Analysts at CIBC are lowering their price expectations for Canadian office real estate investment trusts (REITs) across the board, as investor sentiment remains negative and the impact of remote work takes its toll.

“While it is clear that overall investor sentiment has soured towards the office sub-sector due to a plethora of macroeconomic variables, we would be remiss not to mention that much of the pessimism regarding the Canadian office REITs does indeed stem from declining fundamentals,” Dean Wilkinson, real estate analyst at CIBC Capital Markets and lead author of the note, said on Wednesday.

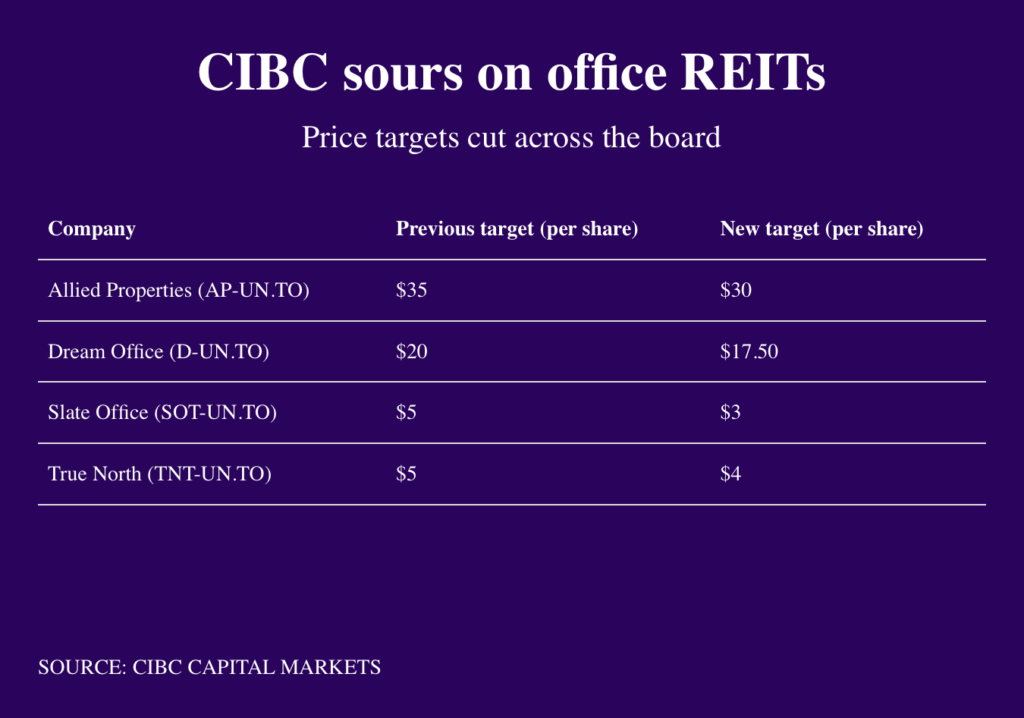

He reduced his 12-month price target for Allied Properties REIT (TSX: AP.un), Dream Office REIT (TSX: D.un), Slate Office REIT (TSX: SOT.un), and True North Commercial REIT (TSX: TNT.un).

Allied and Dream were both downgraded from outperform to neutral, bringing them in line with the other two names.

“Given the long-dated nature of office leases and the erosion of current fundamentals, we envision any form of long-term recovery (or alternate use) will ultimately fall outside of our intermediate forecast period,” Wilkinson added.

While some businesses have established a post-pandemic work arrangement, others are still attempting to strike the perfect mix between in-office, hybrid, and remote employment. Royal Bank of Canada requested its staff to return to the office three or four days a week last month, while simultaneously conceding that hybrid work was “here to stay.”

According to recent Colliers Canada research, the national office vacancy rate was 13.3 percent in the first quarter, a modest uptick from the previous quarter and much higher than pre-pandemic levels.

With greater vacancy rates, CIBC warns that REIT dividends, a key draw for yield-hungry investors, may be reduced. True North and Slate were the first REITs to slash their dividend payouts, making a case for the struggles faced by the real estate industry amid rising interest rates and vacancies.

In a PwC Canada survey, 78% of employers who had yet to return to work intended to do so to some extent in the next three months. When employees were surveyed about their ideal work environment, 34% stated they prefer to work largely or fully remotely, 37% want to be in the office most or all of the time, and the remaining 29% want an equal mix of the two.

However, lease rates for commercial spaces are rising. In Q4 2022, the average industrial leasing rate was $18.04, up from $13.74 in Q4 2021. The average office lease rate increased year over year to $20.43 in Q4 2022, up from $18.60 in Q4 2021.

Information for this briefing was found via Yahoo Finance and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.