The Valens Company (TSX: VLNS) was very busy over the course of the last week. On April 27th, the company announced its entry into the U.S markets with the acquisition of Green Roads for up to U$60 million based on U$40 billion in initial consideration with a potential U$20 million in earnouts. Then the next morning, on April 28th Valens announced that they have applied for a Nasdaq listing as well as a share consolidation.

Valens currently has 9 analysts covering the company with a weighted 12-month price target of C$4.06. This is up from the last month, which was C$3.53. One analyst has a strong buy rating, seven analysts have buy ratings and one analyst has a hold rating. The street high comes from M Partners with a C$5 price target, while Raymond James has the lowest at C$2.50

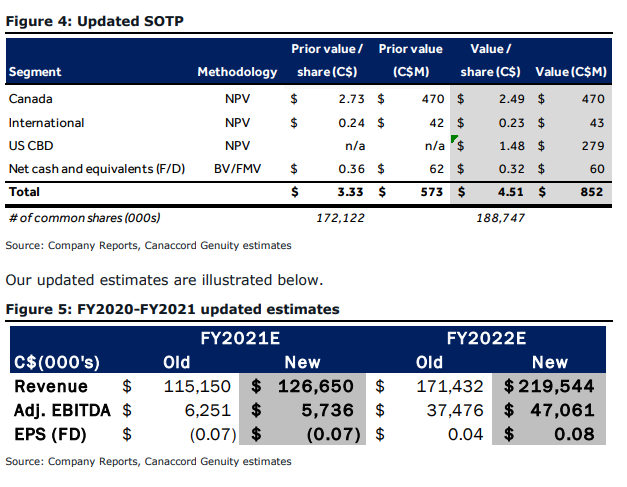

In Canaccord’s note, their analyst Shaan Mir increased their 12-month price target from C$3.50 to C$4.50 and reiterated their speculative buy rating on the company. He says the deal was done at ~1.8x 2020 revenue and if EBITDA milestones get hit, a ~4.5x 2022 EBITDA.

For some details on Green Roads, Mir says that the company has two business lines, one is in-house branded products which have distribution into over 7,000 retail locations, and a B2B manufacturing operation that is “largely immaterial.” Mir adds, “Green Roads is one of few US CBD companies that conduct in-house manufacturing, thus allowing greater control over the supply chain and increased discretion on new formulations/form factors.”

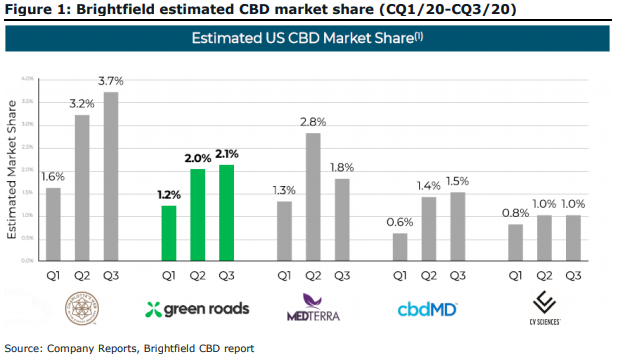

Mir says the price point and deal seem like an attractive entry point into the U.S markets as Green Roads is the second largest CBD company behind Charlotte’s Web. Mir writes, “With this transaction, the company has opened the doors to the US and can use Green Roads’ infrastructure as a vehicle to expand into THC markets once federal legislation permits.” He also believes that there are many deals to be had over the short term with Valens’ ability to bring its third-party manufacturing expertise to the US.

Below you can see the updated 2021 and 2020 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.