FULL DISCLOSURE: First Phosphate is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover First Phosphate on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.

First Phosphate and Arianne Phosphate are two very different yet very powerful players working to make it happen

A confluence of developments could propel the Saguenay-Lac-St-Jean Region in Quebec to become the epicenter of North America’s expanding lithium iron phosphate (LFP) battery industry. Electric vehicle (EV) manufacturers have been rapidly shifting towards using LFP batteries to power their vehicles due to their superior performance and safety characteristics.

LFP batteries are non-toxic, recyclable, have one of the longest lifespans among batteries and generate much less heat, thereby ticking the ESG and environmental friendliness boxes that consumers are demanding. They are also less susceptible to thermal runaway than other lithium-based battery variants, and contain no cobalt in their makeup.

LFP battery manufacturers require the highest-purity battery-grade phosphate to make the high grade purified phosphoric acid (PPA) which then makes the highest grade LFP cathode active material. The highest purity phosphates are extracted from igneous anorthosite phosphate rock, of which almost all of the world’s known supply is exclusively found in Quebec’s Saguenay-Lac-St-Jean Region, within easy reach of North America’s EV battery plants.

LFP Battery Material Sourcing for Electric Vehicles

The North American EV industry requires production of the highest purity, ESG-compliant, ethically-sourced raw materials for battery manufacturing – which must also be consistent in quality, secure, and supply chain integrated. For instance, in 2022, the United States introduced the Inflation Reduction Act, which provides for a tax credit of up to $7,500 on the purchase of a qualifying EV.

As of April 18, 2023, qualifications for that credit require that at least 40% of the critical minerals found in the vehicle’s battery be sourced from the US or a country with a free trade agreement in place with the US. That percentage increases by 10% every year until 2027, when the credit requires that at least 80% of the battery materials are sourced in the US or via a free-trade aligned nation.

One of the most significant impacts from such measures is expected to hit the phosphate industry. The rapidly rising demand for LFP batteries is creating significant supply shortages in the LFP-grade purified phosphoric acid that goes into the making of cathode active material for LFP batteries.

Most people assume that, because the raw materials for LFP are based on iron and phosphate, two very common materials, that there will be no problem. This is not necessarily the case. More can be read on that here.

Phosphate and the LFP Battery Production Process

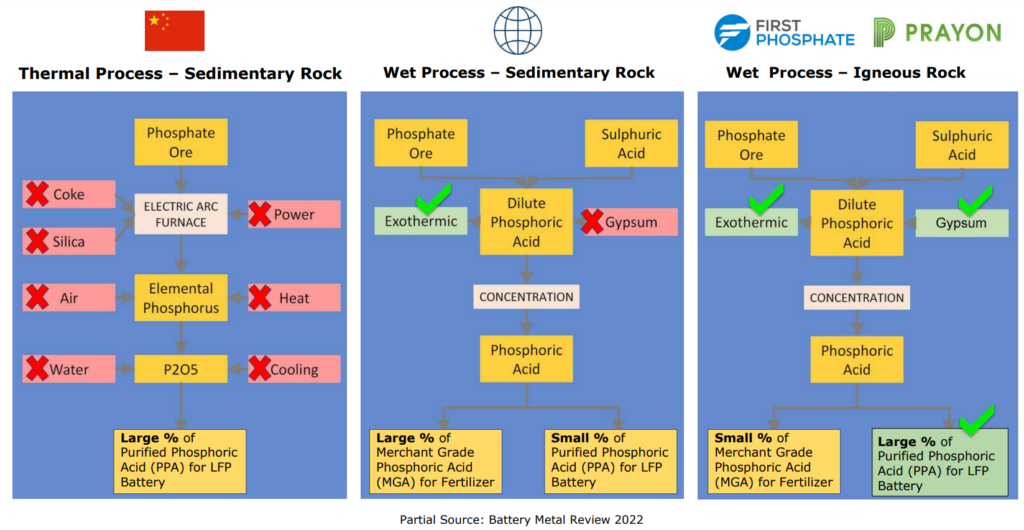

LFP battery makers require the highest-purity phosphate – which poses a slight problem for industry. While phosphate is found in both sedimentary and igneous rocks, and both can be used for the production of the purified phosphoric acid needed by the EV-industry, there are some considerations to be made related to the required processing of the rock.

