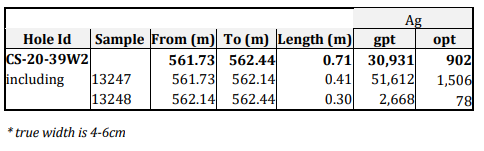

On April 26, Canada Silver Cobalt Works Inc. (TSXV: CCW) announced assays results confirming a second high-grade silver vein in the Robinson Zone of its flagship 100%-owned Castle Silver project in northern Ontario. Hole CS-20-39W2 intercepted 51,612 grams of silver per tonne of resources (g/t of Ag) over a 0.41-meter length with a true width of 4-6 centimeters.

This degree of mineralization is much higher than found in other known silver projects and is equivalent to a gold composition of around 750 g/t. Bonanza grade gold, the highest underground gold grade, is defined as having a density of more than 34 g/t.

The drilled hole described above is six meters away from and is a follow-up to Hole CS-20-39, which encountered 89,853 g/t of Ag over a 0.3-meter span with a true width of 5-7 centimeters in late January 2021. (Another drill hole, CS-20-31, intersected gold with a content of 24.95 g/t over a 0.3-meter span.)

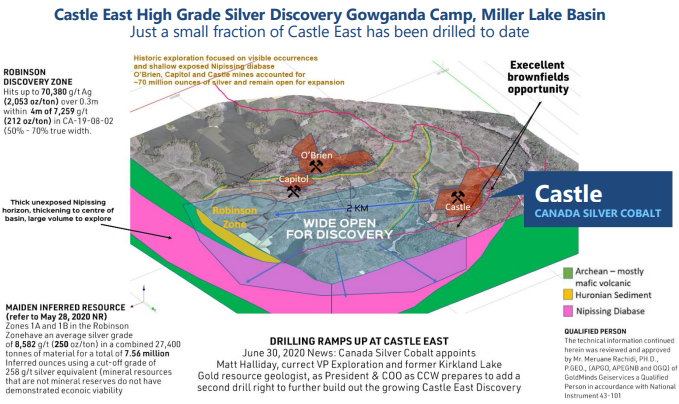

As of March 31, Canada Silver Cobalt had drilled 33 holes and completed 26,000 meters of a planned 50,000-meter drilling program at Robinson. The contemplated drilling depth for each hole is 500 – 800 meters. Five new mineralized veins have been identified so far as part of this program, including the one described above. As a follow-on to this drilling program, the company hopes to begin underground ramp design/construction at the Robinson Zone later this year.

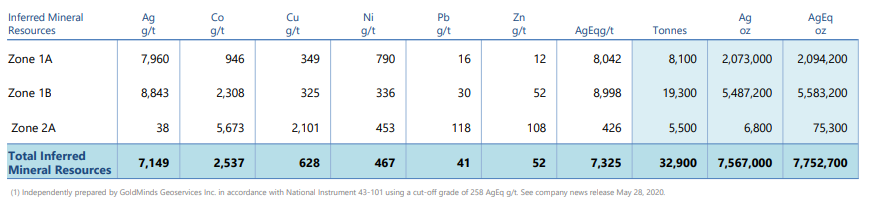

After completing only 3,000 meters of the drilling in Zones 1A and 1B of Robinson, the company commissioned a third party to prepare a NI 43-101 compliant resource estimate based only on that data. In July 2020, GoldMinds Geoservices estimated that those zones contained 7.75 million silver-equivalent ounces. After all drilling is completed, that estimate seems likely to rise substantially.

Solid Balance Sheet But Additional Equity Raises Needed

Canada Silver Cobalt had a cash balance of nearly $5 million as of September 30, 2020 and no debt. In addition, the company has raised an aggregate $5.9 million through the sale of shares and warrants in private placements in November 2020 and April 2021.

Canada Silver Cobalt’s operating cash flow shortfalls averaged about $1.7 million per quarter over the first three quarters of 2020. Given this cash burn rate and the costs of both its ongoing drilling program and the planned underground construction activity at Robinson later this year, the company will probably have to issue additional equity on top of the $5.9 million raised over the last six months.

| (in thousands of Canadian $, except for shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Operating Income | ($4,168) | ($887) | ($1,463) | ($2,826) | ($760) |

| Operating Cash Flow | ($3,000) | ($458) | ($1,572) | ($1,775) | ($694) |

| Cash – Period End | $4,856 | $1,090 | $420 | $686 | $295 |

| Debt – Period End | $0 | $0 | $0 | $0 | $0 |

| Shares Outstanding (Millions) | 112.5 | 93.8 | 91.7 | 90.4 | 83.6 |

The company has reported impressive assay results from its drilling program at the Robinson Zone. If future results prove to be disappointing, investors’ perception of the growth potential of Canada Silver Cobalt could be affected.

The Robinson Zone at Canada Silver Cobalt’s Silver Castle project could prove to be a major silver discovery. Several of the drill hole intercepts have shown extraordinary silver grades; nevertheless, more exploration and of course construction activities must be accomplished before mining begins.

Canada Silver Cobalt Works Inc. is trading at $0.415 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and Canada Silver Cobalt Works. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.