On August 12, Cineplex Inc. (TSX: CGX) reported its second-quarter financial statements. The company reported revenues of $64.9 million, growing 56.9% sequentially, while gross profit came in at $43.7 million up 51.4%. The company had a gross margin of 67.2% while operating margin came in at -108.4%, or -$70 million. The company had -$104 million in net income for this second quarter.

Cineplex only has 7 analysts covering the stock, with 3 having buy ratings and the other 4 having hold ratings. Several analysts marginally changed their price target on the stock, raising the average consensus to $15.36 from $14 last month. The street high sits at $20 from Scotiabank while the lowest comes in at $12.

BMO Capital Markets was one of the firms to reiterate their $12 price target and market perform rating on the stock, saying that the pandemic is still sitting as a large overhang to their performance. They believe that the second half of 2021, “is set up for accelerated recovery in revenue which will help drive neutral or better cash flow through year-end.”

BMO believes that the second quarter results showed a trend that continued from the first quarter, with sequential revenue growth as more locations reopen. But they continue to worry that the reopening will be slowed by COVID-19 variants even though Canada has a high vaccination rate. They do believe that there will be long-term headwinds to the sector and that the same-day releases have hampered subsequent weekend attendance rates.

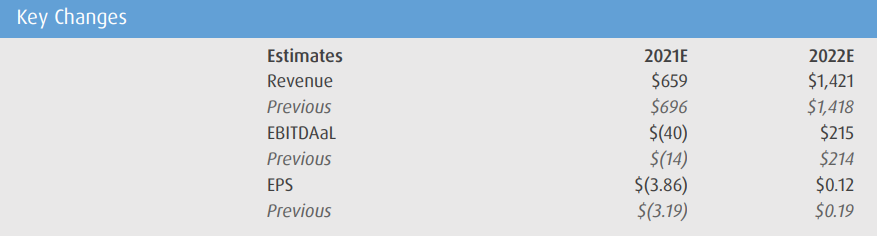

Below you can see BMO’s updated 2021 and 2022 estimates. Firstly, they say that Cineplex’s balance sheet seems strong with $284 million in liquidity, which should cover operations and not be in breach of their debt covenants which will return in the fourth quarter. They say, for the updated estimates, things have not changed too much and they are still using 2019 revenues as the benchmark.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.