Canopy Growth’s (TSX: WEED) BioSteel Sports Nutrition Inc. finds itself in a significant financial bind, owing substantial sums to several prominent sports teams and leagues.

Having recently sought creditor protection, BioSteel has disclosed a preliminary list of its outstanding debts, totaling more than a staggering $439 million. These liabilities extend to a wide array of entities, encompassing manufacturers, distributors, and retailers.

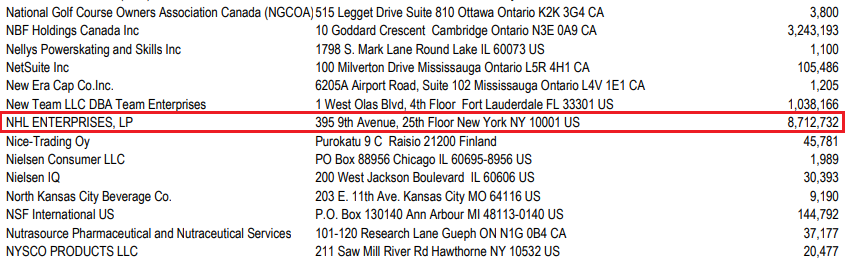

Among the sports organizations identified, the top creditor is NHL Enterprises, the merchandising and licensing arm of the National Hockey League, with a hefty sum of $8.7 million awaiting settlement. The Los Angeles Lakers, a prominent basketball franchise, are next in line, being owed more than $2.5 million.

In close pursuit, the Miami Heat, a fierce competitor of the Lakers, is seeking repayment of just under $1 million, while the United States Soccer Federation is looking to recover approximately $676,000.

The world of basketball sees the Brooklyn Nets and Philadelphia 76ers on the list, with BioSteel owing them $367,000 and $297,000, respectively. Additionally, USA Hockey and Hurricanes Hockey are awaiting payments of $197,000 and $96,000, respectively.

Other unsecured creditors with over a million dollars in the sheet are NBF Holdings Canada ($3.2 million), Flow Alkaline Spring Water ($2.0 million), Imbibe ($1.8 million), Tetra Pak Canada ($1.7 million), XPO Logistics ($1.6 million), Cascades ($1.2 million), Allen Distribution ($1.1 million), and New Team ($1.0 million).

A huge bulk of the outstanding debts is for the secured creditor Canopy Growth, owed around $394.2 million, while also having $4.6 million in unsecured debt associated with the company.

BioSteel’s journey took an unexpected turn when Canopy Growth acquired a majority stake in the company back in 2019. However, due to profitability challenges, Canopy Growth has since decided to divest itself of BioSteel.

BioSteel, founded in 2009 by entrepreneur John Celenza and hockey luminary Michael Cammalleri in Toronto, has forged numerous partnerships, solidifying its presence on arena and sports field benches. Notably, even Cammalleri himself is among the creditors, with an outstanding debt of approximately $12,000.

Information for this briefing was found via Pique and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.