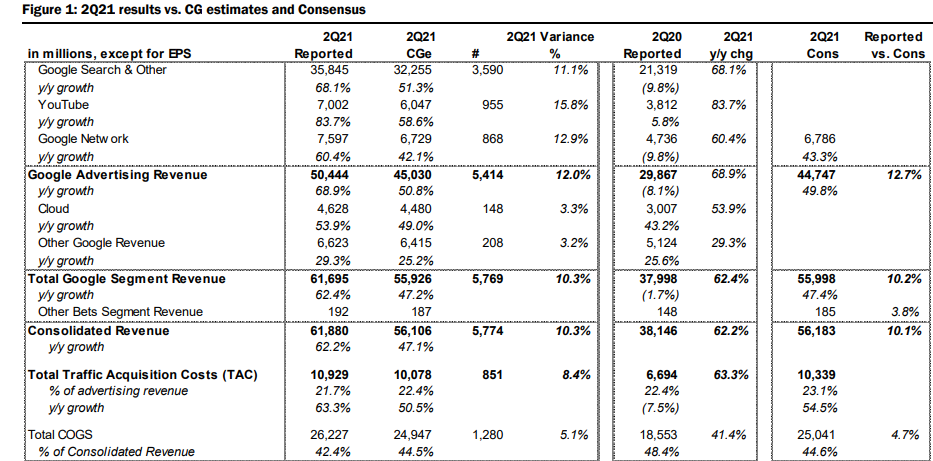

Earlier this week, Alphabet (NASDAQ: GOOGL) reported their second-quarter earnings, smashing analyst expectations. The company reported top-line revenue of $61.88 billion, higher than the $56.16 consensus estimate and even beating out the street high estimate. The company grew its revenues 61.6% year over year, while gross profits came in 80.6% higher year over year at $35.65 billion. The company had gross margins of 56.1% and operating margins of 31.3%. Alphabet reported a net income of $18.52 billion, or $27.26 in earnings per share. The stock hit record highs in early morning trading on Wednesday.

A number of analysts raised their 12-month price target off the back of these earnings, bringing the consensus 12-month price target up to $3,034.14 from $2,794.34 with 47 analysts covering the stock. Elazar Advisors has the street high with a $3,637.22 12-month price target and the lowest price target sits at $1,850. Out of the 47 analysts, 16 have strong buy ratings, 29 have buy ratings and two have hold ratings.

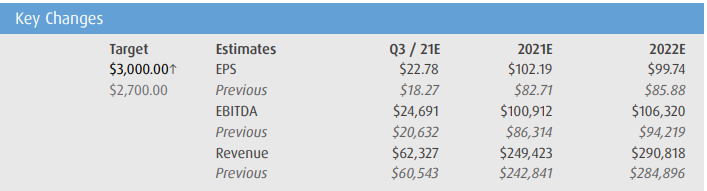

BMO Capital Markets raised their 12-month price target on Alphabet to $3,000 from $2,700 and reiterated their outperform rating on the name. They also went and raised their third quarter, 2021, and 2022 estimates on the company.

The company beat every single one of BMO’s segment estimates, with their network, other, and cloud segment beating by the largest margin. Additionally, the Google Services segment came in at $22.3 billion, beating their $17 billion estimate and the Cloud losses of $591 were only one-third of the $1.5 billion estimate BMO had.

Canaccord also raised their 12-month price target on Alphabet to $3,100 from $2,800 and reiterated their buy rating on the company after its earnings. They attributed the advertising beat to travel and leisure companies spending big to entice customers.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.