Apple Inc (Nasdaq: AAPL) has hastened plans to relocate some of its manufacturing outside of China, which has long been the dominating country in the supply chain that has developed the world’s most valuable firm, according to people involved in the discussions who told The Wall Street Journal.

The smartphone company is instructing suppliers to plan more aggressively for producing Apple products in other parts of Asia, including India and Vietnam, and is trying to minimize reliance on Taiwanese assemblers led by Foxconn Technology Group.

The current situation in Zhengzhou, China–where around 300,000 workers work at a factory run by Foxconn to make iPhones and other Apple products–helped pushed the California-based firm to shift its supply chain. The manufacturer recently faced a rare violent protest at the firm’s plant, focusing attention on the economic and social costs of Xi Jinping’s Covid Zero plan.

Workers furious about salaries and Covid-19 limitations were seen hurling items and chanting “Stand up for your rights!” in videos broadcast online.

According to some involved in Apple’s supply chain, one solution is to draw from a larger pool of assemblers—even if those companies are situated in China. Luxshare Precision Industry Co. and Wingtech Technology Co. are two Chinese companies said to be in line for greater Apple business.

Back in late September, Apple has reportedly told its suppliers not to proceed with efforts to increase production of the new iPhone 14 models as the projected surge in demand failed to materialize.

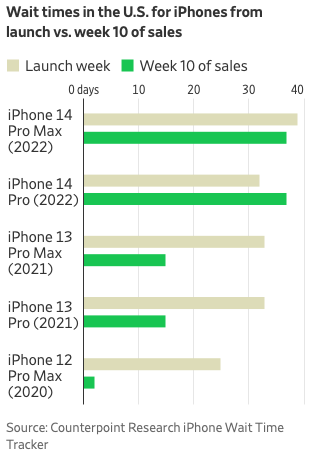

The smartphone brand is also facing a difficult supply chain concern amid the unrest and strict pandemic policies in China, pushing consumers to be stuck with some of the longest wait times for high-end iPhones in 15 years.

Apple also adapted a big change in its manufacturing strategy beginning with the latest smartphone models. Production has shifted away from China, and more towards India. While the firm has been assembling iPhones in India since 2017, it has never before produced the latest model in the country.

The shift is an effort to diversify production away from China and boost usage in India, where the market for the company is currently small.

Reports say outbound exports of India-made iPhones are expected to reach US$2.5 billion in the fiscal year ending March 2023, nearly doubling the prior year. The tech giant will move 5% of its global production for the iPhone 14 to India by the end of this year, according to JPMorgan analysts, adding that the company could make 25% of all iPhones in India by 2025.

Chinese newspaper People’s Daily then tried to downplay the manufacturing shift, saying the American smartphone brand might not find it easy doing business in India.

“Apple’s move to India may be successful, but the process must not be smooth, as it depends on how India can adjust its labor policies,” the paper noted. “If Apple’s presence is to survive and grow, it must be based on India’s improved policies and legal system, which will be beneficial for more foreign companies to enter India in the future.”

The American firm works with its contractors Foxconn for the iPhone 12, 13, and 14 and Wistron for the iPhone SE models in India. However, the retail prices won’t budge that much as components are mostly sourced still outside India, including China.

But India and Vietnam have their own challenges in filling the giant Chinese shoes. Former Foxconn executive Dan Panzica, who now advises firms on supply-chain concerns, said Vietnam’s manufacturing was expanding swiftly but was short on personnel. The country has a population of slightly under 100 million people, which is less than one-tenth of China’s. He claims that it can handle 60,000-person manufacturing sites but not cities like Zhengzhou, which have hundreds of thousands.

On the other hand, India has a population comparable to China’s but lacks the same level of government coordination. Apple has struggled to traverse India since each state is administered differently and regional governments impose conditions on the corporation before allowing it to create products there.

“They’re not doing high-end phones in India and Vietnam,” said Panzica. “No other places can do them.”

Apple last traded at US$147.81 on the Nasdaq.

Information for this briefing was found via The Wall Street Journal and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.