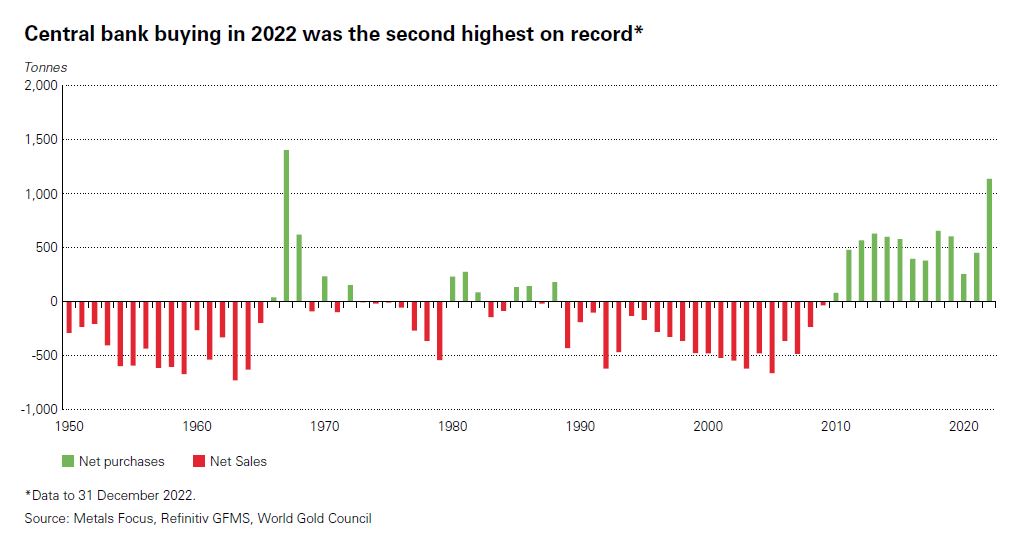

Central banks broke a 55-year gold-buying record in 2022. The gold rush, which is likely brought about by economic turbulence, adds up to a total of 1,136 tonnes of the yellow metal, which in US dollars would be worth around $70 billion, according to data from the World Gold Council (WGC).

This new record also marks a change in central banks’ attitudes towards gold since the 1990’s and 2000’s, when Western European banks used to sell hundreds of tonnes from their stockpiles each year. Since the crash in 2008 to 2009, European banks have held on to their stockpiles while a growing number of emerging economies, led by Russia, Turkey, and India, started buying more and more.

READ: Gold Rush: Volume Bought By Central Banks At A 5-Decade High

Central banks bought the most gold since 1967 last year, World Gold Council reports.

— Wall Street Silver (@WallStreetSilv) January 31, 2023

Central banks bought 1,136 tonnes of gold in 2022

Emerging economies were main buyers.

What are they preparing for? pic.twitter.com/xRq2FgZlD6

Gold thrives in uncertainty, so while inflation was hitting record high after record high, the price of oil was skyrocketing, energy security was being threatened, and debt kept soaring, all in the foreground of Russia’s war in Ukraine, gold-buying accelerated in the second half of 2022.

Q: Why are gold, silver, Bitcoin going higher? A: Because US poor and middle class getting poorer & deeper in bad debt. Please don’t get poorer. At least buy one silver coin. Only $30 and start to get richer.

— Robert Kiyosaki (@theRealKiyosaki) January 31, 2023

WGC data show that central banks bought 862 of the 1,136 tons of gold from July to December. The central banks of Turkey, China, Egypt, and Qatar were all reported to have bought a huge chunk of the metal last year, but two-thirds of the gold purchased by central banks was not publicly disclosed.

Turkey was one of the top buyers, if not the top buyer, as it sought to hedge against inflation that jumped as high as 85% as it continued to go the opposite direction and cut rates. The country’s central bank added 148 tons to its holdings which as of December 31 is at a total of 542 tons, its highest on record.

People’s Bank of China reports that it added 30 tons to its stockpile in December after adding 32 tons in November. The country’s stockpile is at 2,010 tons.

The gold rush also signals central banks’ desire to diversify away from the US treasuries and the dollar.

A currency is being devalued by 90% overnight as gold demand hits a decade high.

— Gold Telegraph ⚡ (@GoldTelegraph_) January 31, 2023

How can you not be paying attention to gold now?

The people who issue your local currency seem obsessed with it.

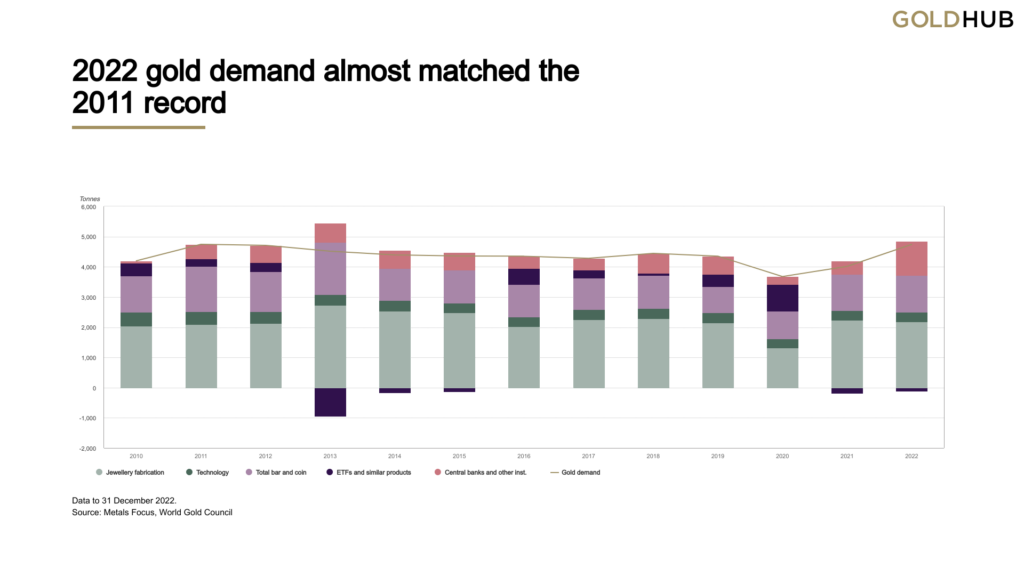

The central bank purchases contributed to total global gold demand of 4,741 tons in 2022, an 18% increase from the previous year and the highest since 2011.

WGC projects that central bank buying in 2023 will not be able to match the record of the year before, given the extraordinary increase.

“It is also reasonable to believe that central bank demand in 2023 may struggle to reach the level it did last year,” it said in the report.

“A slowing of growth in total reserves is likely to put pressure on some central banks, reducing their capacity to allocate to gold. We therefore think it likely that 2023 buying will be more moderate.”

Information for this briefing was found via WGC, Kitco News, Reuters, Bloomberg, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.