China-based Binance announced on Wednesday that it has topped up the balance of its emergency insurance fund to resume its value back to US$1 billion after losing valuation due to the crypto market conditions.

To adjust to recent price fluctuations, #Binance has topped up the #SAFU insurance fund to $1 billion USD equivalent again.

— CZ 🔶 Binance (@cz_binance) November 9, 2022

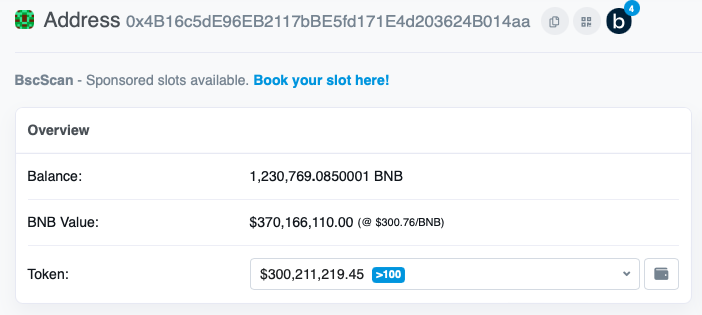

BUSD AND BNB address about 700m: https://t.co/OMoB6HeR6r

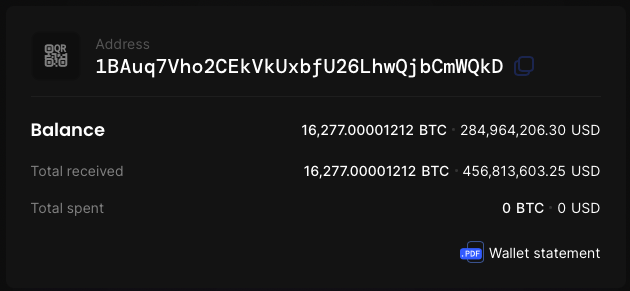

BTC address 300m: https://t.co/6kOJ1MZhMM

Transparency. 1/2

The Secure Asset Fund for Users (SAFU) is a fund that was established in 2018 to protect Binance users in extreme circumstances. In January 2022, the firm said that the SAFU balance was worth US$1 billion.

However, this slumped down to US$735 million over the course of the year given the falling valuation of crypto assets, mainly bitcoin. As of November 2022, the firm said it has topped the fund again to resume to its billion dollar-mark.

“We made a promise to our user base, along with the larger crypto ecosystem, that SAFU would always maintain a sizable level. We’ll continue to uphold that promise and continue to keep building,” the company said in a statement.

Crypto prices continue to decline and haven’t recovered from the so-called “crypto winter” experienced this year. Bitcoin, in particular, is currently trading below the US$20,000-mark–a two-year low for the digital asset.

Binance, the world’s largest crypto exchange, also reiterated that “retail traders and investors place a significant amount of trust in centralized crypto exchanges.”

“This is why we called upon other centralized exchanges to follow our steps and publicly post their insurance wallet addresses. Users deserve to know if they are transferring their hard-earned money into a platform that employs adequate safety measures and is completely transparent with user funds,” the company added.

The crypto exchange also added that it “is not and has never acted as an investment firm or a hedge fund,” a veiled reference to the reportedly insolvent hedge fund Alameda Research–a sister company of FTX. Unverified snapshots of its financials revealed that “the FTT token on Alameda’s balance sheet is roughly 1/3 of their total assets and equal to 88% of Alameda’s net equity.”

Two big lessons:

— CZ 🔶 Binance (@cz_binance) November 8, 2022

1: Never use a token you created as collateral.

2: Don’t borrow if you run a crypto business. Don't use capital "efficiently". Have a large reserve.

Binance has never used BNB for collateral, and we have never taken on debt.

Stay #SAFU.🙏

Binance chief Changpeng Zhao was then involved in a highly followed twitter row with FTX CEO Sam Bankman-Fried after the Chinese crypto exchange moved to liquidate all its FTT holdings after “recent revelations,” creating a domino effect of withdrawals that accumulated backlogs.

READ: Crypto Drama: FTX And Its Growing Red Flags

After much drama in two days, Binance made a 180o turn and came to FTX’s rescue with a non-binding letter of intent to acquire the latter and aid in addressing its “liquidity crunches.”

In September, Binance started converting holdings in leading stablecoins on platform to its own stablecoin, BUSD–halting support trading for leading dollar-pegged coins like USDC, USDP, and TUSD.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.