On July 14th, BMO Capital Markets upgraded Advanced Micro Devices (NASDAQ: AMD) to an outperform rating from market perform and raised their 12-month price target on the stock to $115 from $100, saying, “We see a sustainable compute franchise as a result of continued superior execution on all fronts under Dr. Su’s leadership.”

Advanced Micro Devices currently has 42 analysts covering the stock with an average 12-month price target of $130, or an upside of 66%. Out of the 42 analysts, 9 have strong buy ratings, 19 analysts have buy ratings, 13 have holds and a single analyst has a sell rating on the stock. The street-high 12-month price target sits at $230, which represents an upside of 192%.

In the note, BMO lays out its bull thesis in a few points. The first point is that the company has built a “very sustainable compute franchise,” and BMO believes that AMD will gain market share on the server side versus Intel. This is because they believe the company has been able to generate a number of long-term customers, which helps them build credibility.

They also believe that AMD could reach 30% of the server market share by 2025, saying, “we believe the server market is ripe and has been for a while, for a second credible participant.”

In their other point, they comment that AMD’s stock risk versus reward profile is now favourable with both the company’s free cash flow margin and per share rates growing. They expect AMD to generate over $9 billion in free cash flow by 2025, with a free cash flow per share CAGR of 20% from 2021 to 2025.

They tie this all together by saying that they believe AMD’s revenue will grow to $34.8 billion and an EPS of $6.80 in 2025, while suggesting that their estimates are slightly conservative, “given the parameters presented by the company at the recent analyst day.”

To get to their 2025 $34.8 billion revenue estimate, they believe that computing and graphics will grow to $11.6 billion, enterprise, embedded, and semi-custom segments will grow to become a $18.1 billion segment, and Xillinx to grow to become a $4.5 billion segment.

Additionally, they expect AMD to grow its server-related revenues to $13.1 billion in 2025 as they expect the overall server market to grow at a 10% CAGR. They expect AMD to grow its market share from 15% to 30% over the same time and increase its ASPs by 5% over the next 3 years.

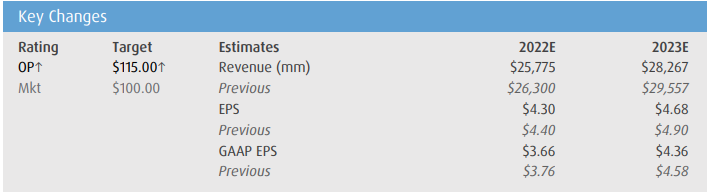

Below you can see BMO’s updated estimates

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.