In the production process, phosphate bearing rock, once mined, is either screened or crushed and processed to obtain what is referred to as concentrated phosphate rock, which is concentrated to a purity level of between 25% and 41% phosphate. In terms of rock types, sedimentary rock is concentrated to a purity level of 25% to 34% phosphate, versus igneous rock which is concentrated to a purity of between 38% and 41%.

The concentrated phosphate rock is then further refined into what is known as merchant grade phosphoric acid (MGA), which is primarily used for making fertilizer and animal feeds. From there, a portion of the MGA can then be processed into pure phosphoric acid (PPA), which holds the requisite purity for industrial applications, such as electronics, pharmaceuticals, and the production of LFP batteries.

The Thermal Method versus the Wet Method in the Production of Purified Phosphoric Acid (PPA) for LFP Batteries

There are two methods of conducting the process of turning phosphate concentrate rocks into a purified phosphoric acid suitable for the use in LFP batteries. The first, is the thermal process, also known as the Turner Process, which is predominantly used in China with sedimentary phosphate-bearing rock of very low grade. The thermal process is crude and power intensive, requiring the use of coke and silica that are fed into an electric arc furnace with the ore and then heated to high temperatures to produce elemental phosphorus and significant amounts of slag and CO2 gas emissions. It gets the job done, but is extremely wasteful in the process and not suitable by Western environmental standards.

Batteries produced using the thermal process method will not survive rigorous ESG lifecycle and environmental assessments in the Western World. In fact, It could potentially be less environmentally polluting to continue to drive fossil fuel vehicles than to drive electric vehicles with batteries produced under low environmental standards.

The second process is known as the Wet Process, which uses sulphuric acid to process phosphate concentrate. This process produces merchant grade phosphoric acid (MGA), heat which can be used for other processes, as well as gypsum. When sedimentary phosphate rock is used in the Wet Process, the gypsum by-product produced tends to be radioactive and poses disposal issues. The merchant grade phosphoric acid (MGA) produced can then be converted economically only into a limited amount of LFP-grade purified phosphoric acid (PPA) while the rest of the MGA needs to be put towards fertilizer based applications.

However, when igneous phosphate rock is used in the Wet Process, a very pure merchant grade phosphoric acid (MGA) is produced of which up to 90% can be converted into LFP grade purified phosphoric acid (PPA). Moreover, the gypsum by-product produced is non-radioactive and can be recycled into other industrial uses for circular economy benefit. This is the soundest and most environmentally friendly process that First Phosphate is focused on by using Prayon Technologies as its processing partner.

Igneous Vs. Sedimentary Phosphate Rock

Of known global phosphate deposits, 95% are found in sedimentary rocks, 4% are found in igneous carbonate rocks, and 1% are found in igneous masif-type rocks. Of known igneous phosphate deposits, 50% are in Russia (the only current exporter of igneous based phosphate rock), and given the current geopolitical climate, are essentially cut off from Western LFP-production markets. This is putting a tremendous strain on purified phosphoric acid manufacturers, who must secure adequate supplies for their production facilities.

In a quirk of geology, almost all of the world’s known supply of igneous anorthosite phosphate rock is located within the Saguenay-Lac-St-Jean Region of Quebec. This form of rock is devoid of heavy metals and contains low sulphur content, providing the potential to yield the highest purity, carbon-neutral phosphate for the LFP battery industry.

