The Green Organic Dutchman (TGOD): the most anticipated initial public offering for 2018. Perhaps ever, when speaking to the cannabis sector specifically. But what makes this company so special, why has it been the talk of the town for months on end?

What it essentially comes down to is a mix between clever marketing, as well as strategic capital raises. For the former, TGOD has identified several items that have greatly benefited its brand image, such as its focus on organics and energy conservation. Both of which are hits within the millennial demographic. For the latter, it performed pre-IPO financing that wasn’t exclusive to just market makers.

The result of this, is an investor base of over 4,000 individuals before even becoming a public company. Undoubtedly this has been a significant driver behind the perceived anticipation of the public offering. Mixed with the retail investor tendency to hold for long periods of time, it will likely create a squeeze of sorts as more try to pile in on the first day of going public due to the current consensus on the stock.

But what are investors getting themselves involved with exactly? What are the highlights of TGOD? Thanks to filings posted to SEDAR yesterday, we’re here to tell you.

The Marketing Genius Behind TGOD

First, let’s be clear. Our briefings during the week are of limited time and space. We typically aim for 1,000 words or so in these pieces. Therefore, don’t view this article as a be-all end-all for highlights on The Green Organic Dutchman. It’s simply a small handful of items that we wanted to address. Rest assured, there is more in the pipeline coming from us on TGOD. Patience is a virtue.

TGOD’s current & future facilities

All right, lets start with the very basics. The most crucial element to the success of any licensed producer, is the facilities in which they are producing. How are they growing product, what is their annual output, what’s their cost basis? Three common questions that we all seek to find an answer to before even entering a position in a cannabis stock.

Speaking to The Green Organic Dutchman, they’ve taken the obvious path. As the name implies, they’ve taken the organic route for growing cannabis at their facilities. This will be conducted in living soil, rather than that of a hydroponic or aquaponic solution. While many producers are utilizing one form of hydro or aquaponics as a cost saving measure, TGOD has gone the opposite route. While utilizing living breathing soil, they’ve taken advantage of technology to reduce the cost per gram of production.

To reduce their cost on a per gram basis, the company has elected to utilize hybrid greenhouses. The result, is a building that isn’t quite an indoor operation but it’s also not quite a greenhouse either. The benefit of this is it enables them to receive the cost effectiveness of utilizing sunlight, while reducing energy loss as a result of the hybridization. Included in this, is strict controls that allows them to closely monitor and adjust key parameters such as temperature and humidity within the facilities, which is more than a traditional greenhouse is capable of.

In terms of the facilities themselves, TGOD intends to operate two large production centers once all expansions are said and done. Currently, they produce cannabis out of their Hamilton facility which is believed to have a total of 27,000 sq ft of space in operation. It is understood that the Hamilton facility is capable growing up to 3,000 KG per annum currently. However, a 123,000 sq ft expansion is under construction with an anticipated completion date of Q4 2018. In it’s entirety, it’s expected that the Hamilton facility will be capable of producing 14,000 KG annually.

The second facility, located on a 72.4 acre property in Valleyfield, Quebec, is set to be the flagship facility for the company. At approximately 820,000 sq ft, the facility will also be of a hybrid construction and is expected to produce roughly 102,000 KG on an annual basis. The permits were first issued for the construction of this facility in December 2017, resulting in a planned completion of Q2 2019.

TGOD’s environmental impact focus

What’s in a name? From a marketing standpoint, the name of a company can have many direct implications. The name of a company is utilized to signal certain things to potential customers or clients. In the case of The Green Organic Dutchman, it’s name is everything. As was discussed previously, it is heavily focused on producing a high quality organic product, which is true to its name. Also true to its name, is the companies focus on being green.

For TGOD, the reference to “green” is two fold. Aside from the connotations related to that of cannabis, it is also a signal to consumers on the companies environmental stewardess. For this, the company has dedicated a section of its presentation to display its virtues.

Green Organic Dutchman has outlined a series of efforts to assist in being positive stewards of the environment. This includes items such as rainwater collection at both of its facilities, as well as the recycling of 90% of water used on site. It also includes items such as utilizing natural gas to eliminate more carbon intensive methods of heating its facilities. Additionally, it has achieved LEED certification, a sought after recognition that identifies a companies commitment to the environment at a particular site.

