On October 7, Sundial Growers (NASDAQ: SNDL) announced that they entered into an agreement to acquire Alcanna Inc (TSX: CLIQ) for total consideration of $346 million or $9.12 per share. The price reflects a 39% premium to Alcanna’s shares at the time.

The deal is being pushed by Alcanna as a way to get liquidity for their shareholders by saying that Sundial has, “Significantly enhanced market liquidity,” and, “Sundial’s daily average trading value for the last 30 trading days has been approximately US$52.5 million on the Nasdaq versus approximately C$1.1 million for Alcanna on the TSX.”

Off the back of this news, only one analyst upgraded their 12-month price target. This brings the average 12-month price target to $0.71, or a 7.5% upside. There are only 5 analysts covering the stock, with 4 analysts having hold ratings and 1 analyst having a sell rating. The street high sits at $0.80 from ATB Capital Markets while the lowest comes in at $0.50.

Canaccord Genuity raised their 12-month price target to $0.80 from $0.75 and reiterated their hold rating after the news, saying, “In our view, this transaction is a step in the right direction for Sundial.” They believe that this will provide Sundial with an established alcohol chain that has free cash flow, as well as makes the firm the largest cannabis retailer in Canada. They expect the company to leverage all the data they will be getting from these locations to help rightsize their adult-use offerings and R&D.

Alcanna is the largest private liquor retailer with 171 stores, which has taken the value-focused growth model. Alcanna also has a 63% interest in Nova Cannabis, which has 62 dispensaries with the majority of them being located in Alberta. Nova Cannabis management has said they want to increase their footprint in Ontario as well as getting to 85 open dispensaries by the end of the year.

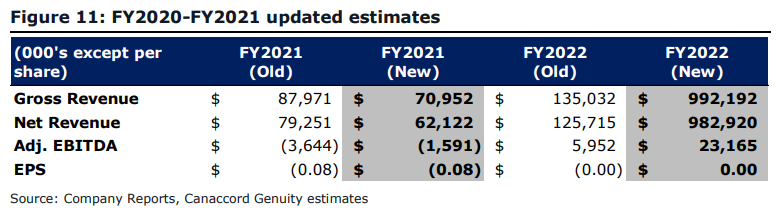

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.