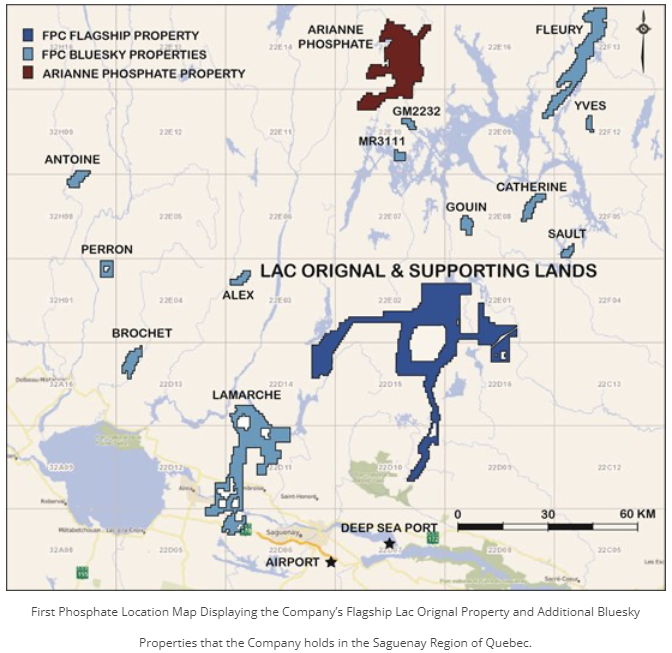

In terms of the Saguenay-Lac-St-Jean Region, two exploration companies have established large land positions that are focused on the production of phosphate from those igneous rocks, First Phosphate Corp. (CSE: PHOS) and Arianne Phosphate Inc. (TSXV: DAN).

First Phosphate Corp.

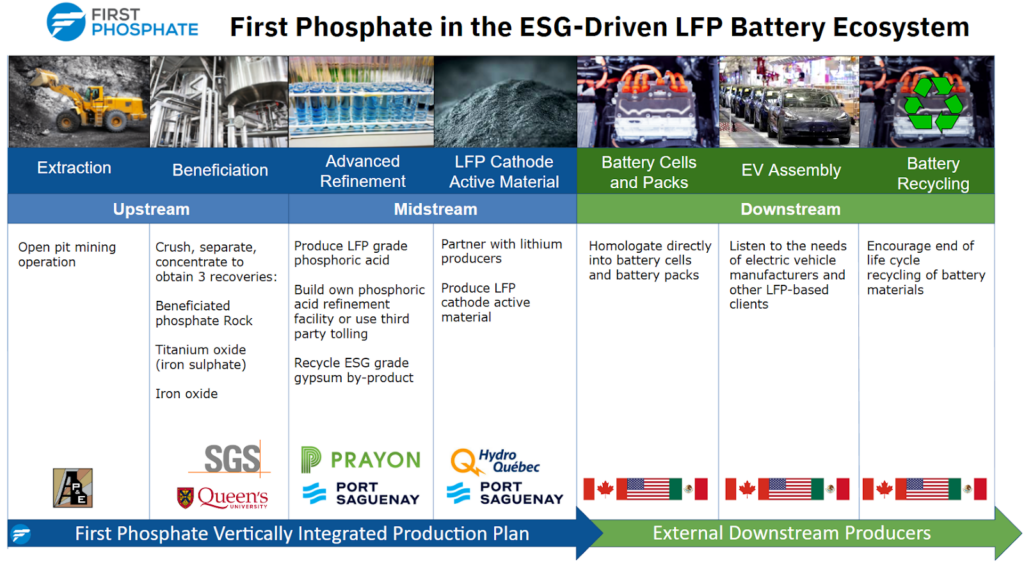

First Phosphate Corp. has assembled a massive 1,500 square kilometre net smelter royalty free land position located for the most part up to 150 kilometres north of the existing deep sea Port of Saguenay. First Phosphate is ESG-driven, with a focus on delivering a critical supply of clean, high-purity, low-carbon-footprint battery-grade purified phosphoric acid (PPA) which it will use in the production of LFP cathode active material for the LFP battery industry. The company is the only private or public company worldwide that is 100% focused on becoming a major long-term supplier of LFP cathode active material to North America’s battery manufacturers.

A NI 43-101 report on First Phosphate’s flagship Lac à l’Orignal property outlines a pit-constrained mineral resource estimate (indicated and inferred) of 49.0 metric tonnes at grades of 5.18% phosphorous pentoxide (P2O5), 4.23% titanium dioxide (TiO2) and 23.90% iron oxide (Fe2O3).