Although this stewardess may not matter to certain demographic groups, it will most certainly impact the companies target consumer. By producing an organic product, it is already catering to a class of individuals that value natural methods of production that reduce the exposure to harmful chemicals. Demographically speaking, individuals focused on the use of organic products are often heavily concerned with the potential impact to the surrounding environment. By taking such initiative, TGOD has only strengthened it’s attractiveness to its target consumer.

The share structure of TGOD

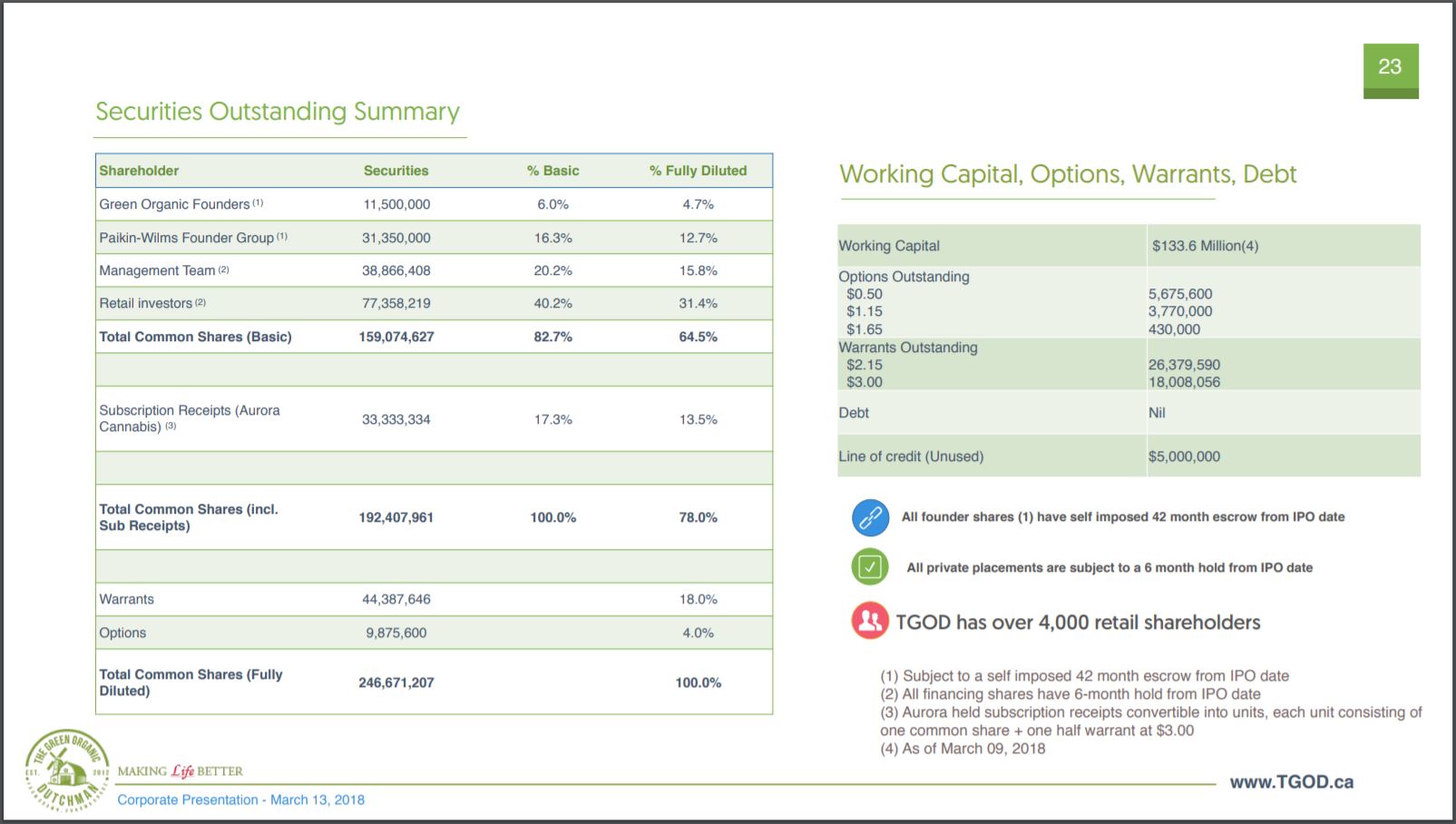

The last item we wanted to touch on is the current share structure of TGOD. As a relatively rare move within the cannabis space, the company elected to fully detail its current share structure in its recently released investor presentation. However, what it does not include is the recently filed IPO financing. Thus, it will be slightly off by the time the company is listed on the public markets.

At the time of writing, the company has a fully diluted share count of 246,671,207. However, with the recently filed prospectus with a $75 million minimum, the share structure is bound to change. Assuming that the maximum of 27,397,260 units are sold for its IPO raise, including the half warrant offered, it will result in further dilution of 41,095,890 on a fully diluted basis. Therefore, in total this would bring the fully diluted share count to 287,767,097.

Utilizing the IPO pricing of $3.65, on a fully diluted basis this would give The Green Organic Dutchman a market cap of $1,050,349,904.05. In other words, it would be known as what is called a ‘unicorn’ right out of the gate if utilizing the fully diluted market cap of the company. Utilizing the total outstanding shares of the company, assuming the IPO is filled in its entirety, would result in a market cap of $802.29 million.

