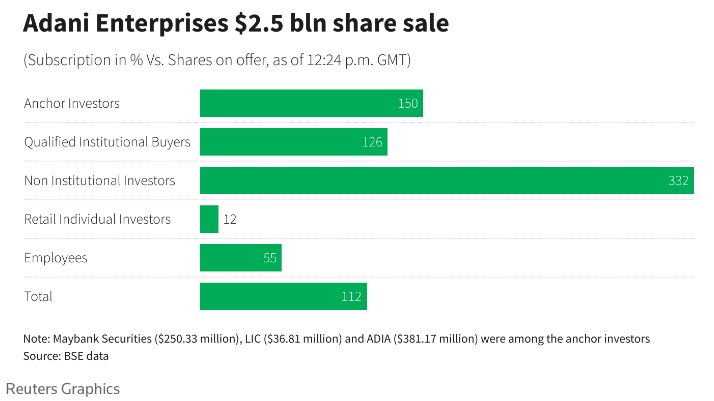

Adani Enterprises canceled its $2.5 billion share offering on Wednesday, only a day after claiming the program was fully subscribed, following a collapse caused by a U.S. short-sellers criticism that ripped billions more off the value of the Indian conglomerate’s stock.

“Today the market has been unprecedented, and our stock price has fluctuated over the course of the day. Given these extraordinary circumstances, the company’s board felt that going ahead with the issue will not be morally correct,” the firm’s chairman, Gautam Adani, said.

This follows after the Adani’s share sale was already reportedly fully subscribed. The 30% anchor portion of India’s largest ever secondary share sale drew investors such as Maybank Securities and Abu Dhabi Investment Authority, as well as HDFC Life Insurance and the state-backed Life Insurance Corporation of India.

The share sale proceeds would not only help the Indian firm address its debt but also project confidence amid a short seller report that ascribes fraudulent schemes and reputation maligning on Adani.

The investigation by Hindenburg Research last week suggested inappropriate use of offshore tax havens and concerns about high debt, which Adani rejected, but the following market meltdown has resulted in a significant and rapid drop in his fortunes, with him falling to eighth from third in Forbes rich list rankings.

The market value of seven listed Adani Group firms has been reduced by $86 billion as a result of the report. On Wednesday, a day after Adani’s share sale ended, his group stocks fell, with Adani Enterprises down 28% and others down further.

The rout bodes well for Hindenburg who disclosed that it has taken a short position on Adani following the results of its investigations.

“Once the market stabilizes, we will review our capital market strategy,” Gautam Adani said after cancelling the share sale.

In one of the points raised by the Hindenburg report, it claimed that Shah Dhandharia, the independent auditor for Adani Enterprises and Adani Gas, had only four partners and eleven staff. The only other listed corporation that the firm examines has a market capitalization of approximately INR 60,000 (US $7.8 million). Both of the audit partners that sign off on Adani Gas and Adani Enterprises’ annual audits are also merely 28 years old.

Adani responded by saying each Adani publicly listed company’s audit committee is made up entirely of independent directors. The committee also makes recommendations to the board of directors for the appointment of statutory auditors, of which Shah Dhandharia is just one of the firms who does the statutory audit.

On Monday, Adani Group said it plans to hire one of the “big six” accounting firms to review its corporate governance and audit standards, according to Mint newspaper. The audit was to be commissioned after Adani Enterprises completed its now-canceled offering.

Losing credit sources

Compounding the problem on funding is Credit Suisse Group stopping the process of accepting Adani Group bonds as collateral for margin loans from its private banking clients.

According to people familiar with the matter who told Bloomberg, the Swiss lender’s private banking arm has assigned a zero lending value to notes sold by Adani Ports and Special Economic Zone, Adani Green Energy, and Adani Electricity Mumbai Ltd. They added that Credit Suisse had previously provided a lending value of around 75% for the Adani Ports notes.

When a private bank reduces loan value to zero, clients are often required to fill up with cash or another kind of collateral, and if they do not, their securities may be liquidated.

Market value losses on Adani enterprises continue on Wednesday following the development, with combined decline now reaching over $90 billion since the Hindenburg report was published.

Prior to this, Adani Group put up millions of dollars in shares on Tuesday to preserve collateral cover on a $1 billion loan after a severe selloff in the conglomerate’s shares, according to persons familiar with the case.

According to one of the sources, Adani added around $300 million in shares for a loan issued by a group of banks including Barclays on Friday.

The company has a specific basket of $2.5 billion in shares of various units set aside in case similar top-ups during price changes are required. The loan was extended with shares pledged at 2.5 times the borrowed amount, and the trigger for top-up was set at two times, according to the sources.

Markets are apparently “overpricing” the risk to Indian bankers from their exposure to Adani Group as a result of the entire ordeal, according to Societe Generale (SocGen), adding that a sell-off in banking shares is overdone.

The Nifty Bank index in India fell as much as 7.7% to its lowest level in three months after the New York-based short-seller made its accusations against tycoon Gautam Adani’s company.

“India’s banking sector has been one of the hardest hit by the collateral damage from the sharp correction in the Adani group stocks over the past week post the Hindenburg report,” SocGen strategists said in a report issued on Wednesday. “We think the market is overpricing the related risks, as we calculate the sector’s direct exposure to the Adani group at just 0.6%.”

Separately, the National Stock Exchange of India reduced the circuit breaker limitations for Adani Transmission Ltd, Adani Total Gas Ltd, and Adani Green Energy Ltd from 20% to 10% on Monday, according to the bourse’s website. The exchange establishes these limits to prevent big fluctuations in stock prices in a short period of time.

Lmao when you nail the thesis so bad the exchange has to change circuit breaker rules for the name. pic.twitter.com/ApigUZKch1

— Justin, KFC (@YounggJustin) February 2, 2023

In response to the Hindenburg report, Adani decried that it was “a calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India.”

Information for this briefing was found via Bloomberg, Financial Post, Reuters, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.