Metallurgical testing, which is part of an oncoming preliminary economic assessment (PEA) study, was able to produce an apatite concentrate grade of 40.2% P2O5, while recovery rates hit 91.4%. At the same time, the firm was able to establish secondary concentrate recoveries of 39.3% TiO2, and 69.0% Fe. First Phosphate is planning to release a PEA for the project in Q4 2023.

Furthermore, a recent research report published by Queen’s University Pufahl Research Group has suggested that this deposit at the Lac à l’Orignal property is a highly probable ESG-compliant source of phosphate for the North American LFP battery industry. This assessment is based on several factors, including a good grade of P2O5 required for phosphoric acid production and low levels of potentially hazardous radioactive elements.

“Collectively, the attributes indicate that First Phosphate’s Lac à l’Orignal deposit is a source of North American phosphorus for the LFP battery industry that has a high probability of being ESG-compliant,” commented Dr. Peir Pufahl, Co-Director, Queen’s University Facility for Isotope Research.

Arianne Phosphate Inc.

Arianne Phosphate has been developing its 267 square kilometre Lac a Paul Project since 2008. It is considered to be one of the world’s largest undeveloped phosphate deposits that is not owned by a major fertilizer company. The Lac a Paul Project hosts 9 identified large-scale igneous phosphate rock zones, which are open in multiple directions and at depth.

According to the project’s 2013 feasibility study, the Lac a Paul Project has proven and probable reserves of 472 million tonnes at 6.9% P2O5. The project is fully permitted and construction ready, with a projected mine life of at least 26 years.

At this point in time, Arianne is primarily focused on providing raw phosphate concentrate to the fertilizer industry, although it has recently alluded to the LFP battery industry as a potential market for its concentrate. Arianne has had historic talks with the New Brunswick government to build a Merchant Grade Phosphoric Acid (MGA) plant near the port at Belledune, NB. This is different from a Purified Phosphoric Acid (PPA) plant which is a step after the MGA plant, i.e. a second purification process for higher industrial uses above and beyond fertilizer. PPA production facilities are required for the production of LFP-grade purified phosphoric acid (PPA). PPA technology is possessed by only 4 companies in the world. Arianne has no PPA agreement with any company at the moment while First Phosphate has an MOU in place with Prayon of Belgium for the license of PPA production technology.

Possible Synergies Between First Phosphate and Arianne Phosphate

First Phosphate and Arianne are the two major phosphate players in the region. While the two companies could be classified as competitors in some aspects of their business, there are also potential synergies between them that could be mutually beneficial.

For instance, because Arianne is primarily focused on the fertilizer market, and First Phosphate is 100% focused on the LFP battery market, there could be a potential opportunity to enter into an offtake agreement whereby Arianne could supply some of its high purity phosphate concentrate to First Phosphate and First Phosphate could supply LFP cathode active material to Arianne. As the North American LFP industry expands, there is plenty of opportunity for both companies to work together to help meet rising phosphate demand.

First Phosphate’s Lac Orignal Property is about 90 kilometres from the new deep sea port that Arianne Phosphate is proposing to build while Arianne Phosphate is 250 kilometres from the potential new deep sea port. Both projects share the same road to get to the new proposed port. Arianne would, in fact, have to drive 160 kilometres south-east from Lac-a-Paul, past the Lac à l’Orignal property (First Phosphate’s property), en route to the new deep sea port that it has envisioned.

Perhaps First Phosphate and Arianne could partner in that First Phosphate’s Lac Orignal property could serve as a vital and friendly pit-stop for Arianne Phosphate trucks en route to Arianne’s new port that it is proposing on the north shore of the Saguenay. Arianne is planning to export large volumes of phosphate concentrate so it cannot cross the bridge at Saguenay with a lesser number of regular 52-tonne trucks like First Phosphate can. Arianne is proposing to move its concentrate over 250 km from Lac-a-Paul with 100 tonne overcharged trucks (which cannot circulate on regular provincial roadways) to its new port facility on the north shore of the Saguenay.

Arianne Phosphate could also ask First Phosphate to participate in the build-out of its new port facility, which was projected to cost Arianne about $260 million (in 2018 dollars), and which could add perhaps up to 3-5 years of lead time from ground-breaking before Arianne could actually export its phosphate concentrate. First Phosphate is, however, planning to use the facilities of the existing south-shore port of Saguenay to cut down on infrastructure costs so it is not certain that it would be willing to contribute to Arianne’s massive infrastructure spend on a brand new port facility.

