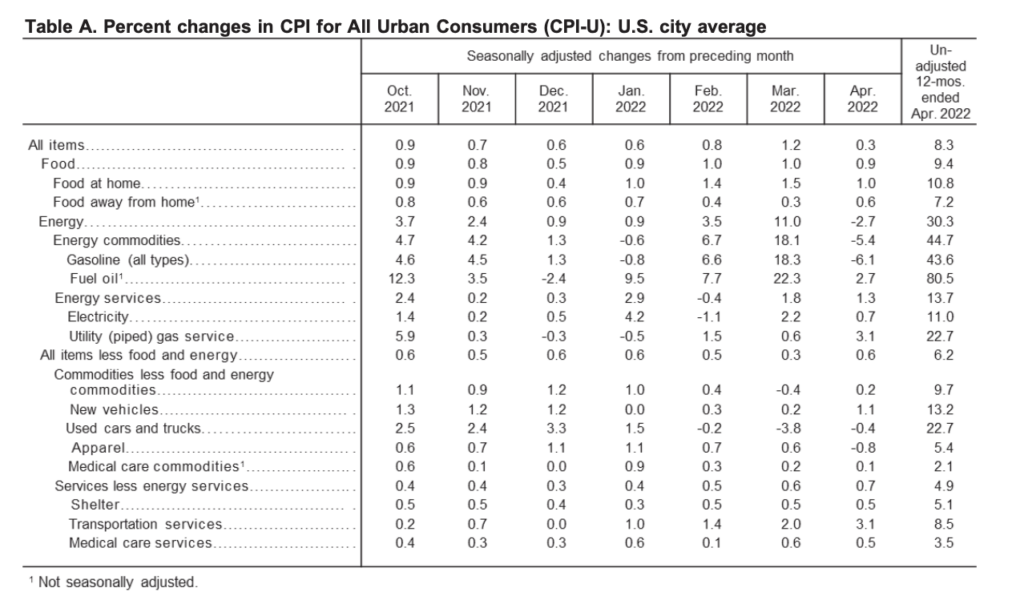

Billionaire investor Bill Ackman is once again calling on the Federal Reserve to wake up and tackle inflation more aggressively, before markets succumb to a complete collapse.

In a series of tweets published on Tuesday, the Pershing Square hedge fund manager warned that the only way to cool the current record-high inflation is to further tighten monetary policy and raise borrowing costs more sharply. “By raising rates aggressively now, the Fed can protect and enhance equity markets and the strength of the economy for all, while stymieing inflation that destroys livelihoods, particularly that of the least fortunate,” he wrote.

while stymieing inflation that destroys livelihoods, particularly that of the least fortunate.

— Bill Ackman (@BillAckman) May 24, 2022

Ackman blamed the recent market correction on diminishing confidence among investors regarding the Fed’s approach to tacking surging price pressures. “If the Fed doesn’t do its job, the market will do the Fed’s job, and that is what is happening now,” the fund manager continued, adding that, “the only way to stop today’s raging inflation is with aggressive monetary tightening or with a collapse in the economy.”

In fact, Ackman believes both markets and investors will side with the central bank should it raise rates more quickly in wake of 40 year-high inflation that is spiralling out of control. In order to show that it is serious about cooling price pressures and preventing the economy from relapsing into another recession, the Fed needs to immediately increase borrowing costs to neutral as well as pledge additional rate hikes until “the inflation genie is back in the bottle.”

Information for this briefing was found via Twitter. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.