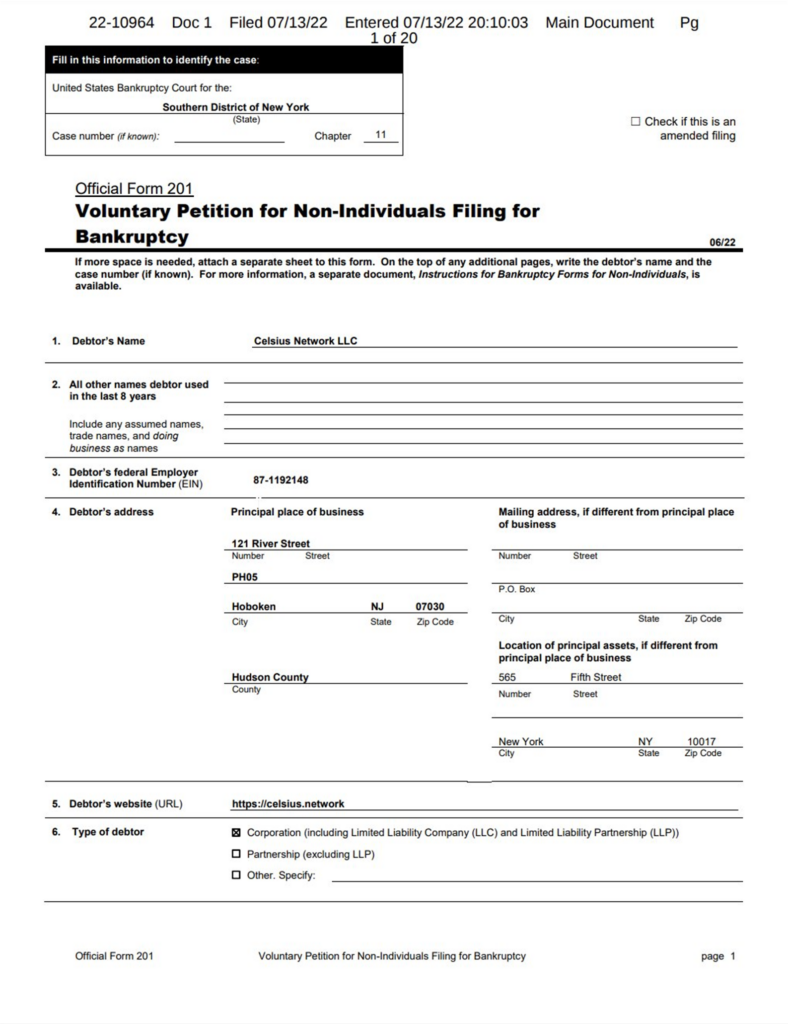

After cleaning out all its on-chain debt, Celsius Network has filed for a Chapter 11 bankruptcy and has expressed its intent to conduct a financial restructuring.

“Today’s filing follows the difficult but necessary decision by Celsius last month to pause withdrawals, swaps, and transfers on its platform to stabilize its business and protect its customers,” the crypto exchange said in a statement.

Acting in the best interest of our stakeholders, including our entire customer community, is our top priority. We look forward to sharing our progress as we go through this transparent process.

— Celsius (@CelsiusNetwork) July 14, 2022

The firm also defended its decision to pause all withdrawals a month ago, saying that without such action, the “acceleration of withdrawals would have allowed certain customers—those who were first to act—to be paid in full while leaving others behind.”

CEO Alex Mashinsky also said that the filing was the right decision for its community and the company.

“We have a strong and experienced team in place to lead Celsius through this process. I am confident that when we look back at the history of Celsius, we will see this as a defining moment, where acting with resolve and confidence served the community and strengthened the future of the company,” Mashinsky added.

While the Chapter 11 bankruptcy is in effect, Celsius clarified that it would continue to operate, albeit focused on the restructuring process. It has sought for a series of customary motions “to continue to operate in the normal course,” including paying its employees and their benefits.

However, the firm also said that it won’t be requesting that customer withdrawals be allowed by the court “at this time” and such concerns will be handled through the Chapter 11 process.

Largest @CelsiusNetwork unsecured creditor announced today in the bankruptcy filing is out $81M but has only 23 followers. Let’s help em out @LanternVentures 🫡 https://t.co/sgekYvOSQe pic.twitter.com/Rn0YWgyu73

— FreddieRaynolds (@FreddieRaynolds) July 14, 2022

The Department of Financial Regulation of the US state of Vermont, one of the states launching an investigation on the crypto exchange, earlier said it believes the firm is “deeply insolvent and lacks the assets and liquidity to honor its obligations to account holders and other creditors.”

However, the firm is still about to face a legal battle as its former investment manager, KeyFi founder Jason Stone, is taking Celsius to court under fraud allegations.

The latest digital debt payments follow a month after Celsius paused all withdrawals, transfers, and swaps–which led to a liquidity crisis.

Information for this briefing was found via Twitter and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.