Tesla (NASDAQ: TSLA) is off -10% on a day that the broader markets continue an extended slump, following a very poor initial reaction to the company’s “Battery Day” AGM event full of inflated objectives of critical gravity and questionable likelihood that was pure, uncut Tesla. While the snark is strong today among the shorts and critics, this wouldn’t be the first time they took a premature victory lap.

Plans that promise big payoffs but border on the impossible are what built Tesla, and not being able to deliver hasn’t slowed this hall-of-fame caliber promotion down yet. Now it has a new set of “truths” for the base to rally around, and if it can get them some momentum through the echo chamber, it won’t be hard to sell this as a buying opportunity.

Any self-respecting cult stock needs to have a killer AGM, and nothing as quaint as the COVID era was going to stop TESLA from putting on a bangin’ live event. In a sort of drive-in Nuremberg Rally, Tesla CEO Elon Musk got up in front of a parking lot full of socially distant Tesla drivers and delivered the next chapter in the greatest stock promotion the world has ever seen.

With the wreckage from the messy crash of his most notable competitor and imitator still on fire (Nikola Corp. (NASDAQ: NKLA) Chairman Trevor Milton resigned Monday), Musk proceeded to unveil a whole new suite of revolutionary innovations set to put Tesla on the cutting edge of the automotive business. This unveiling was conducted while literally saving the world, over the incessant honking of faithful hoards of supporters, and the sputtering eye-rolls of critics who, as loudly as they object that the company hasn’t delivered on their promises, know in their hearts that it’s the market that matters.

In front of dramatic backdrops of last week’s smoky, blood-red San Francisco sky, with an assist from Drew Baglino, Musk used his trademark stuttering, affable, nerd-at-the-science-fair affect to explain that his company was in the process of orchestrating the greatest ever technological leaps. These leaps would be in the areas of materials, energy storage, and manufacturing, and they were going to do it in record time, because the planet is at stake. Wisely, the pair led with their plan to make the biggest manufacturing breakthrough since Henry Ford.

The easiest way to scale is on paper.

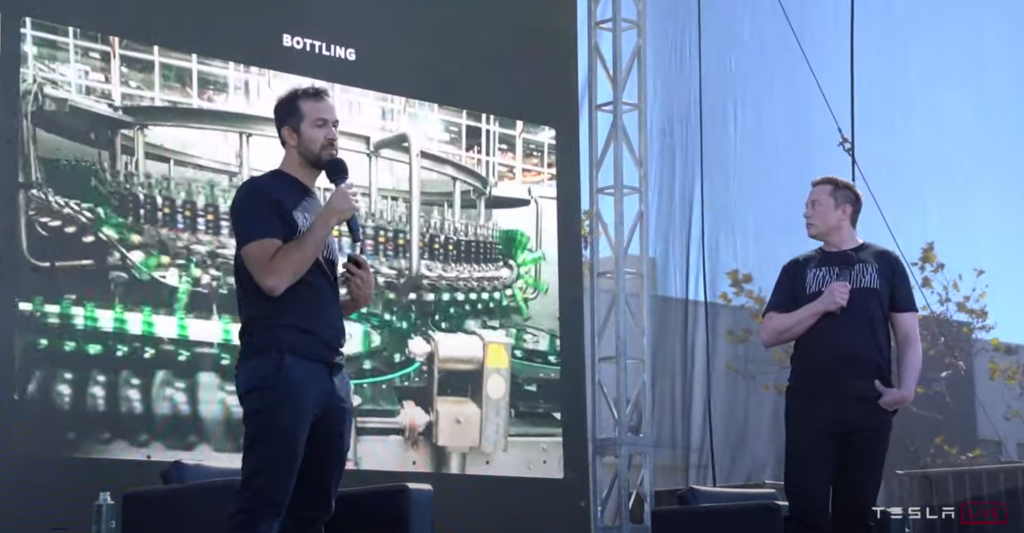

Over appealing classic film of bottling and newspaper lines, Baglino explained that the inspiration for this new process came from the manufacturing principle that objects in motion are best kept in motion.

