Balaji Srinivasan, former general partner at the venture capital firm Andreessen Horowitz, is issuing a bet with two individuals at $1 million a piece. The bet: bitcoin will reach $1 million in 90 days, signifying that the United States will enter hyperinflation.

Answering a tweet by one James Medlock, Srinivasan took up the bait that the US will enter hyperinflation in three months. He is confident enough that he’s only asking Medlock to bet 1 bitcoin, currently priced at $28,000.

Later on, he revealed that he made the same bet with another unspecified person, with the two people “sufficient to prove a point.”

Basically, if bitcoin is worth more than $1 million in 90 days, Srinivasan wins the bet and takes a bitcoin a piece from each person–which would be worth more than $2 million in total should the crypto asset be valued as such.

But if bitcoin isn’t worth beyond a million after the specified timeframe, Srinivasan loses and needs to pay $1 million a piece to each counterparty.

he's actually betting $2 million in total, because he's agreed to take the bet with one as-yet-unspecified person (many have volunteered)

— Molly White (@molly0xFFF) March 18, 2023

they don't even have to put up $1M, just 1 BTC (currently ~$27,500) pic.twitter.com/PzpsKReUxS

But is the US really headed for hyperinflation?

Srinivasan has been sounding the alarm for dollar devaluation, positing that printing money to pay off debts would contribute to the fiat’s decline. He has been advocating for people to move their assets to bitcoin instead.

“We have to define hyperinflation in BTC vs USD terms because all other fiat currencies can and will be inflated away. That is hyperbitcoinization,” Srinivasan tweeted. “What’s going to happen is that individuals, then firms, then large funds will buy Bitcoin.”

While the timeline for dollar devaluation and the so-called hyperbitcoinization seems contentiously fast, Srinivasan noted that “hyperinflation happens fast [and] we’ve seen digital pandemics (COVID), digital riots (BLM), and digital bank runs (SVB).”

“Everything will happen very fast once people check what I’m saying and see that the Federal Reserve has lied about how much money there is in the banks. All dollar holders get destroyed,” he added.

You still don't get it.

— Balaji (@balajis) March 20, 2023

The Fed is devaluing the dollar.

It's what Dalio predicted: monetization of the debt.

All the wars "paid" for in an orgy of printing.

Dollars worth toilet paper on the other end.

This isn't about making money at all.

It's about getting innocents to Bitcoin… https://t.co/MokRZHoE7j pic.twitter.com/coWRYJyGCP

We may be in the big debt crisis Dalio predicted: where the Fed prints money to “pay off” its debts in nominal terms.

— Balaji (@balajis) March 20, 2023

A devaluation of the dollar.

Watch this again. Then substitute the cartoons with real assets going to zero and real people in conflict.https://t.co/p2KxrjS9uJ

The “safest asset in the world” was the riskiest asset in the world.

— Balaji (@balajis) March 20, 2023

Similar to the US banking system itself, which Moody’s has downgraded.

Bitcoin is the one global safe haven. https://t.co/YmQrjqCcv3 pic.twitter.com/oztichQUWA

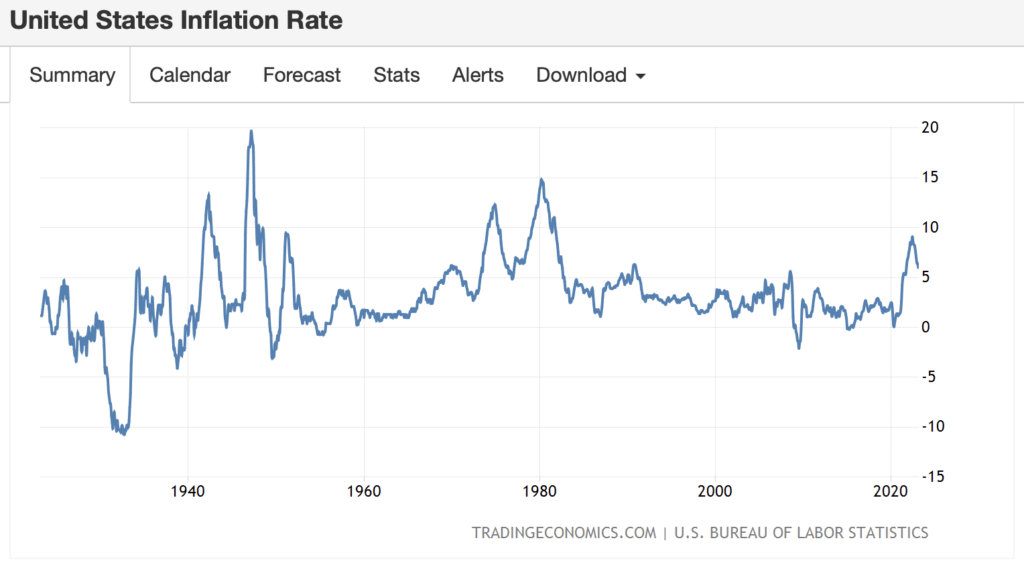

Annual inflation in the United States fell to 6% in February 2023, the lowest level since September 2021, in line with market expectations, and down from 6.4% in January. The rate has fallen since its peak in June at 9.1%.

