Quadron Cannatech Corp (CSE: QCC) has had quite the buzz surrounding it this past weekend. And for good reason – it’s one of the few cannabis related stock that hasn’t seen any movement. That’s not to say it’s a poor investment, it seems to suffer from the fate of being relatively unknown. This in turn has caused it to bumble along, while others in the sector shot for the moon.

For those that are unaware, Quadron Cannatech is an ancillary player in the Canadian cannabis market. That is to say, it does not produce cannabis itself, or really handle it at all. Instead, it manufactures the equipment that producers and users of medical cannabis require. This includes the machines that control the climate in grow rooms, as well as the machines that extract the crude cannabis oil from the source.

In order to lend investors a hand in understanding this company, we chose to provide you with a quick overview of the company. Although this will not be as detailed as our full analysis pieces, it’ll be the perfect size for your Monday morning review.

Quadron Cannatech’s Products & Services

Presently, Quadron Cannatech services it’s customers under three lines of business. Each line is dedicated to one aspect of cannabis production or consumption. This enables the company to easily define the equipment that the specified target market requires.

The first subsidiary listed under Quadron Cannatech is Soma Labs Scientific. This portion of the organization is focused on the extraction of cannabis oils. Their primary products focus is on C02 extraction techniques. To this end, they are currently in the process of releasing “The Boss”, their new line of extraction equipment intended for continuous use. Additionally, they also offer an odor elimination machine, intended to remove foul smells related to grow operations.

Greenmantle Products is the second subsidiary under the Quadron Cannatech brand. The focus is defined as ancillary products for the cannabis market. This includes vaporizers and associated components, edibles, and suppositories. Under this subsidiary, Quadron will also perform custom branding of these products for third party authorized producers. The company views this as one of the highest potential markets in the industry as a result of the growing demand for cannabis oils.

The last subsidiary of Quadron Cannatech is that of Cybernetic Control Systems Inc. Acquired in March 2017, this arm of the company focuses on providing climate control products to greenhouses and grow operations. It includes an array of products, including sensors and VFD’s. Additionally, the subsidiary was recently awarded a license to be a technical distributor and integrator of Schneider Electric products, a global energy management company.

Lastly, the company recently signed a definitive agreement with Lucid Labs. The purpose of the agreement is to develop and commercialize extraction equipment. Through the agreement, a total of four new pieces of equipment will be co-developed for North American markets. They will then be distributed through Lucid Labs in the Western U.S., in addition to Quadron’s current product offerings.

Financials at a Glance for Quadron Cannatech

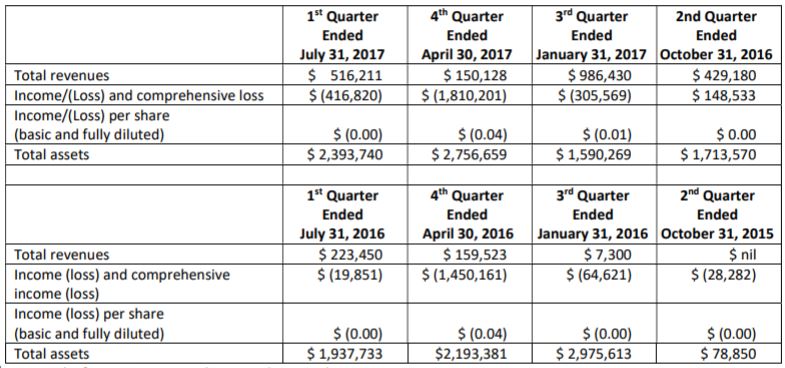

The current financials look very promising for Quadron Cannatech. Quarter over quarter, the revenues have increased substantially. And on a year over year basis, the growth is even more astounding for this small organization.

As can be seen above, the fourth quarter of the previous fiscal year was not positive for revenue growth. However, aside from this anomaly, revenue growth has been excellent. In the most recent quarter, revenues were $516,211, up from $223,450. This is partially a result of the addition of Cybernetic to these revenue figures. On a year over year basis, the company saw an increase of 972% for the year ended April 30, 2017. Also of note is the loss associated with the 4th quarter of 2017, which is related to the acquisition of Cybernetics.

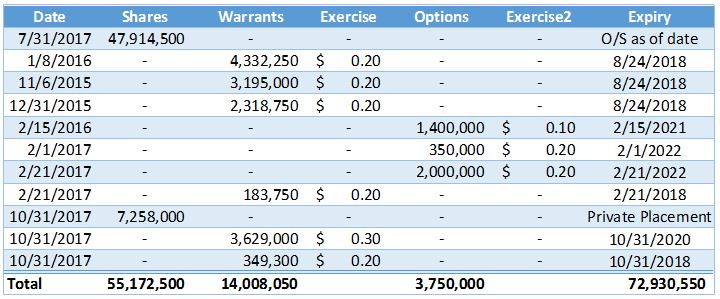

With respect to share structure, on a fully diluted basis there are approximately 73 million shares of Quadron Cannatech. This does not take into account approximately 6 million shares that may be awarded based on sales associated with the Cybernetics purchase. These shares would be listed as Class B shares, and are dependent on the subsidiary generating $2,500,000 in revenues throughout the current fiscal year. The company estimates there is a 75% chance that no Class B shares are awarded in association with this acquisition.

Based on the December 1, 2017 closing price of $0.30, this values the company at approximately $21.8 million on a fully diluted basis. Based on the current outstanding share count, the companies market cap is $16.5 million.

Closing Statements

Overall, based on current revenues Quadron Cannatech may not be classified as an undervalued player. However, if it continues it’s rapid pace of growth, this viewpoint may change. In total last year, it posted revenues of $1,789,188 in revenues, and a slightly largely figure of $1,987,713 in losses. Keeping in mind that $1.3 million of this loss was in relation to the Cybernetics purchase, the company isn’t doing too bad overall. Based on these revenue figures, a market cap of $16 million can likely be classified as close to fair valuation.

However, it needs to focus on having consistent quarters amidst its current growth. The fourth quarter for fiscal year 2017 posted some very poor revenue figures. If it could keep these revenues consistent, or close to it, it might instill a higher degree of shareholder faith in the company. With the explosive growth the cannabis sector has seen as of late, Quadron Cannatech may be positioning itself in an excellent spot – if it can deliver quarter after quarter consistently.

Remember the related fields. Analyze their position. Dive Deep.

Information for this analysis was found via The CSE, SEDAR, and Quadron Cannatech. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.