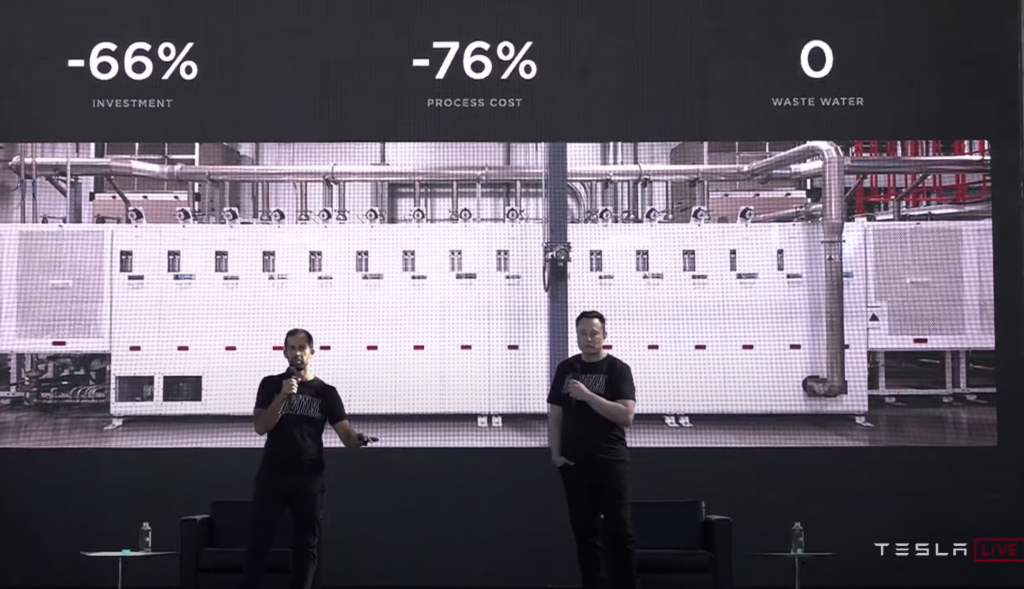

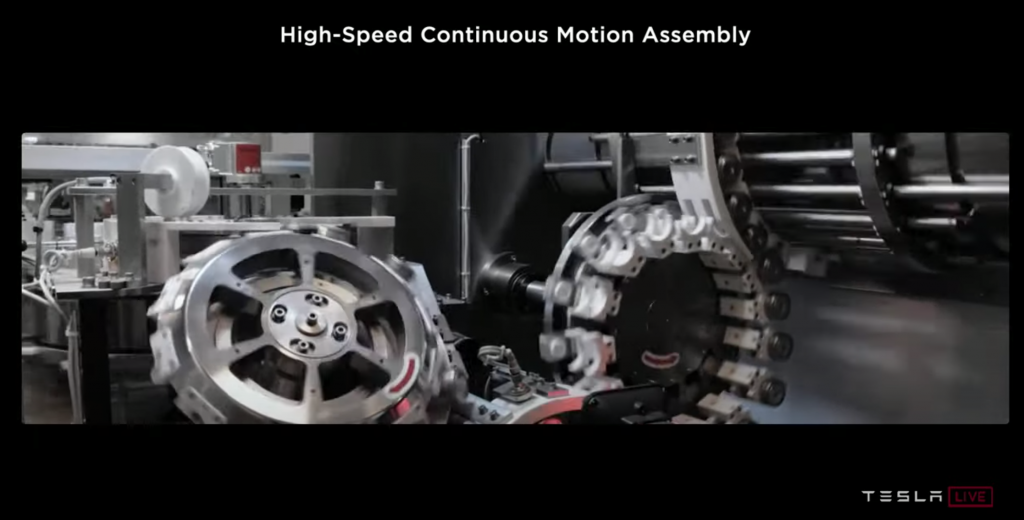

As the video board transitioned seamlessly to modern, clean, red and white Tesla machinery elegantly snaking in-production battery cells along a line in an appealing, fluid, and perfectly-timed symphony, Drew and Elon explained that they had revolutionized the manufacturing process for battery cells. The duo claimed that they have worked out a way to get the cells together more easily and cheaply, while also economizing space, as the horns of the cars in the audience honked like a flock of geese.