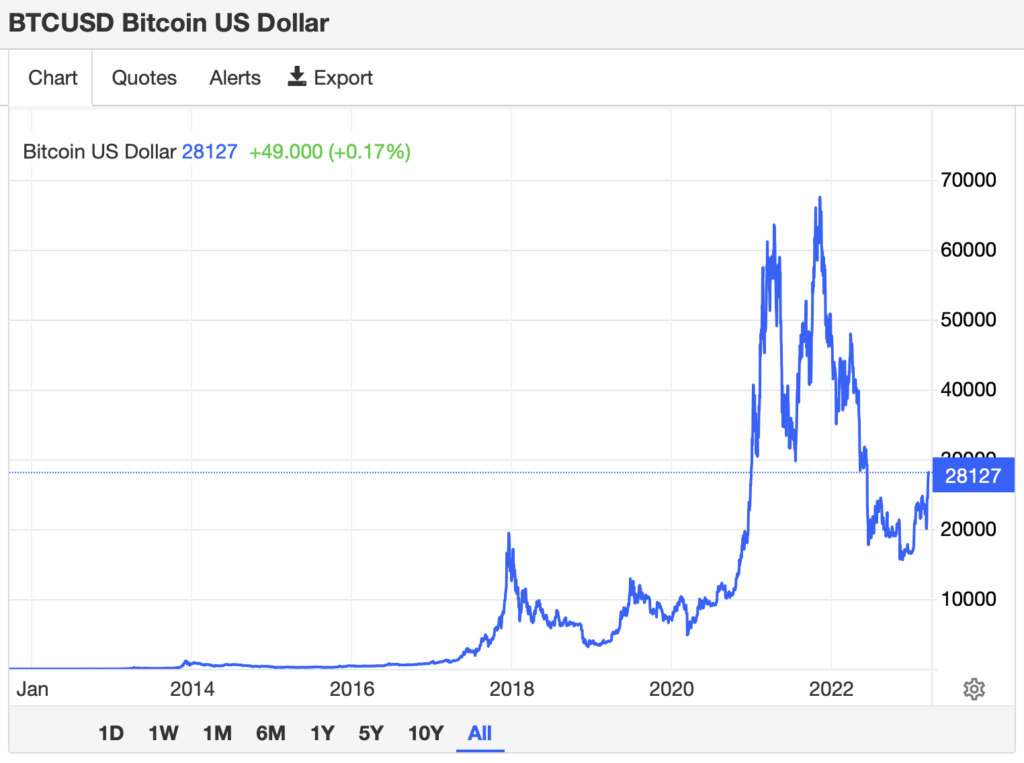

And while bitcoin enjoyed a range of around $66,000 towards the end of 2021, the price slumped through 2022–what observers call the “crypto winter”–before plateauing currently at sub-$30,000.

But Srinivasan is unfazed and is committing to the bet, which he acknowledges has a 40 to 1 odds.

Quick update: we are moving forward with the bet. Just working out escrow logistics.

— Balaji (@balajis) March 19, 2023

But hyperbitcoinization may come at you fast, so don't wait on us to get Bitcoin. When the printing starts in earnest, currency collapse can happen in days.https://t.co/FESPFu4MSH pic.twitter.com/WDZpxeUKVf

Do you believe in Bitcoin or the dollar?

— Balaji (@balajis) March 20, 2023

Either way, the trade is simple.

If you understand Bitcoin, buy BTC and get your coins off exchanges. Hold whatever fiat you need to get through the banking crisis.

But if you have faith in the dollar, put your money into short-term… https://t.co/vW8nbXyMC9

i’m not the world’s greatest trader or anything but if you have $1mm and you think bitcoin will be worth $1mm in 90 days the trade is to buy **40** of em

— Matt Levine (@matt_levine) March 18, 2023

If no party backs down, one thing is for sure at the end of 90 days: someone is about to be a million richer.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Hyperinflation: Remember, GDP = Money Supply x Velocity

When trying to wrap my head around economics, I like to simplify basic principles down...