Position of First Phosphate and Arianne Properties with respect to the Existing Port of Saguenay and Arianne’s Proposed New Port Buildout ($260 million in 2018 dollars)

First Phosphate has a total of 15 properties with strong indications of phosphate, all of which are much closer to the existing deep sea port than Arianne’s Lac-a-Paul property. First Phosphate is currently focused on its Lac à l’Orignal and Begin-Lamarche projects as it feels that feasibility does not exist, without excessive CAPEX expenditure, at distances any further than 150 km from the existing deep sea port on the south shore of the Saguenay river. First Phosphate is a low CAPEX project focused on value-added activities.

First Phosphate’s Begin-Lamarche property is exceptionally well positioned at only 75 km from the existing deep sea port. Recent drilling has indicated some of the highest grade phosphate findings ever discovered in the Saguenay-Lac-Saint-Jean region of Quebec. Perhaps First Phosphate and Arianne could pool resources, cut down on CAPEX, and look at developing the First Phosphate properties which are much closer to the existing deep sea port and which would also minimize the carbon and environmental footprint and the need for a massive spend for the buildout of the new port facilities on the north shore of the Saguenay river which Arianne is currently proposing.

Location where Arianne Plans to Build its New Port for $260 million in 2018 Dollars

Existing Port where First Phosphate Plans to Integrate its Value-Added Facilities and where Quebec Government has committed $105 million to Upgrading Services

First Phosphate and Arianne Phosphate: A Quick and Friendly Comparison

| Details | First Phosphate Corp. | Arianne Phosphate |

|---|---|---|

| Land Position Size | 1,500 km2 | 276 km2 |

| NSR Free | Yes | Unknown |

| Driving Distance to Existing Port | 75 km (Bégin-Lamarche) 140 km (Lac à l’Orignal ) | 300 km (Lac-à-Paul) |

| Mineralized Zones | 4 (Lac à l’Orignal) | 9 |

| Phosphate Grade | 5.2% P2O5 (Lac à l’Orignal) 8-10% P2O5 (Bégin-Lamarche in initial drilling) | 6.88% P2O5 (Lac à Paul) |

| Resources | 49.0 million tonnes indicated & inferred (Lac à l’Orignal) Bégin-Lamarche not yet quantified | 472 million tonnes proven & probable |

| Property Stage | PEA expected Q4 2023 | FS released October 2013 |

| Permit Status | In process at PEA stage | Permit expires December 2025 |

| Type of Mine / Mine Life | Open Pit – Targeted at 12-15 years (PEA dependent) | Open Pit – 26 years |

| Mine Production (tonnes per annum) | Targeting 500,000 | 3,000,000 |

| Truck Transportation | Targeting standard 52 tonne trucks | Oversize 100 tonne trucks |

| Trucking Restrictions | None (targeted) | Heavy haul gravel road only. No provincial highways. |

| Offtake Agreements | Yes (finalizing) | Yes (dated) |

| Focus | 100% LFP | Fertilizer, potentially LFP |

| MGA Production Facility | Proposed at Port of Saguenay | Proposed at Belledune, NB |

| PPA Production Facility | Proposed at Port of Saguenay | No current plans |

| LFP Cathode Active Material Facility | Proposed at Port of Saguenay | No current plans |

| Internalization of own Production for Value-Add | Yes | Potentially |

| Downstream LFP Value Added Partners | Prayon (PPA, LFP) IPL Technologies (LFP) | None as of yet |

| Processing of Secondary Recoveries | Plans to process ilmenite to synthetic rutile and iron sulphate for use in LFP Cam production. Plans to process magnetite to pig iron | Will stockpile ilmenite and magnetite recoveries at onset |

| Potential ESG Compliant Resource for LFP battery | Verified by Queen’s University Study | TBD |

| CAPEX | TBD in PEA | US$1.55 Billion plus potential third party infrastructure buildout (Saguenay north shore port) |