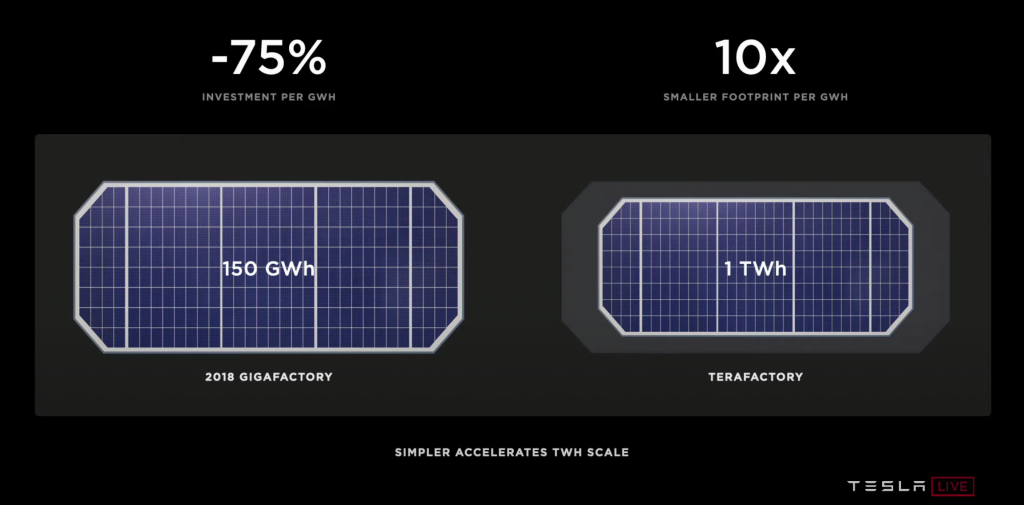

The principle of manufacturing fluidity being recounted in a way that made the audience feel smart for understanding it intuitively, lubricated with the humility of an admission that this is still in the pilot phase, set up a confident assertion that this new and as-of-yet unfinished process being developed in a pilot plant with a theoretical 10 GwH capacity will be ready to produce 100 GwH worth of batteries by 2022, and 3 TwH of batteries by 2030. That may sound ambitious, but it’s necessary. They’re saving the world here.

“But That’s Not All!”

