This morning the Canadian Bankers Association announced there has been 500,000 requests for mortgage deferrals completed since Canada’s banks announced a mortgage deferral program over two weeks ago. The figure represents 10% of the big six bank’s Canadian residential mortgage portfolio.

Canada’s banks are standing by Canadians and have stepped up to help our country work through these challenging times… The COVID-19 pandemic is the most urgent challenge our country has faced in recent memory, and banks will continue to make a positive difference for those who need their help and support.”

Neil Parmenter, President and CEO, Canadian Bankers Association

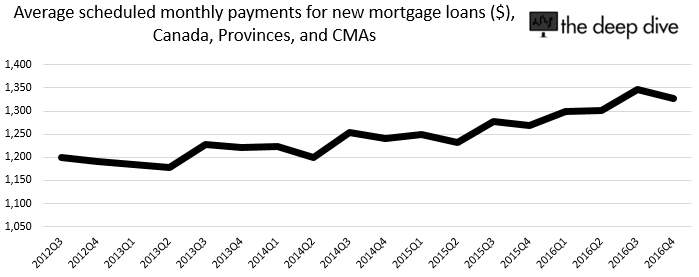

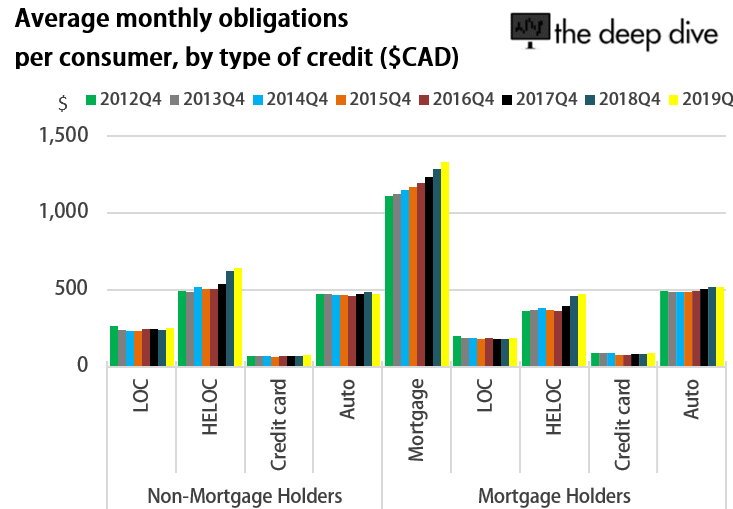

According to the CMHC the average monthly mortgage payment at the end of 2019 was $1325 with new mortgages having an average value of $1451. This works out to approximately $660M in monthly payments that will not be received by the big banks; nearly $2B per quarter.

Mortgages are the area we are watching given they represent the majority of Canadian’s monthly debt payments.

Yesterday the Deep Dive did a piece on Canadian debt and how prior to the Coronapocalypse half of Canadians said they were insolvent or within $200 of insolvency.

Information for this briefing was found via the Canadian Bankers Association and the CMHC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.