Aurora Cannabis (TSX: ACB) (NYSE: ACB) has had a rough week, and for investors, the week just can’t seem to end. Following an analyst calling for a zero price target and labeling the equity as worthless earlier this week, it appears that a certain insider doesn’t tend to disagree. An after hours Sedi filing has revealed that a director disposed of over half of his holdings this week in the troubled firm.

The week was off to a rough start for Aurora, following analyst Gordon Johnson of GLJ Research initiating coverage on the firm, giving it a rating of “sell” on Monday. As if this was not enough on its own, Johnson then gave the equity a price target that is rare among analysts – a whopping $0.00. Commenting on the target, Johnson stated, “Our view that ACB’s equity holds no value is driven by our work, which implies the company is facing a liquidity crunch that will, ultimately, risk its status as a going concern.” The analyst expects major liquidity concerns for the equity by June 2020.

Aurora Cannabis struggled throughout the week following the issuance of the research, with the equity falling from a Monday morning high of $3.53 to close the week 16.4% lower at $2.95 Friday.

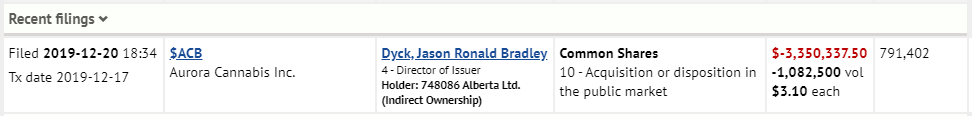

As if this wasn’t enough for shareholders, a Friday evening Sedi filing has revealed that director Jason Dyck has sold 57.7% of his total position in the company. Dyck sold 1,082,500 common shares of Aurora, at an average price of $3.10 per share on the day following the release of the research report. In total, Dyck walked away with $3.35 million as a result of selling his shares, with only 791,402 shares remaining in his holdings as per filings.

Aurora Cannabis last traded at $2.95 on the Toronto Stock Exchange.

Information for this briefing was found via Sedar, Sedi and Aurora Cannabis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

The Skeptical Investor’s Guide to Reading a Corporate Press Release

“I just read it, right? Why do I need a guide?” – You, likely, after...