| Existing Port Access | Yes, at Port of Saguenay on the south shore (existing infrastructure) | No – Proposing to build a new port on the north shore of Saguenay (new expensive infrastructure) |

| Market Capitalization | $34 million | $91 million |

A Friendly Comparison of Business Models

Since initiating operations in June 2022, First Phosphate has moved with surgical precision in advancing its operations towards PEA and beyond into its value-added downstream processes. First Phosphate is also positioning itself to not have to build new infrastructure while it will take Arianne added years and much additional capital to build new infrastructure such as the new port facility that it is proposing on the north shore of the Saguenay river. This will add years to Arianne’s ability to actually produce while First Phosphate will be able to produce as soon as its mine is ready to process ore. It is arguable whether both players are currently not on about the same timeline towards first production date given these nuances.

Arianne, at the end of March 2023, updated its Lac a Paul Project CAPEX to US$1.55 billion, which includes the building of a new port facility on the north shore of the Saguenay River to accommodate its 3 million tonnes per annum phosphate concentrate production plan. It is not clear whether Arianne has updated the CAPEX on its new proposed port facilities which were estimated at about $260 million in 2018 dollars.

First Phosphate can use the existing port and facilities on the south shore of the Saguenay, as it expects to produce 500,000 tonnes per annum of phosphate concentrate, a much smaller quantity than Arianne. First Phosphate plans to take its 500,000 tonnes and process them internally to value-added purified phosphoric acid and then to LFP cathode active material, while Arianne is aiming to sell its phosphate concentrate and to not necessarily participate in any currently defined value-added activities other than the potential of an MGA facility at the Port of Belledune, NB. First Phosphate is definitely targeting a low-out-of-the-ground strategy with CAPEX to be focused on high value add LFP cathode active material production while Arianne is targeting a large raw material production strategy mainly focused on the fertilizer industry that will involve significantly larger CAPEX.

Until First Phosphate completes its PEA on the Lac à l’Orignal high-purity phosphate property in late 2023, an accurate CAPEX comparison cannot be made between the two companies. First Phosphate will certainly have much lower capex requirements as it plans to use existing infrastructure while Arianne will need to build new infrastructure including a new port of the north shore of the Saguenay river. An additional benefit to First Phosphate is that the Quebec government recently committed $105 million to upgrading services at the existing Port of Saguenay on the south shore of the Saguenay River where First Phosphate plans to locate all of its value-added activities. It is unforeseeable whether the Quebec government would be willing to contribute further at this point to the construction of Arianne’s proposed north shore port ($260 million in 2018 dollars).

Value-added Niche Strategy versus Bulk Concentrate Strategy

The fundamental difference between the two companies is that First Phosphate is a value-added niche LFP cathode active material player that wishes to produce phosphate concentrate for its own internal use and which is trying to minimize its infrastructure costs. Arianne Phosphate, on the other hand, aims to be a large commodity based producer of phosphate concentrate which it would then sell to other value-added players, mostly in the fertilizer arena and potentially in the LFP materials space. Both models are different and valid in their own right. First Phosphate articulates its full value-added LFP cathode active material processing business model on the front page of its own website.

On April 3, First Phosphate together with the Regional Conference of the Prefects of Saguenay-Lac-Saint-Jean, announced the signing of a collaboration agreement between First Phosphate and the Regional Economic Benefits Maximization Committee (CMAX). As a result of this agreement, First Phosphate will be able to connect directly to the region’s entrepreneurial workforce to help the company to operate its projects without supplier challenges and will also provide jobs and economic benefits for the Saguenay-Lac-Saint-Jean Region’s construction companies, equipment manufacturers, and other suppliers. Arianne previously entered into similar agreements in 2018. This signifies that both companies have major project status with the Saguenay-Lac-Saint-Jean region of Quebec, and ensures they both have the blessing of the local communities and stakeholders for their respective business models.

