On August 10, Argonaut Gold (TSX: AR) reported its second quarter financial results. The company announced revenues of $111.4 million, down 7% yearly, while gross profits dropped 50% to $19.8 million. Net income came in at $18.4 million, down 16% yearly.

The company announced that it produced 59,192 gold equivalent ounces, down from the 63,750 ounces it produced last year. Argonaut sold 59,241 ounces this quarter at an average realized sales price of $1,884, up from $1,812 last quarter. The company’s cash and all-in sustaining production costs increased to $1,248 and $1,474 from $876 and $1,203 last year, respectively.

In terms of guidance, Argonaut reiterated its 200,000 to 230,000 production guidance for the full year while raising its cash and all-in sustaining cost guidance to $1,200 to $1,300 and $1,500 to $1,600, respectively.

Argonaut Gold has ten analysts covering the stock with an average 12-month price target of C$1.34, or an upside of 150%. Out of the ten analysts, one has a strong buy rating, eight have buy ratings, and the last analyst has a hold rating on the stock. The street high price target sits at C$2.50, or an upside of 365%.

In BMO Capital Markets note on the results, they reiterate their outperform rating but lower their 12-month price target to C$1.00 from C$1.50 as the analysts factor in the company’s updated cost guidance.

On the results, BMO says they came slightly above estimates other than costs, making their overall sentiment on the results slightly negative. They say that they expected production to come in at 59,100 gold equivalent ounces, while the overall results were impacted by the higher-than-expected costs.

For costs, BMO expected the cash costs to be $1,106 per ounce and all-in sustaining costs to be $1,353 per ounce. This put pressure on the company’s bottom line, as BMO expected adjusted earnings per share to come in at $0.06 versus the $0.02 reported.

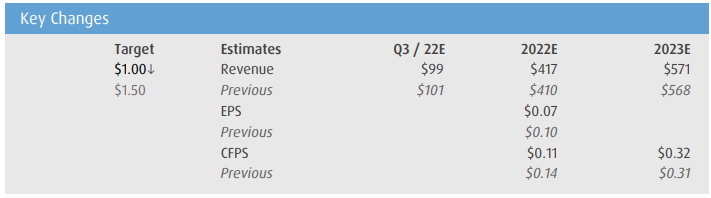

Below you can see BMO’s updated estimates on the stock.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.