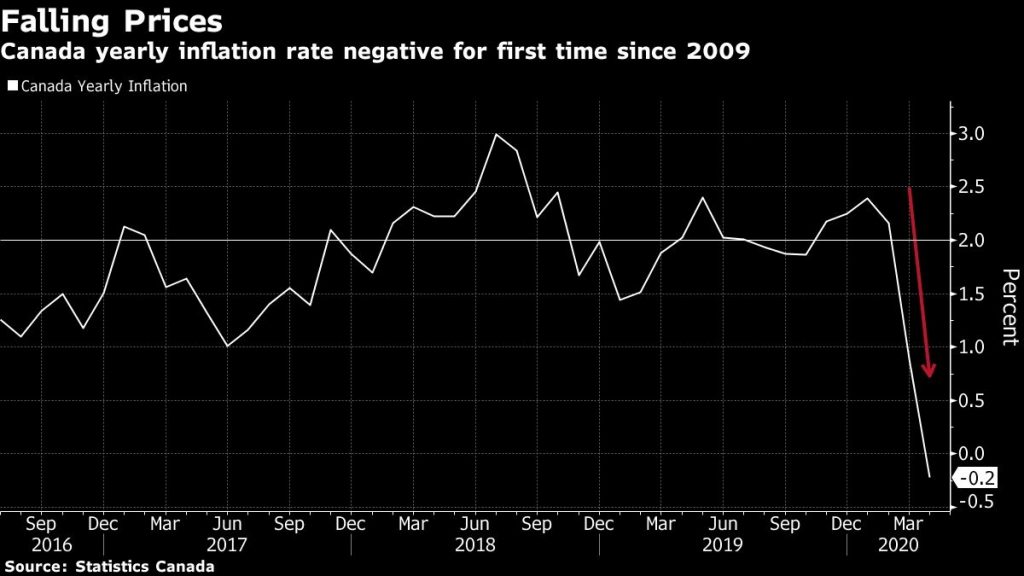

According to recent Statistics Canada data, the inflation rate has hit negative territory for the first time since the 2009 recession.

As the coronavirus pandemic caused Canada’s economy to enter into lockdown mode, the demand for consumerism decreased, and fossil fuel prices plummeted. As a result, prices have dropped by 0.2% in April compared to the same time a year prior- which is definitely not on par with the otherwise annual rate of 0.9% in March.

However, core inflation readings provide a more precise estimate of price changes, since they exclude volatile variables such as fossil fuel prices. As such, core inflation has dropped by 0.3% April, which is the lowest it has been since January of last year. Given that consumers are most likely not going to be returning to pre-pandemic spending levels, inflation will remain at historically low levels for a longer period of time.

If the spell of decreasing inflation persists, it could lead to deflation, which would ultimately increase the value of the Canadian dollar. Nonetheless, the Bank of Canada will most likely not be conducting contractionary policy in the near future.

Information for this briefing was found via Bloomberg, Reuters and Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.