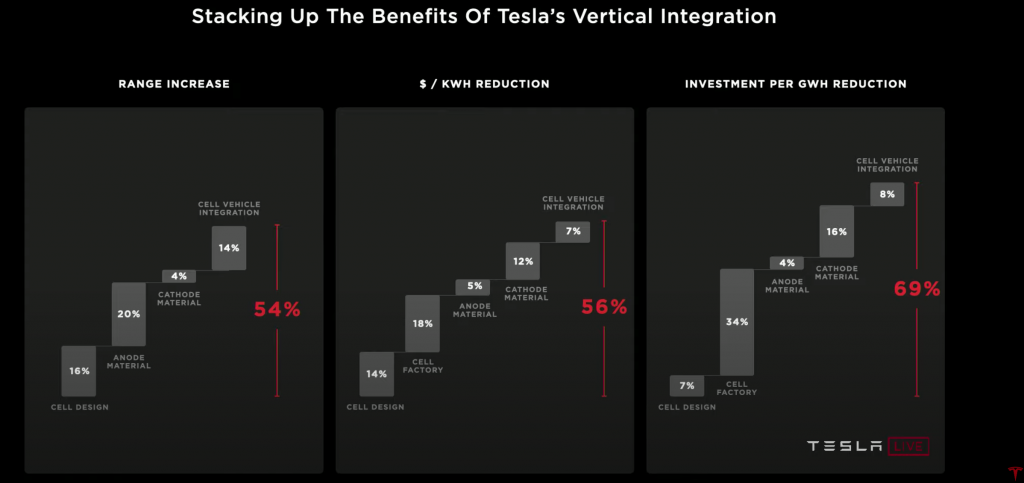

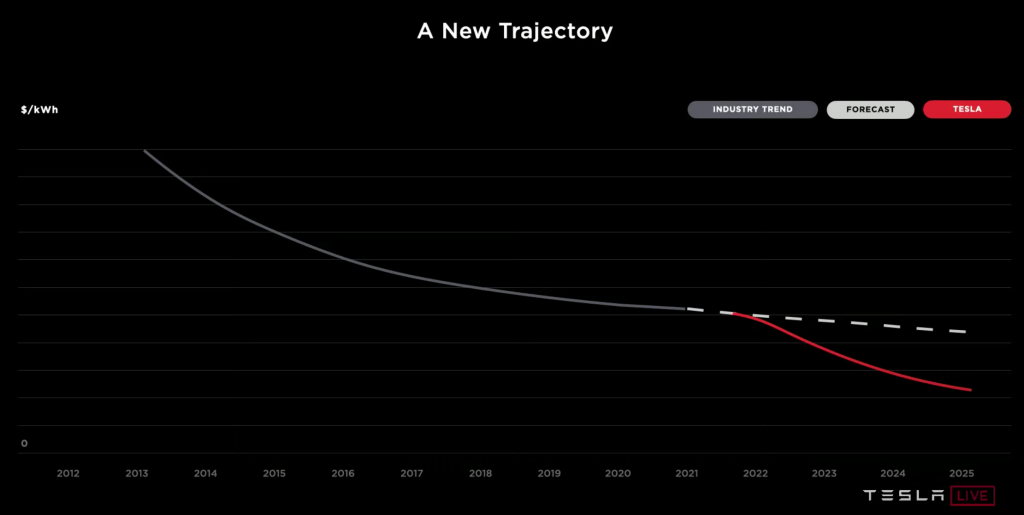

The planned manufacturing quantum leap is one of a series of planned innovations slated to raise the capacity and lower the cost of Tesla’s cells by oddly specific increments, creating a reduction in cost per KwH of storage capacity of 56%.

The plan to produce batteries for just over $2/KwH – less than half their present cost – will facilitate the economic production of several models of vehicles that Tesla has already taken pre-paid orders for.