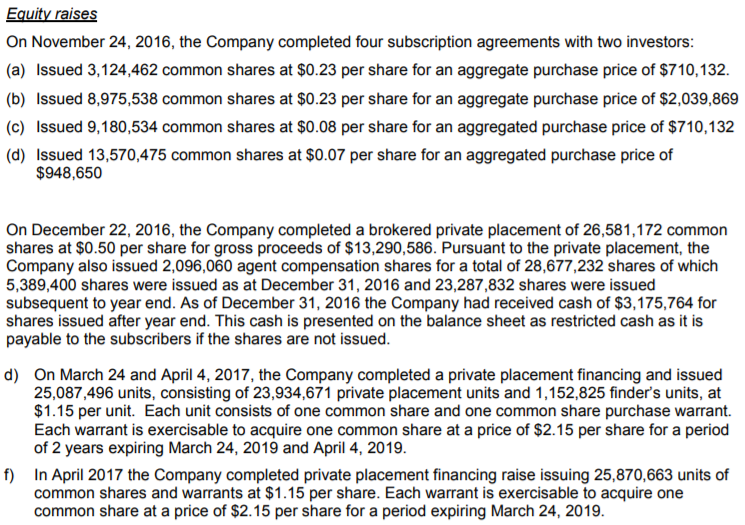

With respect to the current share structure, the last item we wanted to touch on was the buy in price for many of these shares relative to the current IPO price.

Seen above, is a series of snippets compiled together. All of the above was taken from the recently filed TGOD prospectus. Although it does not include all shares that have been issued, it includes the majority of the significant share issuance’s. The intention is for you to be aware of the buy in price many current investors have with their investment, so that you can make a better investment decision. Note the disparity between the current IPO price of $3.65, and the pricing of shares that were issued less than a year ago.

Closing Remarks

The Green Organic Dutchman, if nothing else, is excellent at marketing. Up to this point in time, each action that the firm has taken has been strategic from a marketing perspective. Whether this be the specific naming of the company, or the design of its facilities. This is not to mention the pure genius concept of acquiring a large amount of retail investors before even going public. They essentially have 4,000 brand ambassadors free of charge right now.

The next step for the company, clearly, is to become a listed entity. Based on our research, a date is still not set in stone and the action of going public has been pushed off repeatedly. However, all this has done is enhance the excitement surrounding the stock within the marketplace. With TGOD’s current track record, this too, is likely solely based on marketing. Now, they need to deliver.

Find solid companies with executable plans. Dive Deep.

Information for this analysis was found via Sedar, and The Green Organic Dutchman Holdings Ltd. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.