The Bank of Canada this morning filed with Statistics Canada its latest balance sheet data, and it isn’t pretty. The coronavirus pandemic has evidently done a number on the central bank, with the total assets currently held absolutely exploding over the last three months in comparison to levels seen over the previous decade.

Total assets climbed to an astounding $502.1 billion, a 17.11% increase in a period of just thirty days. The increase came primarily from that of Government of Canada Treasury Bills, which climbed from $85.461 billion to that of $116.646 billion, an increase of 36.49% over the thirty day period. Bonds meanwhile increased to $148.755 billion, from $122.258 billion.

Securities purchased under resale agreements, which includes overnight repo and term repo operations, has grown to an incredible $210.320 billion – a figure which was at $0.0 as last as five years ago in September 2015.

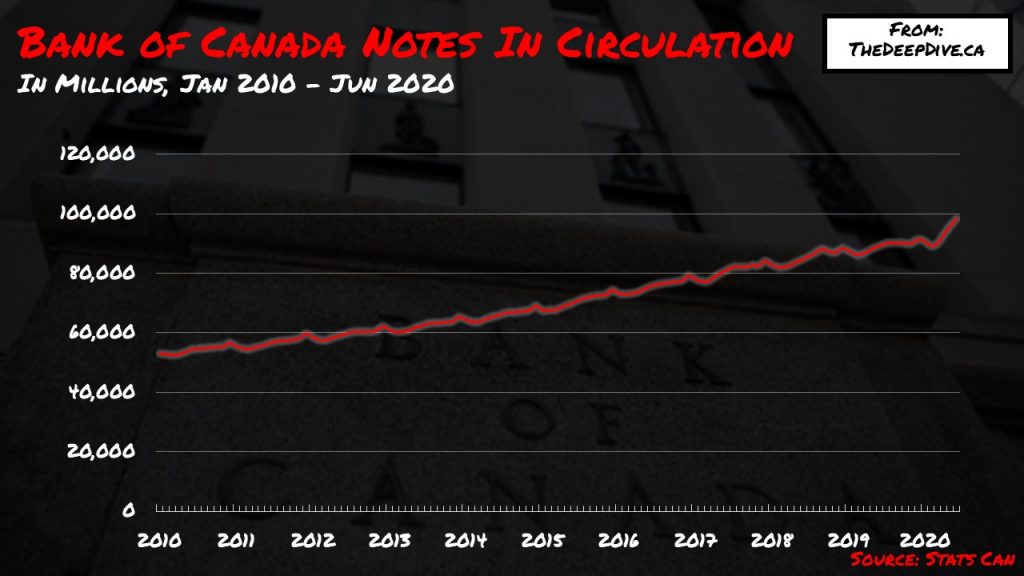

On the liabilities side, notes in circulation has continued its steady climb, growing to $98.260 billion, an increase of 2.60% over the course of a month from $95.751 billion. Meanwhile., dollar deposits reached $137.489 billion with the Government of Canada, up from $112.010 billion in May, and deposits with members of Payments Canada rose to $255.347 billion from $210.232 billion in the month prior.

Information for this briefing was found via Bank of Canada and Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.