift to Bretton Woods III parallels deglobalization, Pozsar explained that what a nation accumulates as reserves–whether dollars or commodities–would matter. And in a monetary world order tied to the security of the real value of the commodities basket, it is clear that the nation’s goal to secure its provisions would influence its fiscal policies.

Shadow Banking

To further stress his point, Pozsar drew parallels between the 1997 banking crisis, the 2008 housing crisis, and the 2020 financial crisis. He explained that these three crises are similar with respect to shadow banking–money market funding of capital market lending. The pattern starts with a “liquidity event, then a backstop at a steep price, and then a lasting impact in financial markets.”

“[In] 1997, a sudden stop, the sale of national assets, and FX reserve accumulation; in 2008, a sudden stop, a fire sale of mortgages, and reserve printing; in 2020, a sudden stop, a fire sale of Treasuries, and reserve printing again.,” he summarized.

He further elucidated that the current financial stress is caused by a shortage in dollars stemming from the imbalance brought by the commodities industry, reiterating his call for central banks to step in and aid the liquidity problems of the commodities traders.

“Today, shadow banking is ‘money market funding of commodity trading’. Commodity traders guarantee price stability, not central banks…it suffices to say that, unless central banks provide a liquidity backstop to commodity traders, they will soon have to underwrite fiscally funded price control measures via [quantitative easing],” he commented.

Simply put, since commodities will have a great influence on price stability–which central banks are supposed to be watching over–the financial regulators should recalibrate policies to consider the world outside nominal variables.

“Credibility is measured not only in terms of a central bank’s ability to deliver on its promise of price stability but also in terms of how a dominant state upholds the rule of law and the notion of open capital accounts,” Pozsar said.

He added that in this context, “weaponizing the dollar and the Eurodollar has further undermined [the] credibility” of central banks.

‘Circumstances Rule Central Banks’

Prior to the shift to the new world monetary order, the financial overseers respond to what a state does either through easing or tightening. Basically, it’s all about influencing the nominal variables to keep the prices stable.

For Pozsar, Bretton Woods III is a different ballgame–and the states’ financial systems should refocus accordingly.

“The state is de-stabilizing the pillar of the Bretton Woods II system (the U.S. dollar) by creating risks to the price level. Once again, the White House and the deputy national security adviser wield far more power over interest rates and foreign exchange rates than the FOMC,” he said.

He explained that the current crisis is yet another challenge for the Federal Reserve’s role in delivering price stability. The three major economic crises he outlined are due to crashes in nominal variables and were addressable by financial policies; given that the current crisis is tied to a real variable like commodities, Pozsar believes that “there is a risk that the Fed won’t be able to deliver on its price stability mandate successfully.”

“Inflation borne [sic] of shortages is a whole different ballgame. You can’t QT or hike your way out of it easily…and if you can’t, credibility gets damaged, a decline of the U.S. dollar is inevitable, and shorting U.S. rates, the U.S. dollar, and some FX pegs make logical sense,” he ended.

Information for this briefing was found via Credit Suisse. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.