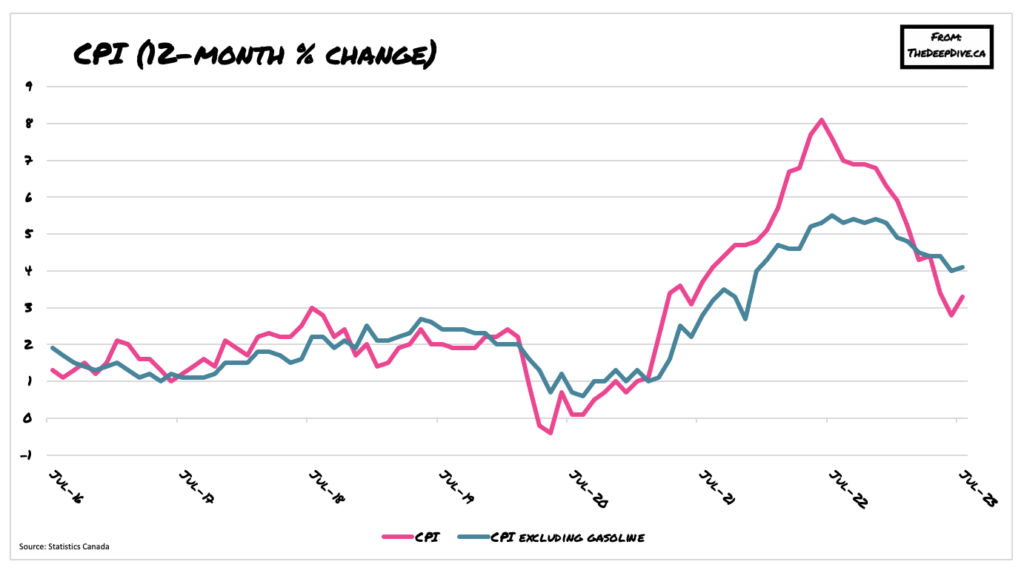

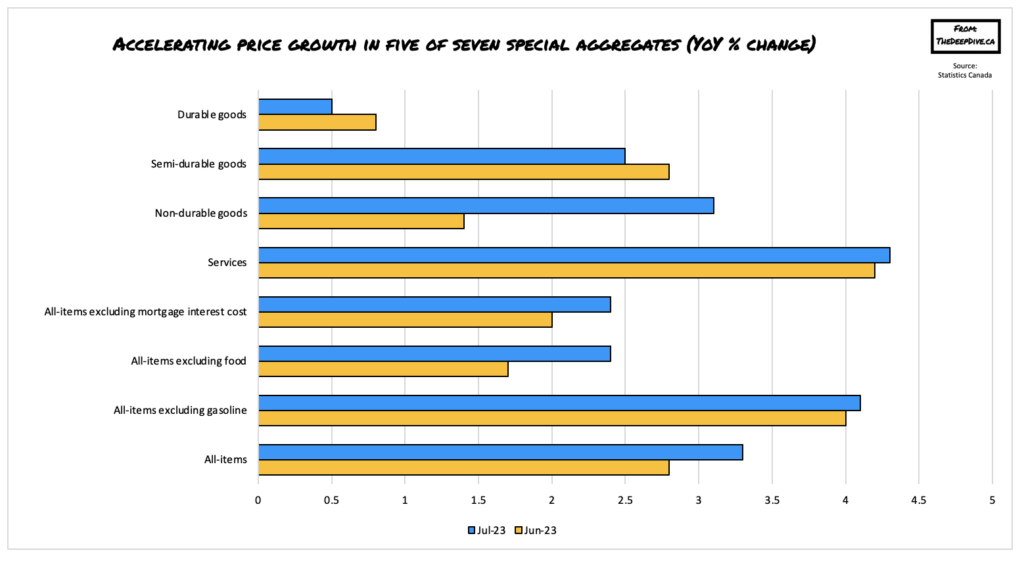

Latest data from Statistics Canada shows consumer prices rose 0.6% month-over-month to an annualized 3.3% in June, marking an increase from May’s reading of 2.8% and substantially above economists’ forecasts calling for a CPI print of 3%. The stark reversal in declining inflation was mostly attributable to base-year effects in gasoline prices, which ceased affecting the year-over-year movement. Gasoline prices aside, the CPI was up 4.1% from July 2022, up from 4% in June.

Among the components, the mortgage interest cost index was the largest contributor to overall CPI, posting yet another record-breaking gain— this time rising a staggering 30.6% over the past 12 months. Excluding this component, inflation would have stood at 2.4% last month.

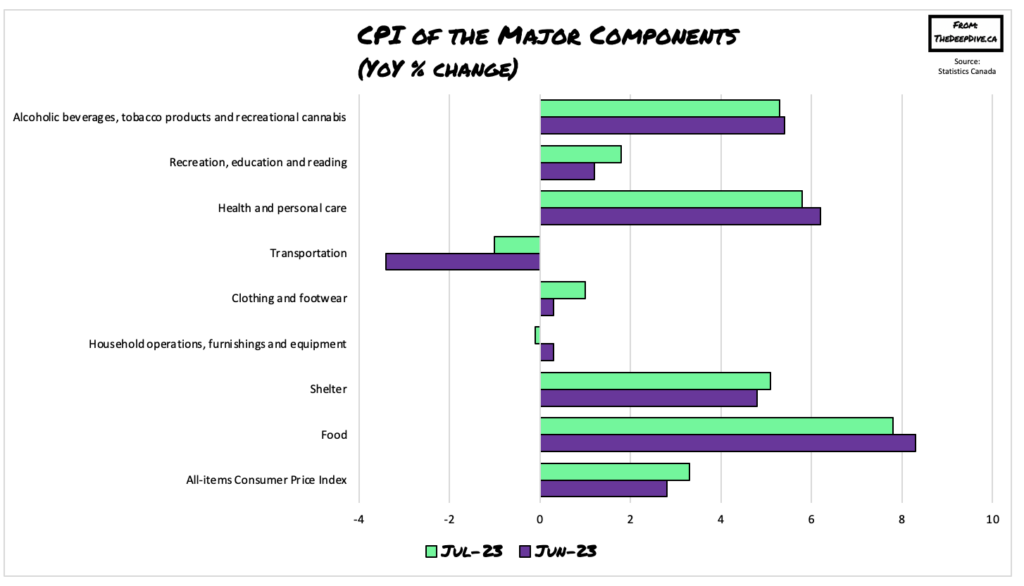

Meanwhile, the decline in energy prices slowed to 8.2% from one year ago, compared to June’s decline of 14.6%. The picture was even more bleak in Alberta, where consumers saw electricity prices increase by a whooping 127.8% compared to July 2022 thanks to the phase-out of provincial rebates and price caps.

Statistics Canada also reported that grocery prices remained elevated last month, rising 8.5% year-over-year following June’s increase of 9.1%.

Information for this story was found via Statistics Canada. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.