SO metal…

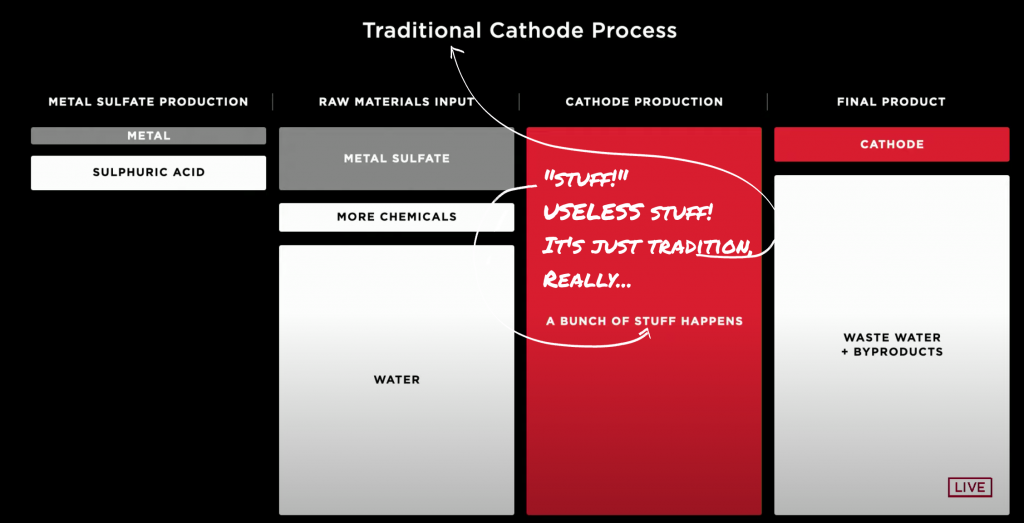

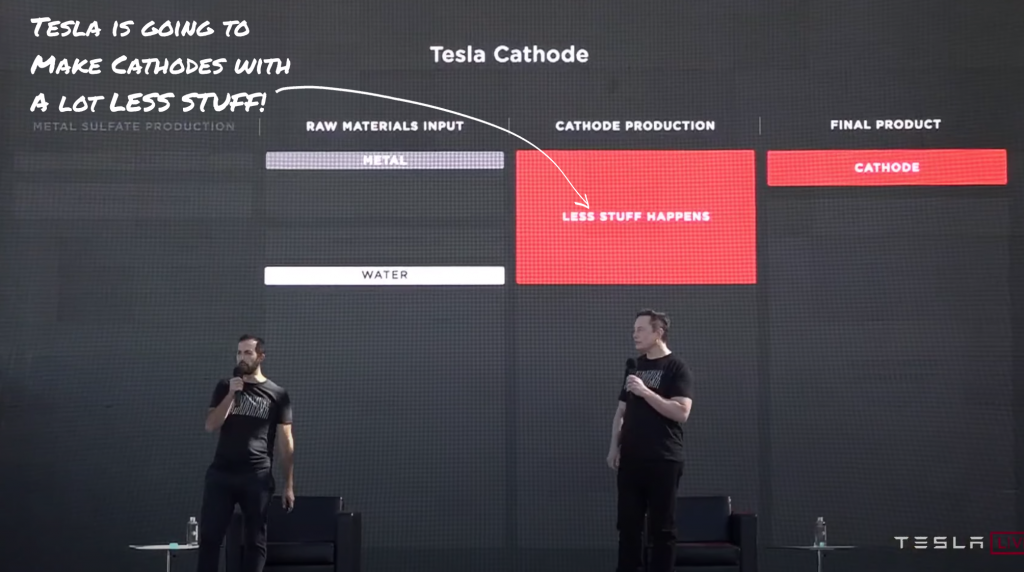

The most interesting projected innovations are in the metallurgical arts, where Elon has really out-done himself. Two key battery material components, nickel and lithium, have apparently been undergoing un-necessary refining steps this whole time. The details on what those steps are and how they’ll be removed are vague, but we’re assured the new way is cheaper and better for the planet.

If they’d have led with this, it would have bombed hard, but further down in the batting order, it appears to have been lost in the larger implausibility of the fantasy.

Tesla’s apparent plan to receive the nickel in the raw, instead of as nickel sulfate, indicates that it won’t be plated onto the electrodes as it is now, but doesn’t say much about how they plan to use it instead.

A “new” zero-impact way of removing lithium from the earth with table salt, at a fraction of the cost, is either Elon’s garbling of the lithium brine extraction process, which is well-known and used to extract most of the world’s lithium from salt flats, or something leading producers Albemarle (NYSE: ALB) and SQM (NYSE: SQM) just hadn’t come around to thinking up, because they’re bound by the confines of tradition. Lithium brine extraction and evaporation is hardly zero impact, as is evident from satellite pictures of the evaporation ponds on the salt flats where it’s extracted.

At the end of last quarter, Tesla had about $5 billion in net cash, which isn’t nearly enough to re-invent manufacturing, energy storage, mining and metallurgy all at once, but a lack of execution hasn’t kept Tesla from building a $354 billion market cap. The company is doing the same thing it’s always done: giving the public something to dream on and letting it carry them as far as it does.

As usual, the vision is in keeping with the aspirations of the popular zeitgeist. As outlandish as building enough manufacturing capacity to electrify every car on the road seems, Tesla would be in a much worse spot if it had to admit to its faithful that its wildest dreams and the efforts of all its competitors could only produce a fraction of the batteries necessary to get the world off of petroleum.

“What’s Good For Tesla is Good For America”

Tesla’s share price isn’t governed by the success or failure of its enterprise, or its ability to deliver; it’s governed by the action and popularity of the larger stock market. The democratization of trading and explosion of self-directed investors has created fertile ground for stock promotions, and Tesla is the best stock promotion.

As long as there is more money coming into the market than leaving it, we expect Tesla to grow like a weed. It has the cash, network and brand power to dominate the media landscape and does whatever it takes to keep itself relevant. It doesn’t trade at an auto-company multiple, because it has successfully convinced the market that it isn’t an auto company; it’s our only hope at our grandchildren not choking to death in a dystopian water-world. Absurd, sure, but so is the stock market carving out all time highs during a global pandemic with record unemployment.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

How do we combat the likes of Australia allowing Adani open up its coal mine in the Galilee Basin which in turn though the construction of its rail line, then opens up fat boy Palmer and extreme rwfw Gina’s leases in the same basin which will open up the 26bn tonnes and keep China building coal fired power stations.

Australia is torching the earth by allowing the exploit of this massive planet wrecker to proceed just for the royalties. No innovation just easy money by extreme rwfw’ sun power selling it as clean coal. Climate criminals should be held to account!