Thanks to skyrocketing interest rates, one out of five Canadians who took out a mortgage with CIBC can no longer afford the interest portion of their loan.

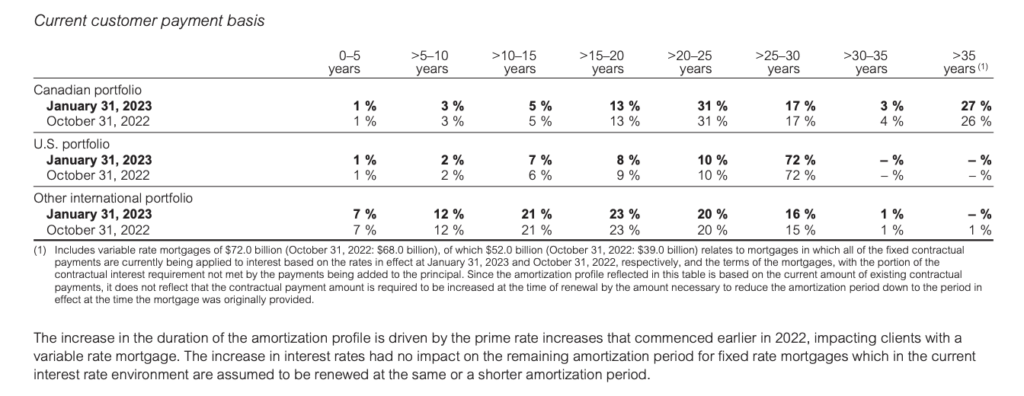

In a footnote included in CIBC’s latest quarterly financial statements, 20% of the bank’s residential mortgage holders have reached their trigger rate, meaning that their monthly payment can no longer cover the interest portion of their loan. In other words, the bank is now increasing the amortization period on $52 billion worth of mortgages out of its $263 billion residential loan portfolio.

Canadians with variable-rate mortgages are facing a precarious situation thanks to the Bank of Canada’s aggressive tightening cycle that brought borrowing costs from near-zero to 4.5% in less than a year. However, banks like CIBC allow customers to surpass their trigger rate by adding the accrued interest amount they aren’t able to cover with their monthly payment onto the mortgage principal, ultimately raising the total loan balance.

However, such a situation could take a turn for the worse if mortgage holders with negative amortizations aren’t able to make the now-higher payments once their renewal date comes. “At this time, we still only see a small portion, less than $20-million, of mortgage balances with clients we see as being at higher risk from a credit perspective,” explained CIBC’s chief risk officer during a conference call cited by the Globe and Mail. “We actively monitor our portfolios and pro-actively reach out to clients who are at higher risk of financial stress.”

In that same filing, CIBC also unveiled that negatively amortized mortgages stood at $39 billion in the fourth quarter, before growing to a staggering $52 billion in the first quarter of 2023. “Higher mortgage rates have resulted in a greater portion of fixed-payment variable mortgages where the monthly mortgage payment does not cover interest and principal,” commented Veritas Investment Research financial services analyst Nigel D’Souza, as cited by the Globe and Mail. “The full impact of higher mortgage rates will be reflected on renewal.”

Take the amortization from 25 years to 35 years. This is how they are keeping the mortgage payments down and allowing the consumer to continue to spend in Canada, despite higher rates. The definition of fighting the Fed. https://t.co/NfQdsk0Gc3

— Dennis Dick, CFA (@TripleDTrader) March 3, 2023

Information for this briefing was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.