On December 14th, Wheaton Precious Metals Corp. (TSX:WPM) announced that it has entered into an agreement to acquire the existing gold stream held by New Gold Inc. (TSX: NGD). Additionally, they entered into a Precious Metal Purchase agreement with Artemis Gold Inc. (TSX: ARTG).

Wheaton will pay an upfront consideration of US$441 million for the two precious metal streams, US$300 to New Gold and US$141 million to Artemis Gold.

Artemis Gold currently has 8 analysts covering the stock with an average 12-month price target of C$13.03, or a 77% upside to the current stock price. Out of the 8 analysts, 1 analyst has a strong buy rating while the other 7 analysts have buy ratings. The street high sits at C$15 from Cormark Securities, while the lowest 12-month price target sits at C$11.

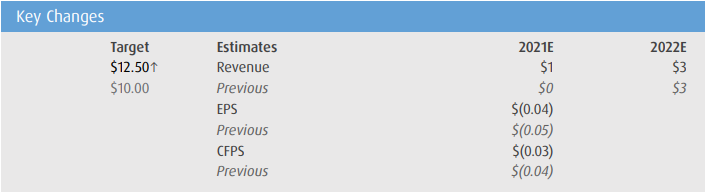

In BMO Capital Markets’ analyst note, they reiterate their outperform rating while raising their 12-month price target from C$10.00 to C$12.50, saying that the new capital injection reduces the finance overhang that Artemis was facing.

BMO says that with this US$141 million investment by Wheaton, Artemis has the $645 million first phase completely funded. The US$141 million investment is on top of Artemis’ $360 million credit facility and treasury.

They add that the latest investment from Wheaton is “the final piece of the financing required to build the first phase of Blackwater,” and believe the investment to basically be cash flow neutral in the long run.

The details of the deal say that Artemis will give 50% of all the silver produced at Blackwater until 18 million ounces has been delivered, then it will drop down to 33%. Wheaton will pay 18% of the prevailing silver price on the initial 18 million ounces, which then rise to 22%. BMO believes that this agreement maintains the companies long term ability to benefit from both gold and silver at Blackwater.

Lastly, BMO notes that Artemis has been working to lock down a good portion of the CAPEX involved in the build-out via an MOU for the construction of the powerline. They believe Artemis shares will see a re-rating as the project continues along and approached construction/production.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.