First Phosphate’s MOU with PPA Global Industry Giant, Prayon of Belgium

As part of its focus in integrating with the LFP battery industry in North America, First Phosphate announced in February that it had signed a Memorandum of Understanding (MOU) with Europe’s largest producer of purified phosphoric acid (PPA), Prayon SA of Engis, Belgium. Prayon is one of only 4 major producers of PPA in the western world, the most environmentally friendly which can process igneous rock phosphate concentrate. The MOU with Prayon covers a number of potential points of collaboration, including:

- Phosphate concentrate long-term offtake agreement

- A toll processing agreement for LFP-Grade purified phosphoric acid (PPA)

- The acquisition of a licence for an LFP-Grade Phosphoric Acid (PPA) production facility

- The development of an LFP Cathode Active Material manufacturing plant

First Phosphate could become a major phosphate concentrate supplier to Prayon. Phosphate concentrate would be processed into merchant grade phosphoric acid (MGA) and subsequently into purified phosphoric acid (PPA) at the Prayon plant in Engis, Belgium.

Most significantly, as part of the MOU, Prayon could grant First Phosphate a license to build its own PPA production facilities in Quebec, or could partner up with First Phosphate to do so. Prayon’s clean technologies, which include options for full gypsum recycling, would be used. The two companies are also considering collaborating on producing LFP Cathode Active Material, and will explore the feasibility of an LFP Cathode Active Material production facility in Quebec to serve North American LFP battery markets.

First Phosphate’s LFP Technology Licensing Agreement with IPL

As part of its strategy to produce LFP Cathode Active Material, First Phosphate has finalized an LFP homologation agreement and LFP production technology licensing agreement with Integrals Power Limited (IPL) of Milton Keynes, United Kingdom. The agreement could serve to anchor the Company’s future LFP cathode active material production facilities.

The agreement provides for the following mutually beneficial, perpetual arrangements between the parties:

- IPL will validate First Phosphate LFP-grade purified phosphoric acid and iron sulphate for the use in LFP battery cells.

- IPLs LFP cathode active material homologation process will use First Phosphate LFP-grade purified phosphoric acid and iron sulphate.

- IPL provides LFP production technology license to First Phosphate in the production of LFP cathode active material at any First Phosphate LFP cathode active material production facilities to be built in Quebec, Canada or elsewhere in North America.

- First Phosphate has acquired 7,386 common shares of IPL for a cost of CAD $83,060.35 and has the right to make follow-on investments in future funding rounds.

- First Phosphate and IPL plan to leverage First Phosphate’s access to green hydro-electric energy in the Saguenay-Lac-St-Jean region of Quebec for optionality in the build-out of IPL’s future production facilities.

The Saguenay-Lac-St-Jean, Quebec Advantage for Both First Phosphate and Arianne

Quebec has indicated that it wants to become a leading North American jurisdiction in the development of a vertically integrated EV industry hub, and as such is offering multiple government incentives to attract investment into this sector. The province for instance boasts in a battery initiative report that 99% of power produced is sourced via hydroelectricity, meeting ESG needs, and preferential rates are provided to large consumers of energy. At the same time, Quebec’s stated goal is to become “the 1st location in North America to provide traceability for green batteries,” and offers a cost-advantage of nearly 30% on salaries for battery manufacturing employees.

Well-known for its world-class aluminium industry and other natural resources, the Saguenay area boasts a low-cost power infrastructure, an excellent road network, the Saguenay-Bagotville Airport, and a deep sea port that will facilitate the ease of transporting phosphate products to North America’s EV and LFP battery manufacturers.

In Closing

Given recent developments in the North American LFP battery industry, First Phosphate and Arianne are well positioned geographically to have a strong roll in the North American LFP battery industry: First Phosphate as a value added producer of LFP cathode active material and Arianne Phosphate as a producer of raw phosphate concentrate for other value added players to process into fertilzer and potentially into phosphate material for LFP-based application.

China currently supplies almost all of the world’s LFP cathode active material. Once First Phosphate’s LFP cathode active material production facilities are built and operational, First Phosphate could reduce reliance on Chinese LFP supply chains in North America.

First Phosphate believes that it will be able to supply LFP cathode active material for the requirements of North American LFP battery producers. If all goes well, the Saguenay-Lac-St-Jean Region may emerge as the LFP battery valley of North America.

FULL DISCLOSURE: First Phosphate is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover First Phosphate on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.