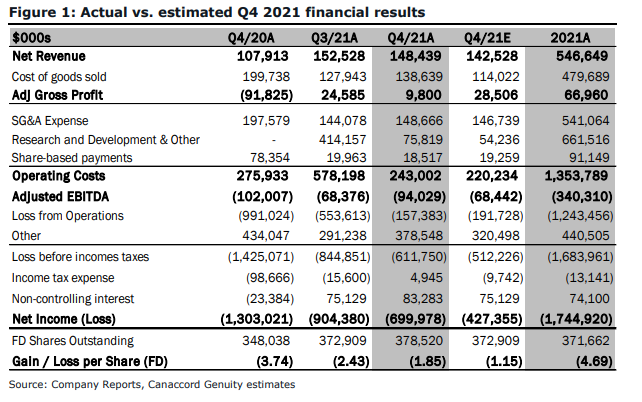

On June 1st, Canopy Growth Corp (TSX: WEED) (NASDAQ: CGC) reported its fiscal fourth quarter financial results. The company reported net revenue of $148.4 million, missing the street’s estimate. The quarterly revenue was up 38% year over year while the company reported a gross margin of only 7%. For the quarter, the company reported adjusted EBITDA of negative $94 million.

With many analysts coming out and slashing their price targets on Canopy, the companies 12-month average price target is down to C$32.61, it was C$37.76 prior to the news release. Of the 15 analysts covering Canopy, one analyst has a strong buy rating, and two have buy ratings. Ten analysts have hold ratings and two have strong sell ratings. MKM Partners has the street high price target at C$51, while the lowest price target sits at C$18 from Bryan Garnier.

Canaccord upgraded Canopy to a hold rating from sell but lowered their price target to C$30 from C$32. Their analyst Matt Bottomley says that this quarter showed, “a step back on its path to profitability.” He adds that although Canopy missed almost all of their estimates for this quarter, their shares have dropped more than 50% since its last quarter and because of this they are raising their rating.

Below you can see how Canopy did against Canaccord’s earnings. Most notably, Canaccord was expecting COVID-19 headwinds as well as provincial inventory rightsizing to weigh more on the top line, so Canopy actually beat their top-line estimate, but the company reported a way smaller gross profit than what was expected by Canaccord. Bottomley says that this was due to “lower production output, less favorable product mix,” as well as a $75 million inventory charge that weighted on the companies results.

The companies retail segment got hit the hardest being down 12%, which is mainly attributed to store closures due to COVID. Wholesale was flat quarter over quarter bringing the firms total Canadian adult-use revenues down roughly 3% quarter over quarter. Bottomley says that pro-forma, backing in the two recent deals, Supreme and Ace Valley, the company has a market share of 18.1%, “Which we believe puts Canopy in a position to compete for the leading adult-use market share in Canada (along with Tilray and Hexo).”

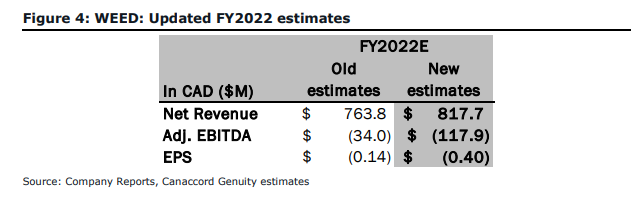

Bottomley also comments that “Canopy took a step backward toward profitability, reporting a lofty adj. EBITDA loss of (C$94.0M).” He thought losses would be equal to what last quarter’s losses of $68.4 million were. He says that Canopy continues to reiterate that they will flip to hitting a positive adjusted EBITDA during the second half of 2022, but its annualized free cash flow burn is almost $500 million.

Below you can see Canaccord’s updated 2022 estimates to include Ace Valley and Supreme Cannabis.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.