Columbia Care (NEO: CCHW) reported its first quarter financial results on May 17th. The company announced pro-forma first quarter revenue of $92.5 million with a 41% gross margin. The company also reported adjusted EBITDA of $10.4 million and reiterated their full-year 2021 guidance of $500 – $530 million revenue, 47%+ gross margin, and $95 – $105 million in EBITDA.

The company currently has a weighted 12-month price target of $14.17 from 11 analysts. Four analysts have strong buy ratings, six have buy ratings and one analyst has a hold rating. PI Financial has the street high at C$19 while Beacon has the lowest at C$12.

In Canaccord’s note, their analyst Matt Bottomley reiterated their C$15 price target and speculative buy rating on the stock, saying, “Seasonal headwinds as CCHW continues to execute on its overall growth strategy.” He also reiterated Columbia Care as one of their top picks and says, “we would continue to be buyers of CCHW at these levels.”

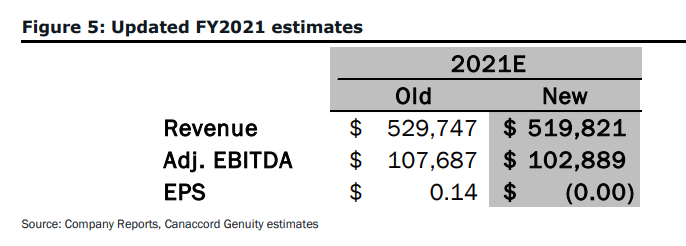

For the quarter, the company came just below Canaccord’s estimates. Canaccord estimated $94.56 million in first quarter revenue, while they expected EBITDA to come in at $13.26 million. Bottomley believes that this slight miss was due to seasonality in its key market of Colorado, while their California operations are getting affected by COVID-19 headwinds. Bottomley writes that Columbia Care, “continued to demonstrate strong sequential growth from the majority of its national portfolio.”

Bottomley believes that the company can hit the guidance set out by management but flags the slightly lower gross margins of 40.8% this quarter as something to watch. For revenue and adjusted EBITDA, Bottomley says that the guidance is assuming a mid-year close for Green Leaf and does not include any sales from the New Jersey adult-use market which is expected to start during the second half of this year.

You can see Canaccords updated 2021 estimates below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.