Americans are increasingly relying on borrowing money to make ends meet. So much so, that credit card debt has soared to the highest on record, as expensive necessities such as food and shelter are no longer attainable with ordinary disposable income.

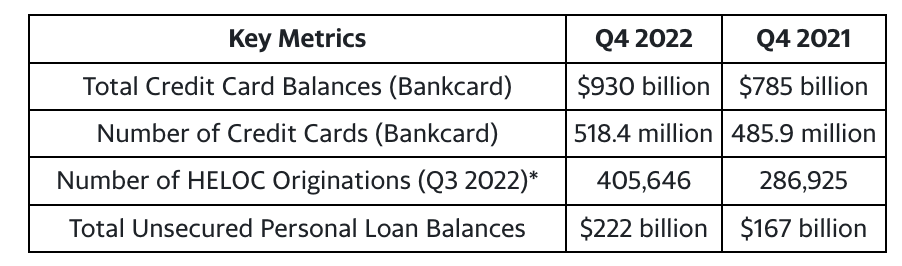

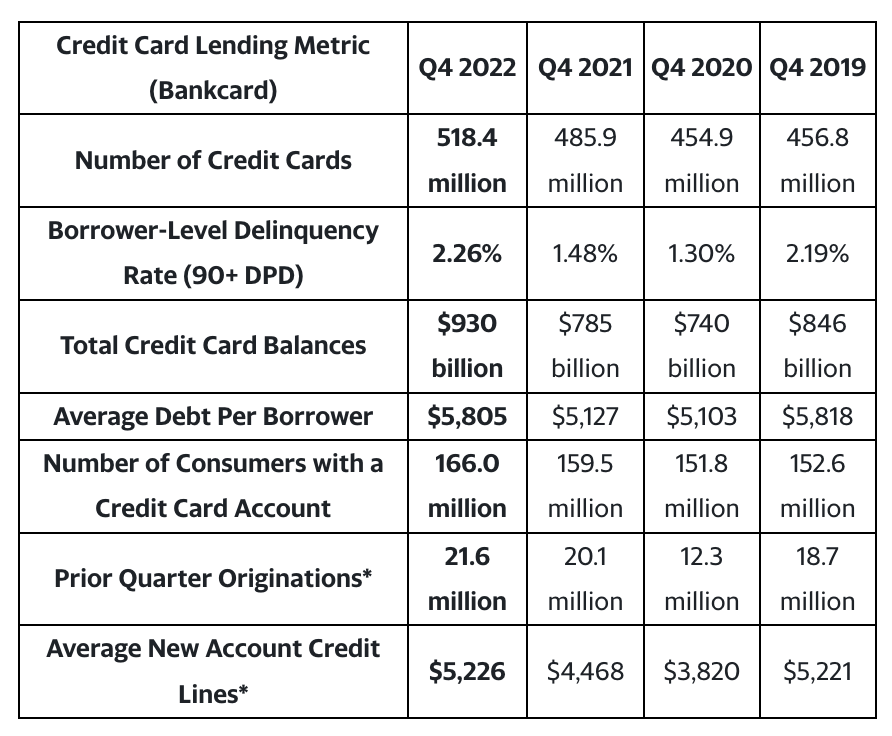

The latest report from TransUnion showed that Americans racked up a record $930.6 billion in credit card debt in the fourth quarter, marking an 18.5% increase from the same period one year ago. The average balance on credit cards also increased, rising to $5,805, as consumers face steeper payments thanks to rising interest rates. “Whether it’s shopping for a new car or buying eggs in the grocery store, consumers continue to be impacted in ways big and small by both high inflation and the interest rate hikes implemented by the Federal Reserve,” said TransUnion vice president of US research and consulting Michele Raneri.

While credit card debt continues to rise, so does the number of new accounts being opened. TransUnion said that 202 million more credit accounts were opened in the final three months of 2022, bringing the total amount of credit cards circulating throughout the US economy to 518.4 million. A majority of the new customers were adults aged 18 to 25, whom also fell into the subprime category thanks to their lack of history with revolving credit.

However, Raneri pointed out that delinquencies are also on the rise, particularly among users with inadequate credit use knowledge. “The increase in delinquencies is something to watch,” she warned. “If unemployment goes up, and we see a spike in delinquencies, then that indicates a longer-term problem.” Thankfully, the BLS’ latest seasonally adjusted nonfarm payrolls report showed the unemployment rate ticked down to a record-low 3.4% in January— a sure sign that things are going great despite continuous layoff announcements from companies…

Information for this story was found via TransUnion. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.