Canadian housing starts were down between July and August, as the pace of urban starts slowed down.

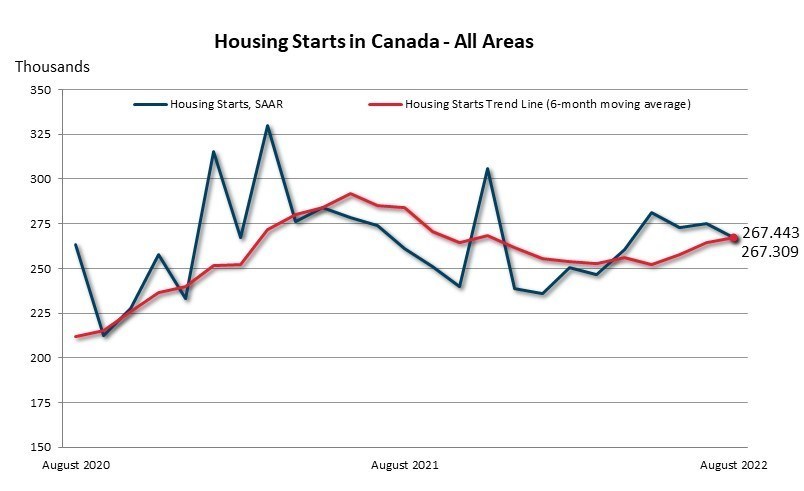

The Canada Mortgage Housing Corporation (CMHC) reported on Friday that housing starts stood at 267,443 units in August, marking a decline of 3% from the month prior. Still, the figure came in higher than the 265,000 forecast by economists cited by Reuters. Although single-detached starts rose 1% to 59,169 units, they were unable to outpace the 4% decline in multi-unit starts, which fell to 187,602. The CMHC estimated rural starts at 20,672 units last month.

“Housing starts activity remains elevated in Canada historically and have been well above 200,000 units since 2020,” said CMHC chief economist Bob Dugan. Even though housing starts surpassed expectations in August, recent housing price declines across the country suggest demand for real estate may be waning as rising interest rates keep an increasing number of potential homebuyers away from the market.

A recent note from RBC economist Robert Hogue warns housing prices will likely continue to fall in tandem with the central bank’s increases in borrowing costs. “The likelihood the Bank of Canada will take its policy rate deeper into restrictive territory by year-end is poised to keep buyers on the defensive in the coming months,” he said. “Higher interest rates will disqualify more buyers from obtaining a mortgage and shrink the size of a mortgage others can qualify for.”

Information for this briefing was found via the CMHC and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.